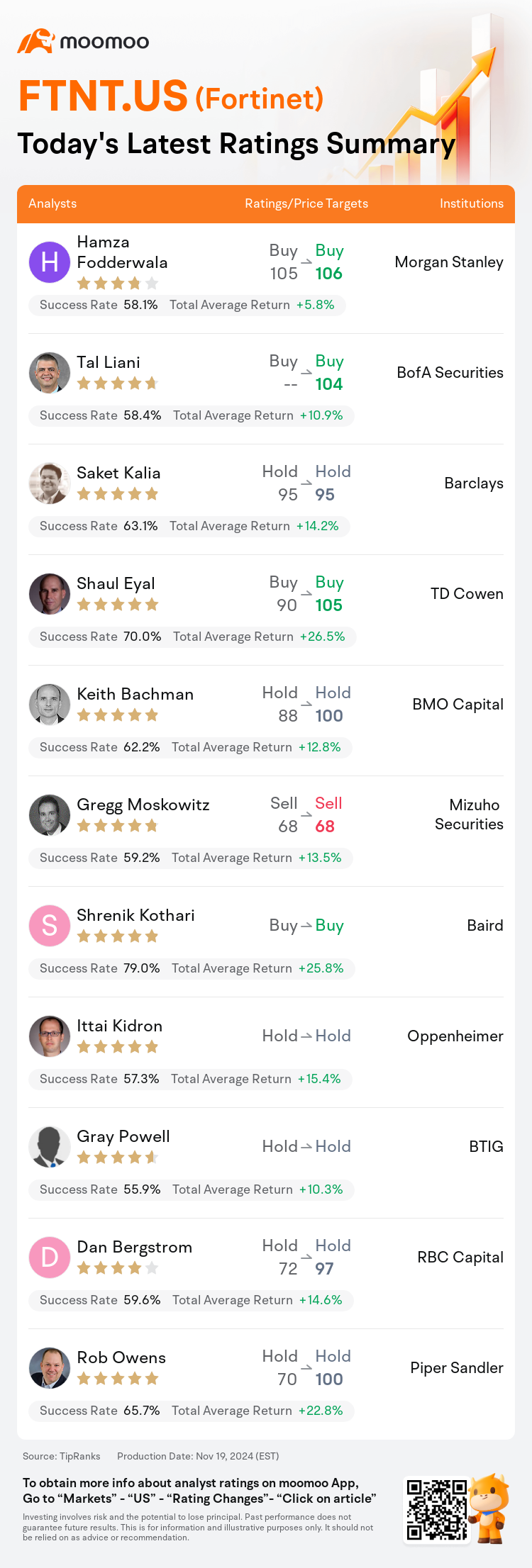

On Nov 19, major Wall Street analysts update their ratings for $Fortinet (FTNT.US)$, with price targets ranging from $68 to $106.

Morgan Stanley analyst Hamza Fodderwala maintains with a buy rating, and adjusts the target price from $105 to $106.

BofA Securities analyst Tal Liani maintains with a buy rating, and sets the target price at $104.

Barclays analyst Saket Kalia maintains with a hold rating, and maintains the target price at $95.

Barclays analyst Saket Kalia maintains with a hold rating, and maintains the target price at $95.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and adjusts the target price from $90 to $105.

BMO Capital analyst Keith Bachman maintains with a hold rating, and adjusts the target price from $88 to $100.

Furthermore, according to the comprehensive report, the opinions of $Fortinet (FTNT.US)$'s main analysts recently are as follows:

Following a recent analyst day meeting, it was noted that the long-term guidance targets provided by management were supported by the approaching 2026 and 2027 firewall end-of-support cycle and enhanced traction for Unified SASE and Security Operations. Although there was no guidance given for 2025, which introduces some uncertainty regarding the extent of the forthcoming firewall refresh cycle, the three- to five-year targets presented are considered robust, suggesting potential for further upsides.

After attending Fortinet's in-person analyst day, analysts noted the company's emphasis on expanding its platform strategy encompassing Secure Networking, SASE, and SecOps. This strategic direction is mainly driven by the upcoming firewall refresh cycle. Although the mid-term targets align with previous expectations, there appears to be potential for exceeding these targets.

Fortinet's strategy and vision have been clearly defined, showcasing several intrinsic platform strengths that are crucial in leveraging the possibilities within a $284B market opportunity. Despite these factors, there are reservations due to the fact that Fortinet's growth drivers currently represent a minor portion of the overall business mix, coupled with risks linked to competitive pressures that could potentially impact growth and profitability.

The company's medium-term targets are believed to be reasonable, and there is optimism regarding Fortinet's increased investments in SASE/SecOps. Furthermore, there is significance in Fortinet's refresh opportunity projected for 2025, with the company's portfolio and common OS cited as offering competitive advantages, particularly for small and medium-sized organizations.

During its Analyst Day, it was communicated that the company has set new medium-term targets, which were slightly above market expectations. This indicates that the leading vendor in global firewall shipments is expected to continue gaining market share from traditional firewall vendors.

Here are the latest investment ratings and price targets for $Fortinet (FTNT.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月19日,多家華爾街大行更新了$飛塔信息 (FTNT.US)$的評級,目標價介於68美元至106美元。

摩根士丹利分析師Hamza Fodderwala維持買入評級,並將目標價從105美元上調至106美元。

美銀證券分析師Tal Liani維持買入評級,目標價104美元。

巴克萊銀行分析師Saket Kalia維持持有評級,維持目標價95美元。

巴克萊銀行分析師Saket Kalia維持持有評級,維持目標價95美元。

TD Cowen分析師Shaul Eyal維持買入評級,並將目標價從90美元上調至105美元。

BMO資本市場分析師Keith Bachman維持持有評級,並將目標價從88美元上調至100美元。

此外,綜合報道,$飛塔信息 (FTNT.US)$近期主要分析師觀點如下:

在最近的一次分析師會議上,提到管理層提供的長期指導目標得到了2026年和2027年防火牆停止支持週期即將來臨以及統一SASE和安防運營的增強吸引力的推動。儘管沒有給出2025年的指導,這帶來了一些關於即將到來的防火牆更新週期的不確定性,但提出的三到五年目標被視爲穩健,表明有進一步向上的潛力。

在參加飛塔信息的現場分析師日後,分析師注意到該公司強調擴展其平台策略,包括安全網絡、SASE和安全運營。這個戰略方向主要受到即將到來的防火牆更新週期的推動。儘管中期目標與之前的預期一致,但似乎有超過這些目標的潛力。

飛塔信息的策略和願景已經明確,展示了幾個內部平台優勢,這對利用2840億市場機會的可能性至關重要。儘管有這些因素,但由於飛塔信息的增長驅動因素目前只佔整體業務組合的一小部分,加上與競爭壓力相關的風險,仍然存在保留意見。

公司中期目標被認爲是合理的,且對於飛塔信息在SASE/安全運營的增加投資持樂觀態度。此外,飛塔信息預計將在2025年有更新機會,公司在產品組合和通用操作系統方面被認爲提供了競爭優勢,特別是對於中小型組織。

在分析師日上,傳達了公司設定的新中期目標,這些目標略高於市場預期。這表明,全球防火牆出貨量的領先供應商預計將繼續從傳統防火牆供應商那裏獲得市場份額。

以下爲今日11位分析師對$飛塔信息 (FTNT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Saket Kalia維持持有評級,維持目標價95美元。

巴克萊銀行分析師Saket Kalia維持持有評級,維持目標價95美元。

Barclays analyst Saket Kalia maintains with a hold rating, and maintains the target price at $95.

Barclays analyst Saket Kalia maintains with a hold rating, and maintains the target price at $95.