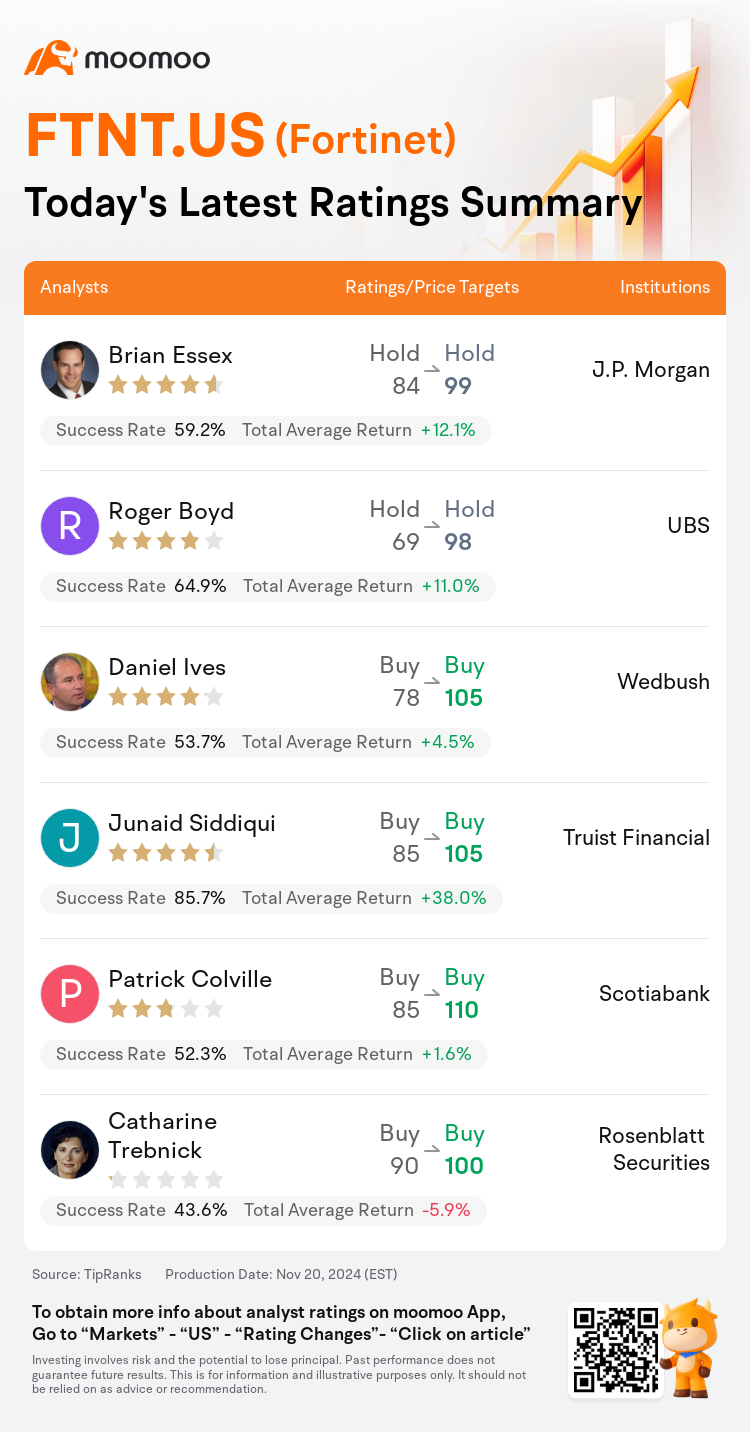

On Nov 20, major Wall Street analysts update their ratings for $Fortinet (FTNT.US)$, with price targets ranging from $98 to $110.

J.P. Morgan analyst Brian Essex maintains with a hold rating, and adjusts the target price from $84 to $99.

UBS analyst Roger Boyd maintains with a hold rating, and adjusts the target price from $69 to $98.

Wedbush analyst Daniel Ives maintains with a buy rating, and adjusts the target price from $78 to $105.

Wedbush analyst Daniel Ives maintains with a buy rating, and adjusts the target price from $78 to $105.

Truist Financial analyst Junaid Siddiqui maintains with a buy rating, and adjusts the target price from $85 to $105.

Scotiabank analyst Patrick Colville maintains with a buy rating, and adjusts the target price from $85 to $110.

Furthermore, according to the comprehensive report, the opinions of $Fortinet (FTNT.US)$'s main analysts recently are as follows:

After management provided long-term guidance targets, supported by a 2026 and 2027 firewall end-of-support cycle, as well as improved traction for Unified SASE and Security Operations at the company's analyst day meeting, some uncertainty remains about the magnitude of the upcoming firewall refresh cycle due to the lack of guidance for 2025. However, the three- to five-year guidance targets are regarded as solid, indicating potential for further upside.

Following an in-person analyst event hosted by the company, it was conveyed that there's great emphasis on its broader platform strategy across Secure Networking, SASE, and SecOps, spurred by the forthcoming firewall refresh cycle. Although the mid-term targets primarily aligned with prior expectations, there's perceived potential for surpassing these targets.

Fortinet's strategy and vision were effectively communicated during its analyst day, highlighting several inherent advantages of its platform in driving technology convergence to capitalize on a significant market opportunity valued at $284B. However, growth drivers for Fortinet still represent a minor component of its business mix, with persistent risks that competitive pressures could impede growth and profit margins.

During the company's Analyst Day, management provided 3- to 5-year financial targets and updates to its projected product refresh cycle for 2026 and beyond. Fortinet anticipates that about a quarter of its current installed base for firewalls will face end of service by the end of 2026. The company expects customer engagement primarily in early 2025, with the majority anticipated in the second half of 2025. This timing aligns with more enterprises seeking vendor consolidation within security, which presents significant opportunities for cross and up-selling. The event was regarded as overall positive.

The company's Analyst Day presentation effectively emphasized its opportunities and customer journey across Secure Networking, Unified SASE, and Ai-Driven SecOps, while also discussing potential product refreshes and laying out medium-term targets. The outlook presented was mixed compared to investor expectations. The compelling opportunities displayed will be further clarified with initial 2025 guidance expected early next year, providing insights on expected revenue and margin evolution towards the Rule of 45.

Here are the latest investment ratings and price targets for $Fortinet (FTNT.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月20日,多家華爾街大行更新了$飛塔信息 (FTNT.US)$的評級,目標價介於98美元至110美元。

摩根大通分析師Brian Essex維持持有評級,並將目標價從84美元上調至99美元。

瑞士銀行分析師Roger Boyd維持持有評級,並將目標價從69美元上調至98美元。

韋德布什分析師Daniel Ives維持買入評級,並將目標價從78美元上調至105美元。

韋德布什分析師Daniel Ives維持買入評級,並將目標價從78美元上調至105美元。

儲億銀行分析師Junaid Siddiqui維持買入評級,並將目標價從85美元上調至105美元。

豐業銀行分析師Patrick Colville維持買入評級,並將目標價從85美元上調至110美元。

此外,綜合報道,$飛塔信息 (FTNT.US)$近期主要分析師觀點如下:

在管理層提供了長期指導目標之後,得益於2026年和2027年的防火牆支持結束週期,以及公司分析師日會議上對統一SASE和安防-半導體運營的更好吸引力,關於即將到來的防火牆更新週期的規模依然存在一些不確定性,因爲對2025年缺乏指導。然而,三到五年的指導目標被視爲穩健,這表明未來有進一步上升的潛力。

在公司舉辦的一次面對面的分析師活動後,傳達出對更廣泛的平台策略在安全網絡、SASE和安防-半導體操作方面的高度重視,這主要受到即將到來的防火牆更新週期的推動。儘管中期目標主要與之前的預期一致,但被認爲有超越這些目標的潛力。

飛塔信息的策略和願景在其分析師日上得到了有效傳達,強調了其平台在推動科技融合以把握價值2840億人民幣的重大市場機會方面的幾個固有優勢。然而,飛塔信息的增長驅動因素仍然只佔其業務組成的一小部分,持續存在的風險是競爭壓力可能會妨礙增長和利潤率。

在公司的分析師日上,管理層提供了3至5年的財務目標並更新了其針對2026年及以後的產品更新週期的預測。飛塔信息預計到2026年底,大約四分之一的當前防火牆安裝基礎將面臨服務結束。公司預計客戶參與主要集中在2025年初,絕大多數預計發生在2025年下半年。這一時機與更多企業在安防領域尋求供應商整合的趨勢相一致,這爲交叉銷售和增銷提供了顯著機會。此次活動總體上被視爲積極。

該公司的分析師日演示有效強調了其在安全網絡、統一SASE和人工智能驅動的安防-半導體操作方面的機會和客戶旅程,同時討論了潛在的產品更新和中期目標的設定。所呈現的前景與投資者的預期相比是混合的。展示的引人注目的機會將在明年初的2025年初步指導中進一步明確,提供有關預期營業收入和利潤率演變的見解,以滿足45法則。

以下爲今日6位分析師對$飛塔信息 (FTNT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

韋德布什分析師Daniel Ives維持買入評級,並將目標價從78美元上調至105美元。

韋德布什分析師Daniel Ives維持買入評級,並將目標價從78美元上調至105美元。

Wedbush analyst Daniel Ives maintains with a buy rating, and adjusts the target price from $78 to $105.

Wedbush analyst Daniel Ives maintains with a buy rating, and adjusts the target price from $78 to $105.