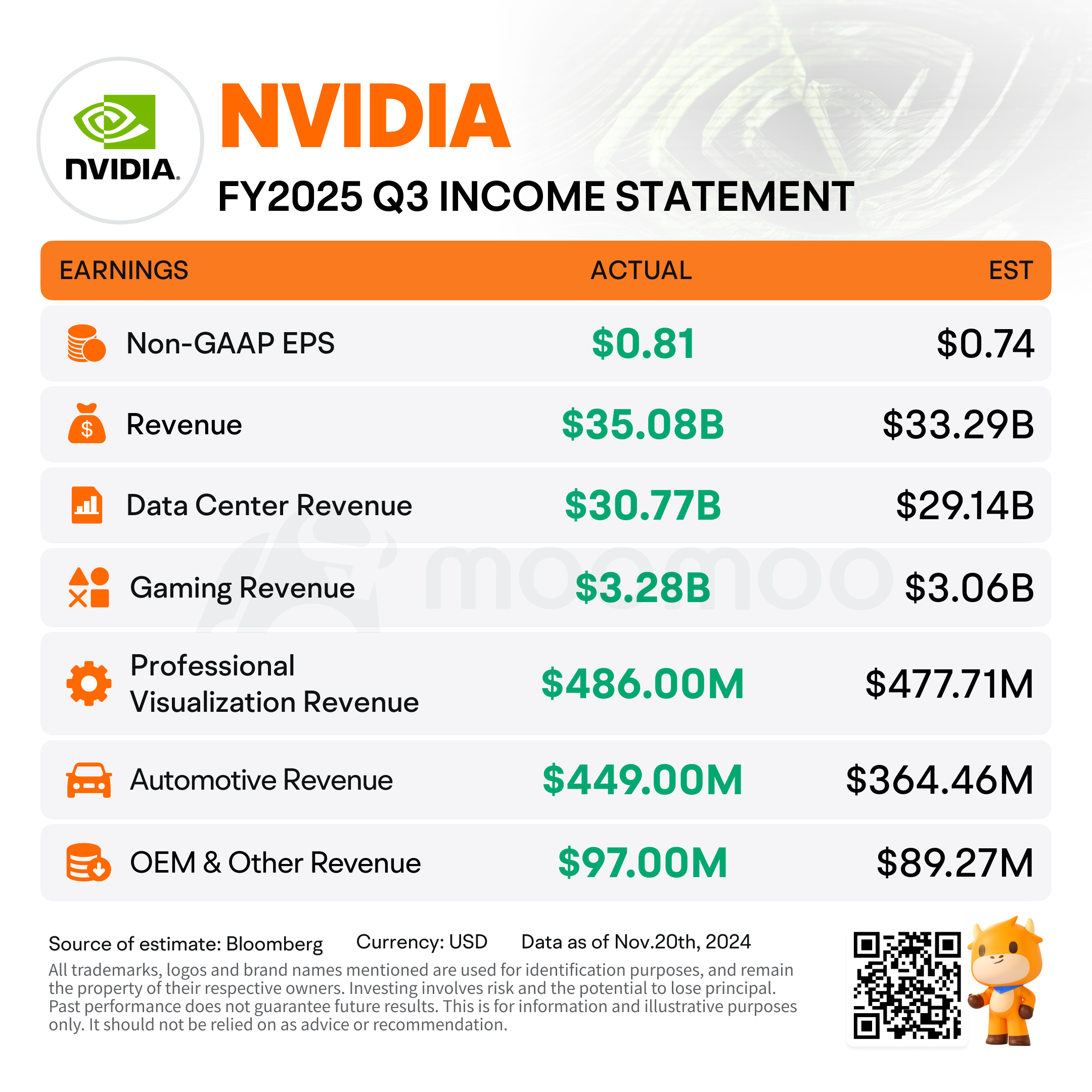

$NVIDIA (NVDA.US)$ reported Q3 2025 adjusted earnings of $0.81/share, vs estimates of $0.74/share, on revenue of $35.08 vs estimates of $33.25B Wednesday. In a release, the firm said the Blackwell Chips are on the way, due for shipped release in the current fourth quarter, but they do have known issues.

$英偉達 (NVDA.US)$ 報告2025年第三季度調整後每股收益爲0.81美元,超過預估的0.74美元,營業收入爲35.08億美元,低於預估的332.5億美元。週三發佈的消息中,該公司表示Blackwell芯片已在製作中,計劃在本季度末發售,但存在已知問題。

In light of the AI chip firms' stellar year, investors picked through the firm forward-looking numbers for an ounce of weakness. Nvidia reported guidance of $37.5 B vs. estimates calling for adjusted EPS of $0.82 on revenue of $37.08B. The highest estimates were at $41B, meaning Nvidia's outlook was below midpoints.

鑑於AI芯片公司過去一年表現強勁,投資者仔細研究了公司未來的數據,想找出一絲薄弱之處。英偉達報告的指導值爲375億美元,而分析師估計的調整後每股收益爲0.82美元,營業收入爲370.8億美元。市場最高預估值爲410億美元,這意味着英偉達的展望低於市場中間水平。

"We completed a successful mask change for Blackwell, our next Data Center architecture, that improved production yields. Blackwell production shipments are scheduled to begin in the fourth quarter of fiscal 2025 and will continue to ramp into fiscal 2026," CFO Colette M Kress said in an earnings commentary. "We will ship both Hopper and Blackwell systems in the fourth quarter of fiscal 2025 and beyond. Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026."

「我們成功完成了Blackwell的掩膜版更改,這是我們下一個數據中心架構,改善了生產產出。 Blackwell生產船舶計劃在財政2025年第四季度開始,並將繼續在財政2026年逐步增加,」首席財務官Colette m Kress在一篇盈利評論中說道。「我們將在財政2025年第四季度及以後同時發貨Hopper和Blackwell系統。 Hopper和Blackwell系統都存在一定的供應約束,預計Blackwell的需求將在財政2026年的幾個季度中超過供應。」

Earnings per share were up from a year ago when the firm posted earnings of 40C on revenue of $18B. EPS came in 8.9% above estimates.

每股收益比去年同期上升,當時公司每股盈利爲40美分,營收爲$180億。每股收益比預估高出8.9%。

Eyes were following Data Center Revenue closely, at $30.77B vs. street estimates of $29.14B. Last quarter, the firm beat most estimates, but its forward-looking guidance lagged, sending the stock to the lowest place on the NASDAQ 100 by a total percentage decline the following day.

關注着數據中心營業收入,達307.7億美元,超過了街頭估計的291.4億美元。上個季度,公司超過了大多數估算,但其展望落後,導致股價在隨後一天的NASDAQ 100中跌至最低點,總體百分比下降。

A month and a half later, the stock hit all-time highs.

一個半月後,股價達到歷史最高水平。

Earnings per share were up from a year ago when the firm posted earnings of 40C on revenue of $18B. EPS came in 8.9% above estimates.

Earnings per share were up from a year ago when the firm posted earnings of 40C on revenue of $18B. EPS came in 8.9% above estimates.