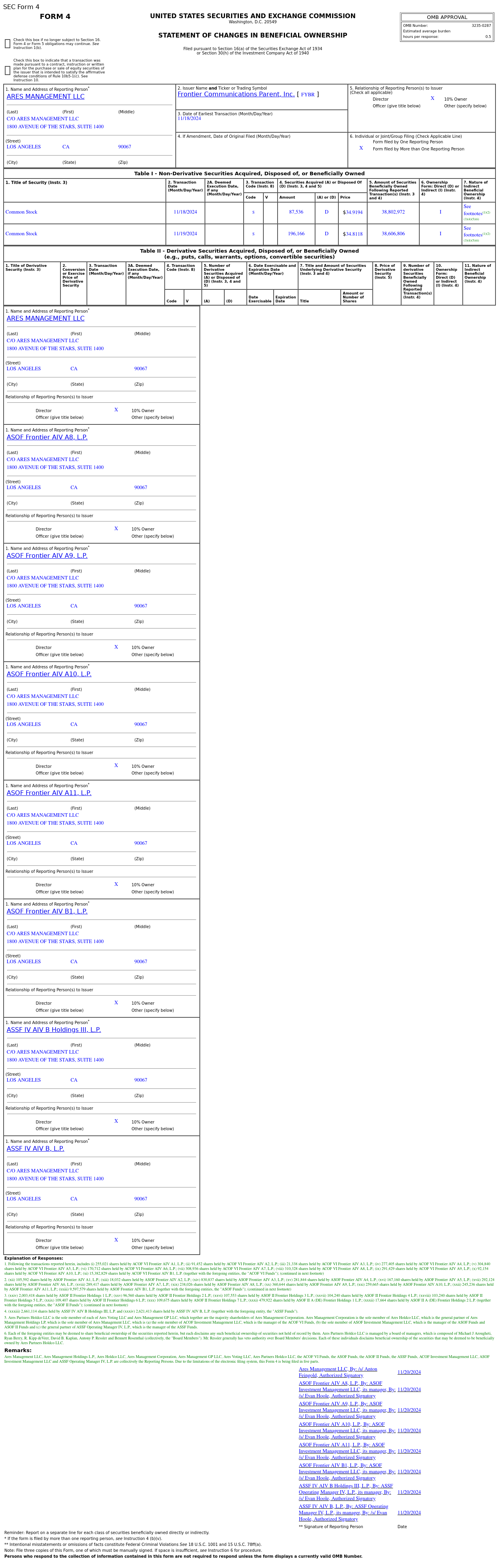

$Frontier Communications (FYBR.US)$ 10% Shareholder ARES MANAGEMENT LLC sold 283.7K shares of common stock on Nov 18, 19, 2024 at an average price of $34.845 for a total value of $9.89 million.

This transaction involves other related parties: ASOF Frontier AIV A8, L.P., ASOF Frontier AIV A9, L.P., ASOF Frontier AIV A10, L.P., ASOF Frontier AIV A11, L.P., ASOF Frontier AIV B1, L.P., ASSF IV AIV B Holdings III, L.P., ASSF IV AIV B, L.P., ASOF II Frontier Holdings 1 L.P., ASOF II Frontier Holdings 2 L.P., ASOF II Frontier Holdings 3 L.P., ASOF II Frontier Holdings 4 L.P., ASOF II Frontier Holdings 5 L.P., ASOF II Frontier Holdings 6 L.P., ASOF II Frontier Holdings 7 L.P., ASOF II A (DE) Frontier Holdings 1 L.P., ASOF II A (DE) Frontier Holdings 2 L.P., ACOF VI Frontier AIV A10, L.P., ACOF VI Frontier AIV B1, L.P., ASOF Frontier AIV A1, L.P., ASOF Frontier AIV A2, L.P., ASOF Frontier AIV A3, L.P., ASOF Frontier AIV A4, L.P., ASOF Frontier AIV A5, L.P., ASOF Frontier AIV A6, L.P., ASOF Frontier AIV A7, L.P., ACOF Investment Management LLC, ASOF Investment Management LLC, ASSF Operating Manager IV, L.P., Ares Management Holdings L.P., Ares Holdco LLC, Ares Management Corp, Ares Management GP LLC, Ares Voting LLC, Ares Partners Holdco LLC, ACOF VI Frontier AIV A1, L.P., ACOF VI Frontier AIV A2, L.P., ACOF VI Frontier AIV A3, L.P., ACOF VI Frontier AIV A4, L.P., ACOF VI Frontier AIV A5, L.P., ACOF VI Frontier AIV A6, L.P., ACOF VI Frontier AIV A7, L.P., ACOF VI Frontier AIV A8, L.P. and ACOF VI Frontier AIV A9, L.P..

What is statement of changes in beneficial ownership of securities?

It is a requirement under federal securities laws that mandates individuals, including officers, directors, and those who hold more than 10% of any class of a company's securities (collectively known as "insiders"), to report their purchases, sales, and holdings of their company's securities by submitting Forms 3, 4, and 5.

11月20日報道,根據美國證券交易委員會(SEC)11月20日披露的文件,$Frontier Communications (FYBR.US)$股東ARES MANAGEMENT LLC於11月18日、19日以每股均價34.845美元售出28.37萬股普通股股份,價值約為988.56萬美元。

本交易涉及其他相關方:ASOF Frontier AIV A8, L.P.、ASOF Frontier AIV A9, L.P.、ASOF Frontier AIV A10, L.P.、ASOF Frontier AIV A11, L.P.、ASOF Frontier AIV B1, L.P.、ASSF IV AIV B Holdings III, L.P.、ASSF IV AIV B, L.P.、ASOF II Frontier Holdings 1 L.P.、ASOF II Frontier Holdings 2 L.P.、ASOF II Frontier Holdings 3 L.P.、ASOF II Frontier Holdings 4 L.P.、ASOF II Frontier Holdings 5 L.P.、ASOF II Frontier Holdings 6 L.P.、ASOF II Frontier Holdings 7 L.P.、ASOF II A (DE) Frontier Holdings 1 L.P.、ASOF II A (DE) Frontier Holdings 2 L.P.、ACOF VI Frontier AIV A10, L.P.、ACOF VI Frontier AIV B1, L.P.、ASOF Frontier AIV A1, L.P.、ASOF Frontier AIV A2, L.P.、ASOF Frontier AIV A3, L.P.、ASOF Frontier AIV A4, L.P.、ASOF Frontier AIV A5, L.P.、ASOF Frontier AIV A6, L.P.、ASOF Frontier AIV A7, L.P.、ACOF Investment Management LLC、ASOF Investment Management LLC、ASSF Operating Manager IV, L.P.、Ares Management Holdings L.P.、Ares Holdco LLC、Ares Management Corp、Ares Management GP LLC、Ares Voting LLC、Ares Partners Holdco LLC、ACOF VI Frontier AIV A1, L.P.、ACOF VI Frontier AIV A2, L.P.、ACOF VI Frontier AIV A3, L.P.、ACOF VI Frontier AIV A4, L.P.、ACOF VI Frontier AIV A5, L.P.、ACOF VI Frontier AIV A6, L.P.、ACOF VI Frontier AIV A7, L.P.、ACOF VI Frontier AIV A8, L.P.和ACOF VI Frontier AIV A9, L.P.。

什麼是持股變動聲明?

SEC要求上市公司內幕人士公開披露其證券交易和持股情況,當內幕人士的持股發生變化時,根據不同情形,需要在交易結束後的一定時間內向SEC提交持股變動聲明。

內幕人士包括公司的董事和高管,以及任何擁有公司10%或以上流通股的股東。