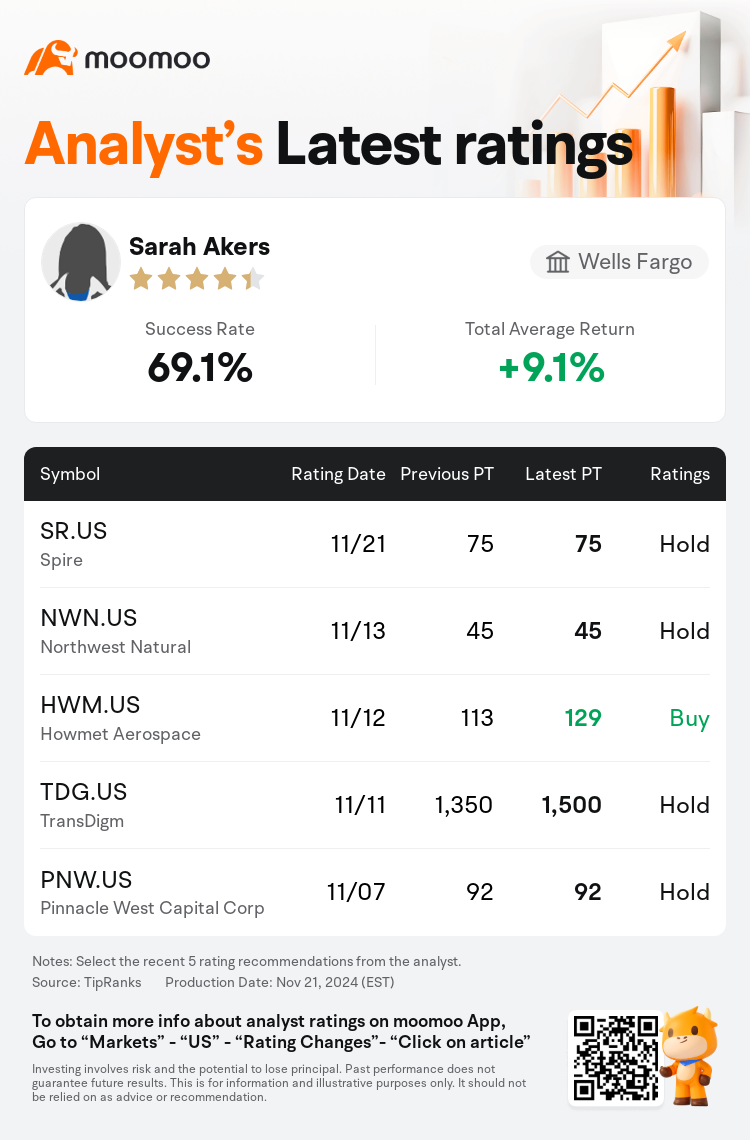

Wells Fargo analyst Sarah Akers maintains $Spire (SR.US)$ with a hold rating, and maintains the target price at $75.

According to TipRanks data, the analyst has a success rate of 69.1% and a total average return of 9.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Spire (SR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Spire (SR.US)$'s main analysts recently are as follows:

Spire's FY24 outcomes were considered disappointing, as the company did not meet the EPS guidance range, previously adjusted in their Q3 announcement. However, many of the challenges it faces are seen as manageable through improved cost controls. The firm also foresees advantages from a supportive regulatory environment in Missouri. Current market prices may excessively reflect the risks associated with the company's earnings growth, and forthcoming developments in Missouri might serve as positive influences.

The company's 2024 EPS was observed to be below the expected guidance range. Nevertheless, the projected EPS growth of 5%-7% remains aligned with the original forecasts for 2024. Management anticipates returning to the target range by 2026, contingent upon favorable outcomes in the rate case in MO.

Spire's shares have underperformed compared to the broader utilities group, a situation attributed to inconsistent execution. This trend followed Spire's reduction in FY24 adjusted EPS guidance during its fiscal Q3 update, along with a decrease in guidance for its core regulated Utility segment. It is anticipated that the situation may deteriorate further before witnessing improvement, with expectations of subdued FY25 guidance until a rate case in Missouri potentially stimulates growth in FY26.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

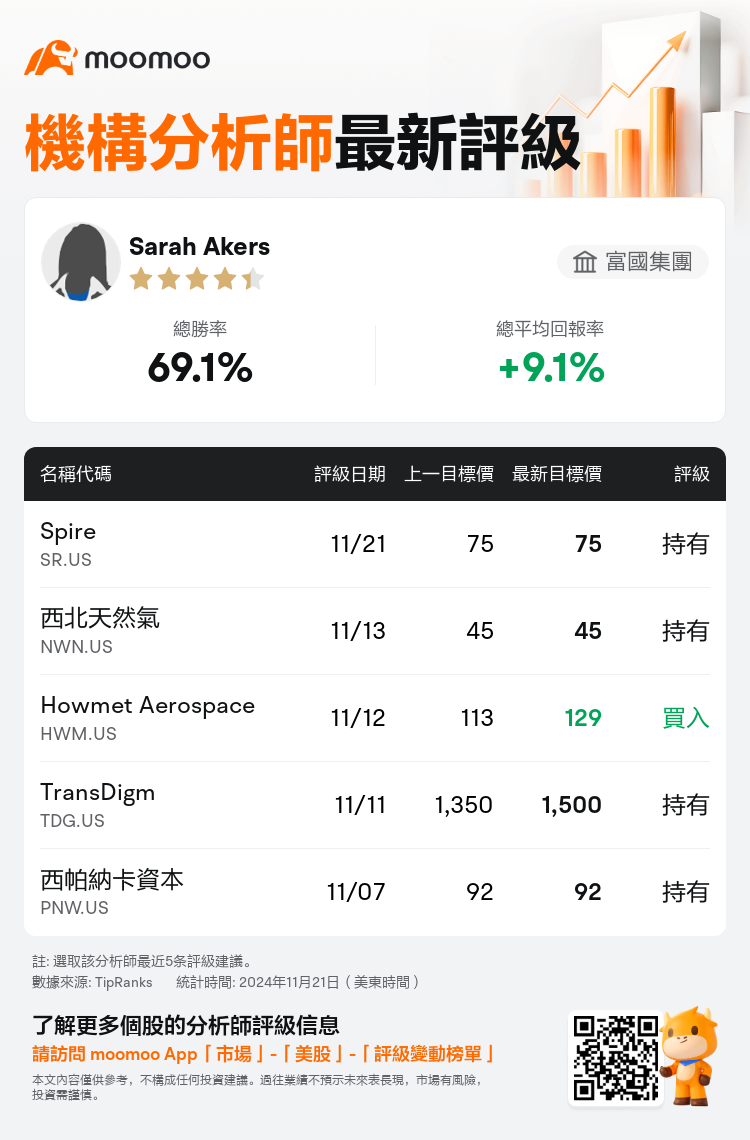

富國集團分析師Sarah Akers維持$Spire (SR.US)$持有評級,維持目標價75美元。

根據TipRanks數據顯示,該分析師近一年總勝率為69.1%,總平均回報率為9.1%。

此外,綜合報道,$Spire (SR.US)$近期主要分析師觀點如下:

此外,綜合報道,$Spire (SR.US)$近期主要分析師觀點如下:

spire的FY24業績被認爲令人失望,因爲公司未達到之前在Q3公告中調整過的每股收益指導區間。然而,公司面臨的許多挑戰被視爲能夠通過改善成本控制得以應對。該公司還預見到來自密蘇里州支持性監管環境的優勢。當前市場價格可能過度反映了與公司盈利增長相關的風險,而密蘇里州未來的發展可能會起到積極影響。

公司的2024年每股收益被觀察到低於預期指導區間。儘管如此,預期的5%-7%每股收益增長與2024年的原始預測保持一致。管理層預計在2026年前恢復到目標區間,這取決於MO地區費率案的有利結果。

spire的股價表現不及更廣泛的公用事業集團,這種情況歸因於執行不一致。這一趨勢發生在spire在其財務Q3更新期間下調FY24調整後的每股收益指導,以及其核心受監管公用事業部門指導的減少之後。有預期認爲在在看到改善之前,這種情況可能會進一步惡化,預計在密蘇里州的費率案件刺激FY26年增長之前,FY25年指導可能會持續疲弱。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Spire (SR.US)$近期主要分析師觀點如下:

此外,綜合報道,$Spire (SR.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of