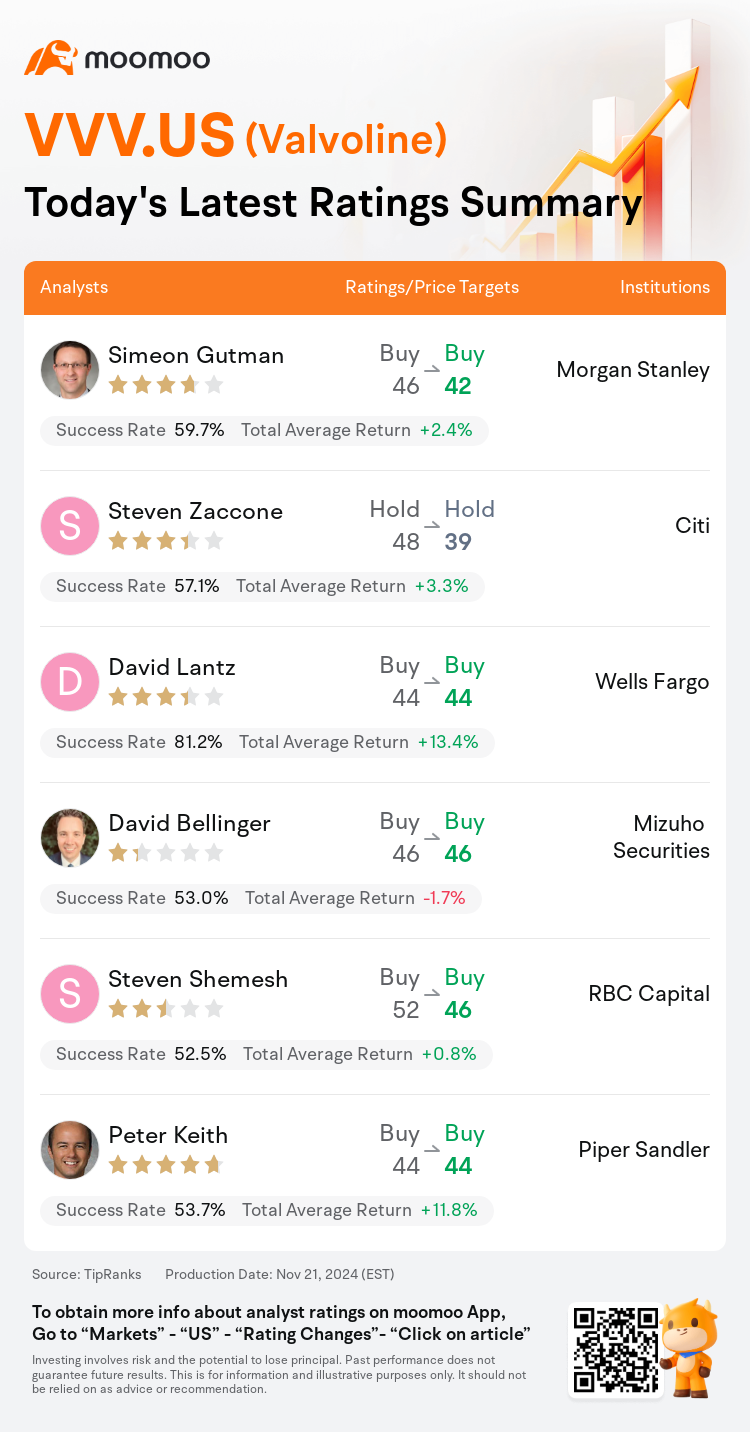

On Nov 21, major Wall Street analysts update their ratings for $Valvoline (VVV.US)$, with price targets ranging from $39 to $46.

Morgan Stanley analyst Simeon Gutman maintains with a buy rating, and adjusts the target price from $46 to $42.

Citi analyst Steven Zaccone maintains with a hold rating, and adjusts the target price from $48 to $39.

Wells Fargo analyst David Lantz maintains with a buy rating, and maintains the target price at $44.

Wells Fargo analyst David Lantz maintains with a buy rating, and maintains the target price at $44.

Mizuho Securities analyst David Bellinger maintains with a buy rating, and maintains the target price at $46.

RBC Capital analyst Steven Shemesh maintains with a buy rating, and adjusts the target price from $52 to $46.

Furthermore, according to the comprehensive report, the opinions of $Valvoline (VVV.US)$'s main analysts recently are as follows:

The firm maintains its positive outlook on Valvoline based on stable and limited growth opportunities paired with potential valuation gains. However, the expected growth in earnings per share has seen a recent decline, influenced by the fiscal year 2025 sales and adjusted EBITDA forecasts, which fell approximately 7% short of average market expectations.

The underlying business of Valvoline remains robust, however, due to a directional slowing in comparisons and potential risks to their long-term algorithm, the stock is expected to stay within a confined range in the near term. While considered undervalued, there are no significant immediate catalysts foreseeable that might significantly influence the stock's performance.

Valvoline's solid performance for FY24 was somewhat dimmed by a weaker profit forecast, influenced by uncertainties in costs and an increase in IT expenditures. Additionally, there is noted escalation in promotional activities among tire and repair shops.

While the fourth quarter generally met expectations, Valvoline's stock underperformance is understandable as predictions for FY25 trend downwards and the long-term outlook remains uncertain. The near-term may be volatile, but the outlook for the distant future retains positive potential.

Here are the latest investment ratings and price targets for $Valvoline (VVV.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月21日,多家華爾街大行更新了$勝牌 (VVV.US)$的評級,目標價介於39美元至46美元。

摩根士丹利分析師Simeon Gutman維持買入評級,並將目標價從46美元下調至42美元。

花旗分析師Steven Zaccone維持持有評級,並將目標價從48美元下調至39美元。

富國集團分析師David Lantz維持買入評級,維持目標價44美元。

富國集團分析師David Lantz維持買入評級,維持目標價44美元。

瑞穗證券分析師David Bellinger維持買入評級,維持目標價46美元。

加皇資本市場分析師Steven Shemesh維持買入評級,並將目標價從52美元下調至46美元。

此外,綜合報道,$勝牌 (VVV.US)$近期主要分析師觀點如下:

在穩定的增長機會與潛在的估值收益的基礎上,該公司對勝牌依然保持樂觀態度。然而,每股收益的預期增長最近有所下降,受2025財年銷售和調整後的EBITDA預測影響,這一預期大約低於市場預期平均水平約7%。

勝牌的基礎業務仍然強勁,然而,由於比較方向的減緩以及長期算法的潛在風險,預計股票短期內將保持在一個有限的區間內。雖然被認爲是被低估的,但短期內並沒有能夠顯著影響股票表現的重大即期催化劑可預見。

勝牌在2024財年的出色表現在某種程度上被利潤預測的疲軟所抹平,受成本不確定性和IT支出增加的影響。此外,輪胎和維修店之間的促銷活動明顯升級。

雖然第四季度總體符合預期,但由於2025財年的預測趨勢下降且長期展望仍不確定,勝牌的股票表現不佳是可以理解的。短期內可能會有波動,但對遙遠未來的展望仍保持積極潛力。

以下爲今日6位分析師對$勝牌 (VVV.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師David Lantz維持買入評級,維持目標價44美元。

富國集團分析師David Lantz維持買入評級,維持目標價44美元。

Wells Fargo analyst David Lantz maintains with a buy rating, and maintains the target price at $44.

Wells Fargo analyst David Lantz maintains with a buy rating, and maintains the target price at $44.