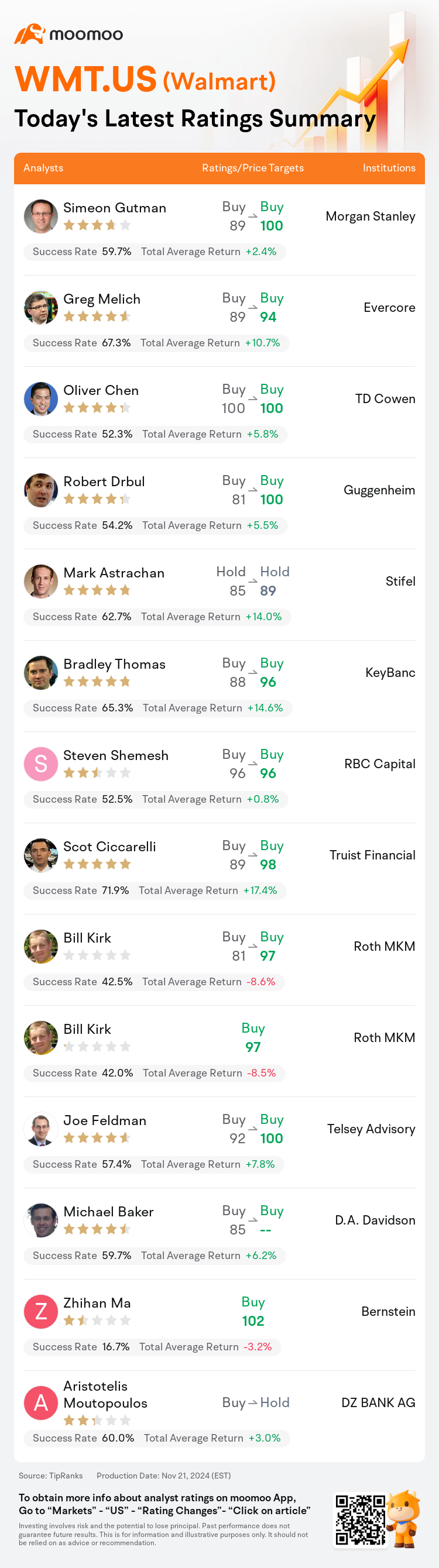

On Nov 21, major Wall Street analysts update their ratings for $Walmart (WMT.US)$, with price targets ranging from $89 to $102.

Morgan Stanley analyst Simeon Gutman maintains with a buy rating, and adjusts the target price from $89 to $100.

Evercore analyst Greg Melich maintains with a buy rating, and adjusts the target price from $89 to $94.

TD Cowen analyst Oliver Chen maintains with a buy rating, and maintains the target price at $100.

TD Cowen analyst Oliver Chen maintains with a buy rating, and maintains the target price at $100.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $81 to $100.

Stifel analyst Mark Astrachan maintains with a hold rating, and adjusts the target price from $85 to $89.

Furthermore, according to the comprehensive report, the opinions of $Walmart (WMT.US)$'s main analysts recently are as follows:

Walmart's strengths in price and cost leadership are enhanced as it leverages its scale and technology to both gain market share and expand its alternative revenue streams.

Walmart is showcasing the potential for sustainable growth as it transitions into the next phase of its life cycle. This evolution is reminiscent of its historical shift from big-box stores to supercenters, underscoring its position as a fundamental, long-term investment.

Following a robust third quarter, the outlook for Walmart remains optimistic with anticipated broad-based share gains and a projected enhancement in long-term profitability. This is expected to be driven by the growth of high-margin digital advertising and third-party Marketplace seller fees, alongside improvements in core e-commerce losses.

Walmart's Q3 report exemplifies the effectiveness of its omnichannel approach, with significant momentum noted as its digital presence continues to expand. The analyst highlighted the company's Walmart Plus membership, which is growing at a double-digit rate, and its third-party dealings, which surged by over 40%. With these advancements, Walmart is experiencing increased traffic, improved margins, more loyal customers, and enhanced returns on investment amidst varying economic conditions.

The firm revised its fiscal year 2025-2026 EPS estimates upward slightly after Walmart posted strong Q3 results, with comp growth and EBIT figures surpassing expectations. This performance, particularly a 5.3% U.S. comp growth, suggesting continued market share gains in several categories including grocery and general merchandise, shows an improvement over recent years.

Here are the latest investment ratings and price targets for $Walmart (WMT.US)$ from 14 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

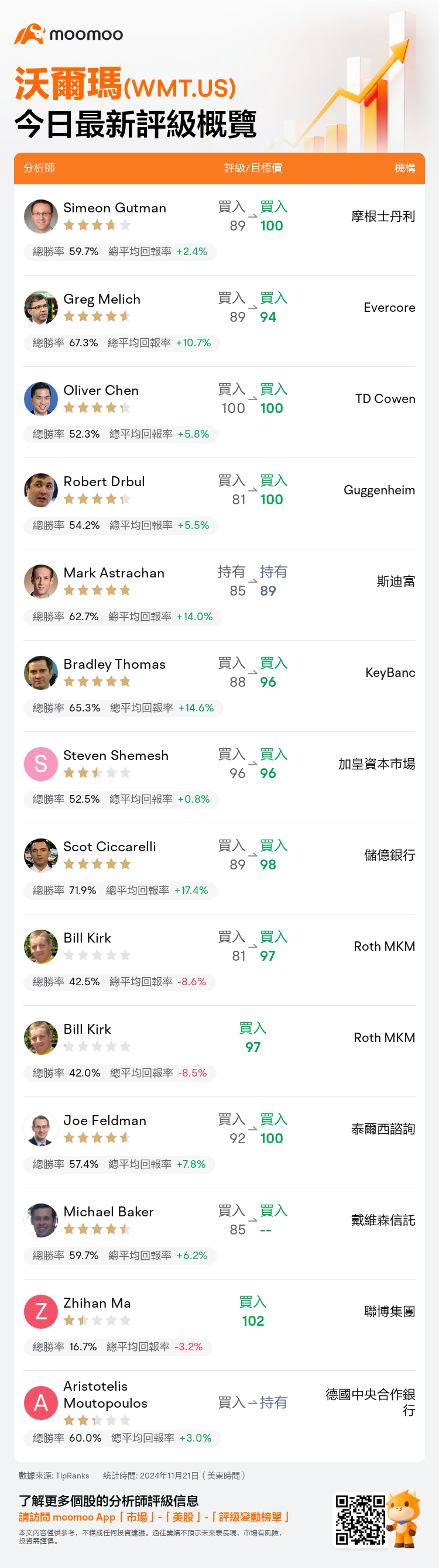

美東時間11月21日,多家華爾街大行更新了$沃爾瑪 (WMT.US)$的評級,目標價介於89美元至102美元。

摩根士丹利分析師Simeon Gutman維持買入評級,並將目標價從89美元上調至100美元。

Evercore分析師Greg Melich維持買入評級,並將目標價從89美元上調至94美元。

TD Cowen分析師Oliver Chen維持買入評級,維持目標價100美元。

TD Cowen分析師Oliver Chen維持買入評級,維持目標價100美元。

Guggenheim分析師Robert Drbul維持買入評級,並將目標價從81美元上調至100美元。

斯迪富分析師Mark Astrachan維持持有評級,並將目標價從85美元上調至89美元。

此外,綜合報道,$沃爾瑪 (WMT.US)$近期主要分析師觀點如下:

沃爾瑪在價格和成本領先方面的優勢得到了增強,因爲它利用其規模和科技來獲取市場份額,並擴展其替代營業收入來源。

沃爾瑪展示了可持續增長的潛力,因爲它正過渡到其生命週期的下一個階段。這一演變令人想起其從大賣場到超級中心的歷史轉變,突顯其作爲一個基本的長期投資的地位。

在強勁的第三季度之後,沃爾瑪的前景仍然樂觀,預計會有廣泛的市場份額增長和長期盈利能力的提升。這預計將受到高利潤數字廣告和第三方市場賣家費用增長的推動,同時核心電子商務虧損也在改善。

沃爾瑪的第三季度報告 exemplifies 其全渠道方法的有效性,隨着其數字業務的持續擴張,顯著的增長勢頭被 noted。分析師強調該公司的沃爾瑪Plus會員,正在以雙位數的速度增長,以及其第三方交易,激增超過40%。憑藉這些進展,沃爾瑪正在經歷流量增加、利潤改善、客戶忠誠度提升和投資回報的增強,儘管經濟條件各異。

在沃爾瑪發佈強勁的第三季度業績後,公司的 2025-2026 財年每股收益預測被略微上調,複合增長和EBIT數字超出預期。這一表現,特別是5.3%的美國複合增長,暗示在多個類別中包括食品雜貨和一般商品的市場份額持續增長,顯示出過去幾年的改善。

以下爲今日14位分析師對$沃爾瑪 (WMT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師Oliver Chen維持買入評級,維持目標價100美元。

TD Cowen分析師Oliver Chen維持買入評級,維持目標價100美元。

TD Cowen analyst Oliver Chen maintains with a buy rating, and maintains the target price at $100.

TD Cowen analyst Oliver Chen maintains with a buy rating, and maintains the target price at $100.