Decoding NVIDIA's Options Activity: What's the Big Picture?

Decoding NVIDIA's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on NVIDIA. Our analysis of options history for NVIDIA (NASDAQ:NVDA) revealed 509 unusual trades.

金融巨頭對NVIDIA採取了明顯的看跌舉動。我們對NVIDIA(納斯達克股票代碼:NVDA)期權歷史的分析顯示了509筆不尋常的交易。

Delving into the details, we found 39% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 87 were puts, with a value of $5,771,224, and 422 were calls, valued at $42,566,316.

深入研究細節,我們發現39%的交易者看漲,而42%的交易者表現出看跌趨勢。在我們發現的所有交易中,有87筆是看跌期權,價值爲5,771,224美元,422筆是看漲期權,價值42,566,316美元。

What's The Price Target?

目標價格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $0.5 to $280.0 for NVIDIA over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將NVIDIA的價格定在0.5美元至280.0美元之間。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

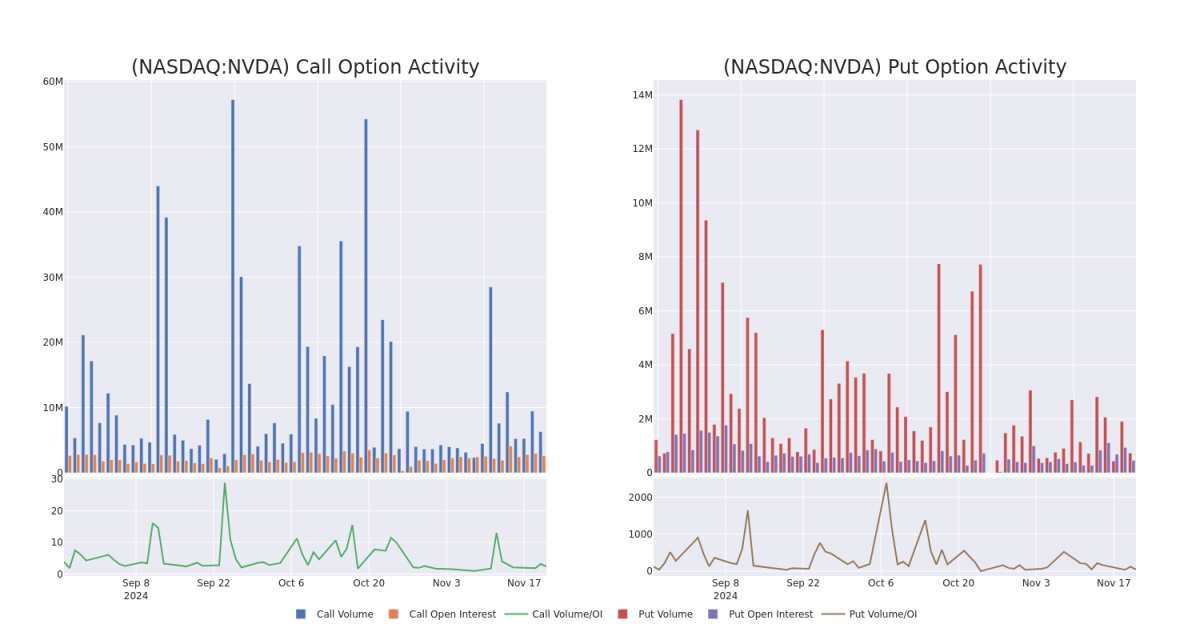

In terms of liquidity and interest, the mean open interest for NVIDIA options trades today is 29645.59 with a total volume of 6,724,021.00.

就流動性和利息而言,今天NVIDIA期權交易的平均未平倉合約爲29645.59,總交易量爲6,724,021.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for NVIDIA's big money trades within a strike price range of $0.5 to $280.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天內NVIDIA大額資金交易的看漲和看跌期權交易量和未平倉合約的變化,行使價區間爲0.5美元至280.0美元。

NVIDIA Option Activity Analysis: Last 30 Days

NVIDIA 期權活動分析:過去 30 天

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | NEUTRAL | 01/16/26 | $33.95 | $33.75 | $33.84 | $150.00 | $795.2K | 26.7K | 543 |

| NVDA | CALL | SWEEP | BULLISH | 11/29/24 | $2.9 | $2.87 | $2.9 | $150.00 | $219.9K | 57.1K | 24.2K |

| NVDA | CALL | SWEEP | NEUTRAL | 01/16/26 | $7.85 | $7.6 | $7.73 | $280.00 | $181.7K | 18.2K | 539 |

| NVDA | CALL | SWEEP | BULLISH | 11/29/24 | $3.25 | $3.2 | $3.25 | $150.00 | $158.2K | 57.1K | 27.9K |

| NVDA | CALL | SWEEP | BEARISH | 11/29/24 | $2.83 | $2.8 | $2.81 | $150.00 | $132.6K | 57.1K | 21.3K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | 打電話 | 掃 | 中立 | 01/16/26 | 33.95 美元 | 33.75 美元 | 33.84 美元 | 150.00 美元 | 795.2 萬美元 | 26.7 K | 543 |

| NVDA | 打電話 | 掃 | 看漲 | 11/29/24 | 2.9 美元 | 2.87 美元 | 2.9 美元 | 150.00 美元 | 219.9 萬美元 | 57.1K | 24.2K |

| NVDA | 打電話 | 掃 | 中立 | 01/16/26 | 7.85 美元 | 7.6 美元 | 7.73 美元 | 280.00 美元 | 181.7 萬美元 | 18.2K | 539 |

| NVDA | 打電話 | 掃 | 看漲 | 11/29/24 | 3.25 美元 | 3.2 美元 | 3.25 美元 | 150.00 美元 | 158.2 萬美元 | 57.1K | 27.9 K |

| NVDA | 打電話 | 掃 | 粗魯的 | 11/29/24 | 2.83 美元 | 2.8 美元 | 2.81 美元 | 150.00 美元 | 132.6 萬美元 | 57.1K | 21.3K |

About NVIDIA

關於英偉達

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

Nvidia 是圖形處理單元的領先開發商。傳統上,GPU 用於增強計算平台上的體驗,最值得注意的是 PC 上的遊戲應用程序。此後,GPU 用例已成爲人工智能中使用的重要半導體。Nvidia不僅提供人工智能GPU,還提供用於人工智能模型開發和訓練的軟件平台Cuda。Nvidia還在擴展其數據中心網絡解決方案,幫助將GPU結合在一起以處理複雜的工作負載。

In light of the recent options history for NVIDIA, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於NVIDIA最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Where Is NVIDIA Standing Right Now?

NVIDIA 現在處於什麼位置?

- Currently trading with a volume of 48,977,431, the NVDA's price is up by 4.01%, now at $151.74.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 90 days.

- NVDA目前的交易量爲48,977,431美元,價格上漲了4.01%,目前爲151.74美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計收益將在90天后發佈。

What The Experts Say On NVIDIA

專家對 NVIDIA 的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $177.4.

5位市場專家最近發佈了該股的評級,共識目標價爲177.4美元。

Turn $1000 into $1270 in just 20 days?

在短短 20 天內將 1000 美元變成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for NVIDIA, targeting a price of $175. * An analyst from JP Morgan persists with their Overweight rating on NVIDIA, maintaining a target price of $170. * An analyst from Truist Securities persists with their Buy rating on NVIDIA, maintaining a target price of $167. * Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for NVIDIA, targeting a price of $190. * Maintaining their stance, an analyst from Melius Research continues to hold a Buy rating for NVIDIA, targeting a price of $185.

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處查看。* 奧本海默的一位分析師堅持自己的立場,繼續維持英偉達跑贏大盤的評級,目標價爲175美元。* 摩根大通的一位分析師堅持對NVIDIA的增持評級,維持170美元的目標價格。* Truist Securities的一位分析師堅持對NVIDIA的買入評級,維持167美元的目標價格。* Benchmark的一位分析師維持其立場,繼續維持買入評級對於NVIDIA而言,目標價格爲190美元。* Melius Research的一位分析師保持立場繼續維持NVIDIA的買入評級,目標價格爲185美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

In terms of liquidity and interest, the mean open interest for NVIDIA options trades today is 29645.59 with a total volume of 6,724,021.00.

In terms of liquidity and interest, the mean open interest for NVIDIA options trades today is 29645.59 with a total volume of 6,724,021.00.