Strong Week for Stitch Fix (NASDAQ:SFIX) Shareholders Doesn't Alleviate Pain of Three-year Loss

Strong Week for Stitch Fix (NASDAQ:SFIX) Shareholders Doesn't Alleviate Pain of Three-year Loss

Over the last month the Stitch Fix, Inc. (NASDAQ:SFIX) has been much stronger than before, rebounding by 40%. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 85% in that time. So it sure is nice to see a bit of an improvement. But the more important question is whether the underlying business can justify a higher price still. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

On a more encouraging note the company has added US$57m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Because Stitch Fix made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Stitch Fix's revenue dropped 17% per year. That's definitely a weaker result than most pre-profit companies report. And as you might expect the share price has been weak too, dropping at a rate of 23% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

Over the last three years, Stitch Fix's revenue dropped 17% per year. That's definitely a weaker result than most pre-profit companies report. And as you might expect the share price has been weak too, dropping at a rate of 23% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

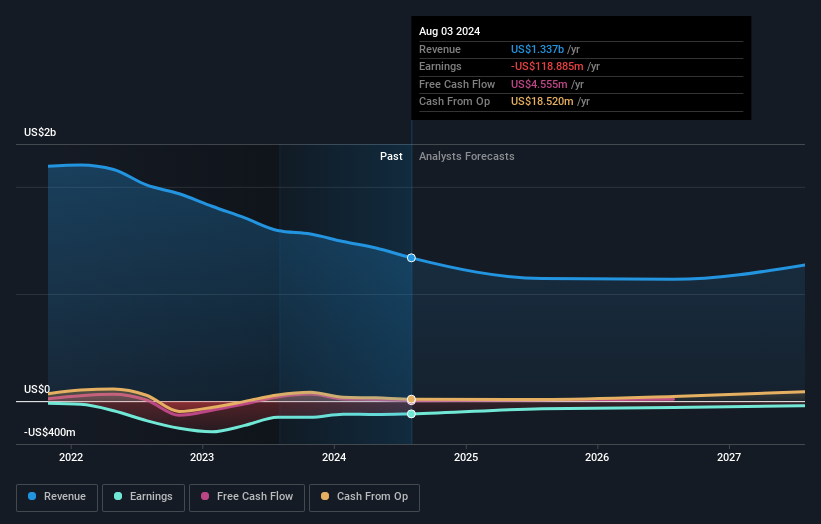

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Stitch Fix's financial health with this free report on its balance sheet.

A Different Perspective

Stitch Fix provided a TSR of 21% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 13% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Stitch Fix better, we need to consider many other factors. Even so, be aware that Stitch Fix is showing 3 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.