Top 3 Materials Stocks That Could Blast Off In November

Top 3 Materials Stocks That Could Blast Off In November

The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

材料板塊中最過度賣出的股票爲買入低估公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

Aspen Aerogels Inc (NYSE:ASPN)

阿斯彭氣凝膠股份有限公司(紐交所:ASPN)

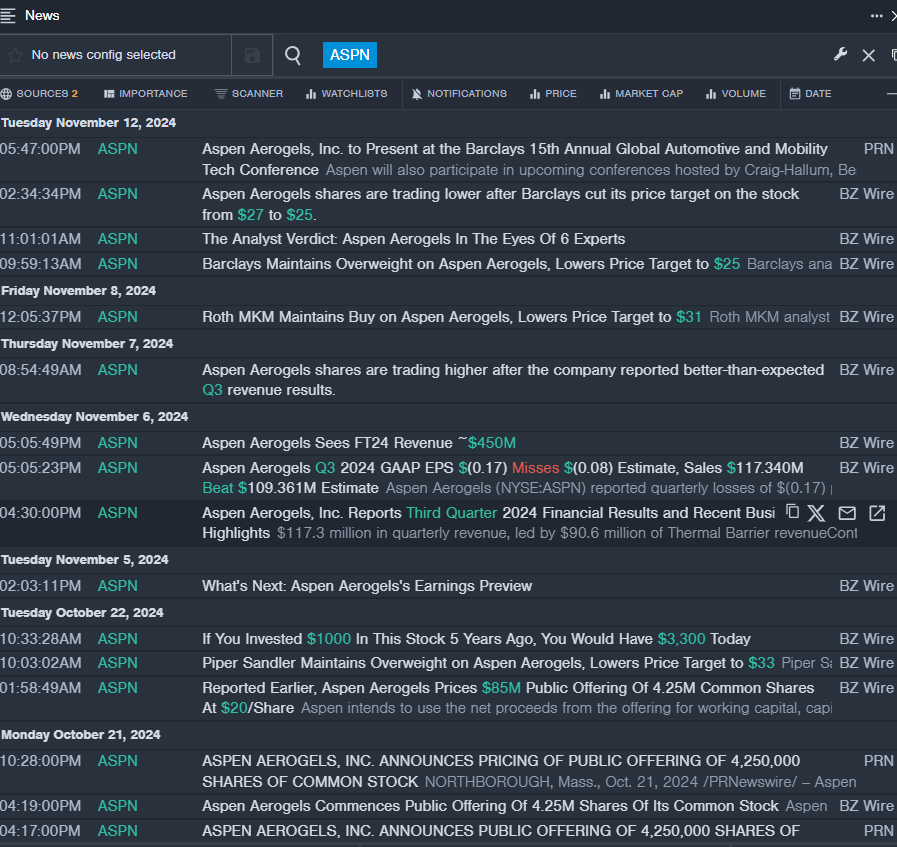

- On Nov. 6, Aspen Aerogels reported better-than-expected third-quarter revenue results.. The company's stock fell around 31% over the past month and has a 52-week low of $10.31.

- RSI Value: 26.83

- ASPN Price Action: Shares of Aspen Aerogels rose 0.1% to close at $14.00 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest ASPN news.

- 11月6日,阿斯彭氣凝膠報告了好於預期的第三季度營業收入結果。該公司股價在過去一個月下跌了約31%,目前的52周最低點爲10.31美元。

- RSI數值:26.83

- ASPN價格走勢:阿斯彭氣凝膠股票上漲0.1%,週四收盤價爲14.00美元。

- Benzinga Pro的實時新聞提醒了最新的ASPN新聞。

Braskem SA ADR (NYSE:BAK)

Braskem SA ADR(紐交所:BAK)

- On Sept. 18, UBS upgraded the stock from Neutral to Buy and raised its price target from $7.7 to $10. The company's stock fell around 36% over the past month and has a 52-week low of $64.98.

- RSI Value: 18.13

- BAK Price Action: Shares of Braskem fell 2.4% to close at $4.96 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in BAK stock.

- 9月18日,瑞士銀行將該股評級從中立提升至買入,並將價格目標從7.7美元提高至10美元。該公司股價在過去一個月內下跌了約36%,52周最低價爲64.98美元。

- RSI數值:18.13

- BAK價格走勢:Braskem股價週三下跌了2.4%,收於4.96美元。

- Benzinga Pro的圖表工具有助於識別BAK股票的趨勢。

TMC the metals company Inc (NASDAQ:TMC)

金屬公司股份有限公司(納斯達克:TMC)

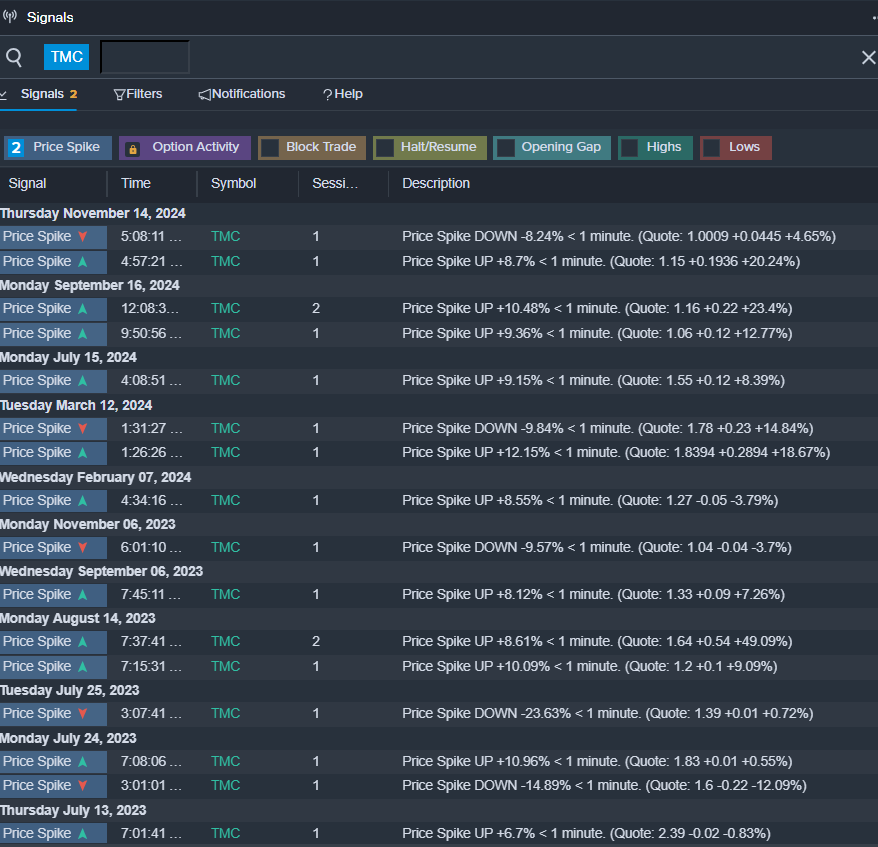

- On Nov. 14, TMC Metals posted third-quarter loss of 6 cents per share. Gerard Barron, Chairman & CEO of The Metals Company commented, "This week we announced June 27, 2025, as the date for NORI to submit its exploitation application to the ISA. This decision, made in close consultation with NORI's Sponsoring State Nauru, represents years of preparation, backed by the largest dataset ever collected on the deep sea in international waters. We're excited to share our application with the ISA and stakeholders and recognize the responsibility that comes with submitting the world's first application of this kind." The company's stock fell around 13% over the past month and has a 52-week low of $0.80.

- RSI Value: 28.06

- TMC Price Action: Shares of TMC the metals company fell 2.1% to close at $0.88 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in TMC shares.

- TMC Metals在11月14日發佈了每股6美分的第三季度虧損。 The Metals Company的董事長兼首席執行官Gerard Barron評論說:「本週我們宣佈2025年6月27日爲NORI提交其利用申請給ISA的日期。這一決定是與NORI的贊助國瑙魯密切磋商的結果,代表了多年的準備工作,根據在國際水域中收集到的有史以來最龐大的數據集。我們很高興與ISA和利益相關者分享我們的申請,並認識到提交這種世界首例申請所帶來的責任。」該公司股價在過去一個月下跌了約13%,52周最低價爲0.80美元。

- RSI數值:28.06

- TMC股票走勢:TMC the metals company的股價週四下跌2.1%,收於0.88美元。

- Benzinga Pro的信號功能通知了TMC股票潛在突破。

Read This Next:

Read This Next:

- Dow Surges Over 450 Points As Nvidia Climbs Post-Earnings, Google, Amazon Slip: Fear Index Shifts To 'Greed' Zone

- 道瓊斯指數在英偉達業績後勁升逾450點,谷歌和亞馬遜下滑:恐懼指數轉向「貪婪」區間