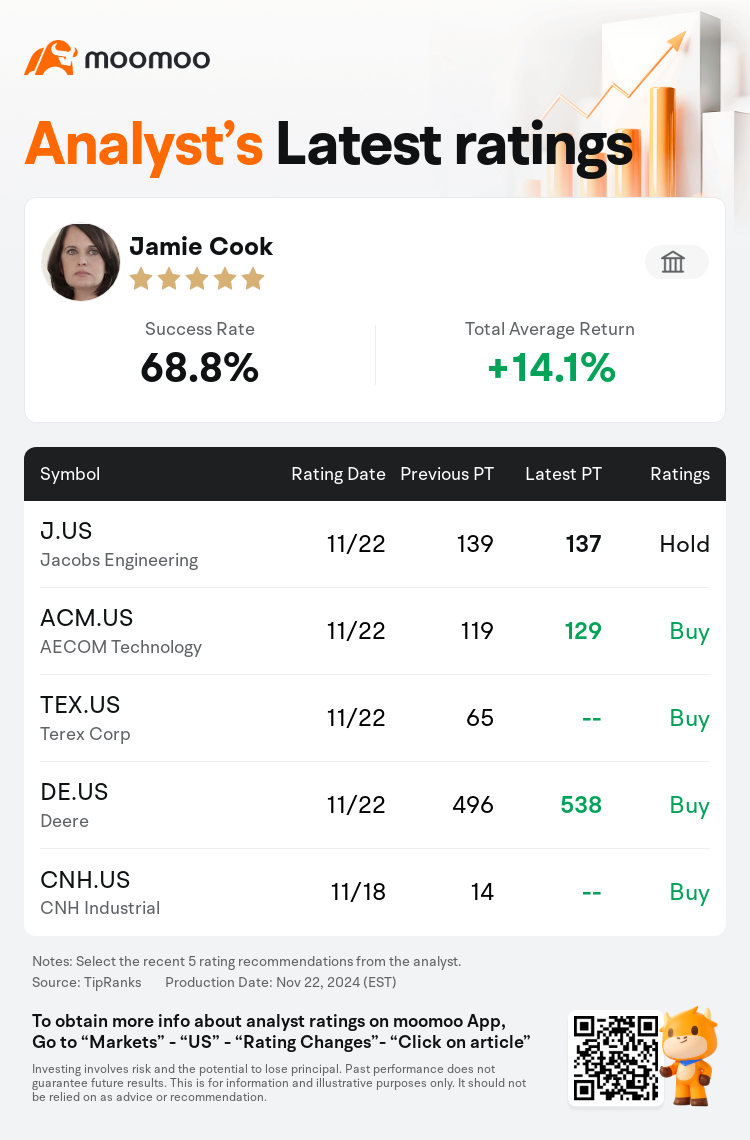

Truist Financial analyst Jamie Cook maintains $Jacobs Engineering (J.US)$ with a hold rating, and adjusts the target price from $139 to $137.

According to TipRanks data, the analyst has a success rate of 68.8% and a total average return of 14.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Jacobs Engineering (J.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Jacobs Engineering (J.US)$'s main analysts recently are as follows:

The company's fiscal 2025 guidance was perceived as somewhat disappointing to investors, yet it appears to incorporate a level of conservatism in response to the ongoing cautious economic landscape. Despite the challenges in certain sectors, the company's strong backlog and robust overall bookings environment are anticipated to drive considerable sales growth in fiscal 2025.

Jacobs's Q4 results aligned closely with market expectations, and their F25 guidance was also consistent with analyst forecasts. Attention is now shifting to the investor day scheduled in February, where the company is expected to set medium-term targets and unveil its forward-looking strategy. This disclosure reflects analysts' view that the valuation multiple correctly represents Jacobs's prospects for organic growth.

The company's first quarter post-spin performance was noted as surprisingly clean, and its initial F2025 guidance aligns well with the expected mid to high single-digit organic growth projections.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

儲億銀行分析師Jamie Cook維持$雅各布工程 (J.US)$持有評級,並將目標價從139美元下調至137美元。

根據TipRanks數據顯示,該分析師近一年總勝率為68.8%,總平均回報率為14.1%。

此外,綜合報道,$雅各布工程 (J.US)$近期主要分析師觀點如下:

此外,綜合報道,$雅各布工程 (J.US)$近期主要分析師觀點如下:

該公司的2025財年指導被投資者視爲有些令人失望,但它似乎在應對持續謹慎的經濟形勢時體現了一定的保守態度。儘管某些行業面臨挑戰,公司強勁的訂單積壓和整體預訂環境預計將推動2025財年的顯著銷售增長。

雅各布公司的第四季度業績與市場預期緊密吻合,其2025財年指導也與分析師的預測一致。現在的關注點轉向定於二月舉行的投資者日,屆時公司預計將設定中期目標並揭示其前瞻性策略。這一披露反映了分析師對雅各布公司有機增長前景的估值倍數正確性的看法。

該公司的首季度分拆後表現被認爲出乎意料的乾淨,其初步的2025財年指導與預期的中高個位數有機增長預測良好對接。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$雅各布工程 (J.US)$近期主要分析師觀點如下:

此外,綜合報道,$雅各布工程 (J.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of