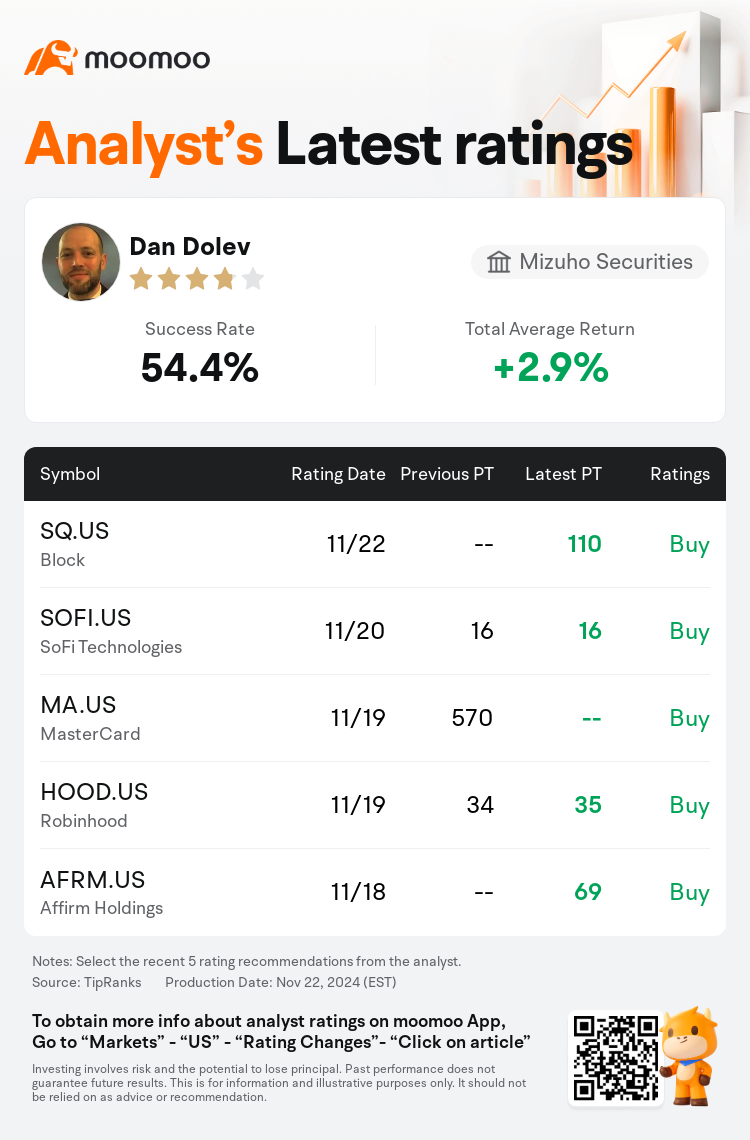

Mizuho Securities analyst Dan Dolev maintains $Block (SQ.US)$ with a buy rating, and sets the target price at $110.

According to TipRanks data, the analyst has a success rate of 54.4% and a total average return of 2.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Block (SQ.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Block (SQ.US)$'s main analysts recently are as follows:

While some investors have shown skepticism regarding Block's ambition of no less than 15% profit growth by 2025, analyses suggest a more favorable outcome is plausible for the firm's three main ecosystems. Cash App, with the exclusion of buy-now-pay-later, might achieve mid-teen profit increase rates annually by adding approximately 1 million monthly active users while moderating monetization rate growth. Furthermore, anticipated initiatives in verticalization and streamlined merchant onboarding may see Square's profits increase by 12%. Additionally, a potentially high twenties percentage growth is projected for the company's buy-now-pay-later profits by 2025. Collectively, these assessments underpin a forecast of at least 16% growth in Block's total gross profits for 2025.

The company's growth is noted to be slowing after recent share rallies. Analysts express a more cautious view concerning Cash App, alongside a mild downside risk to consensus estimates following the stock's rally over the last month.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

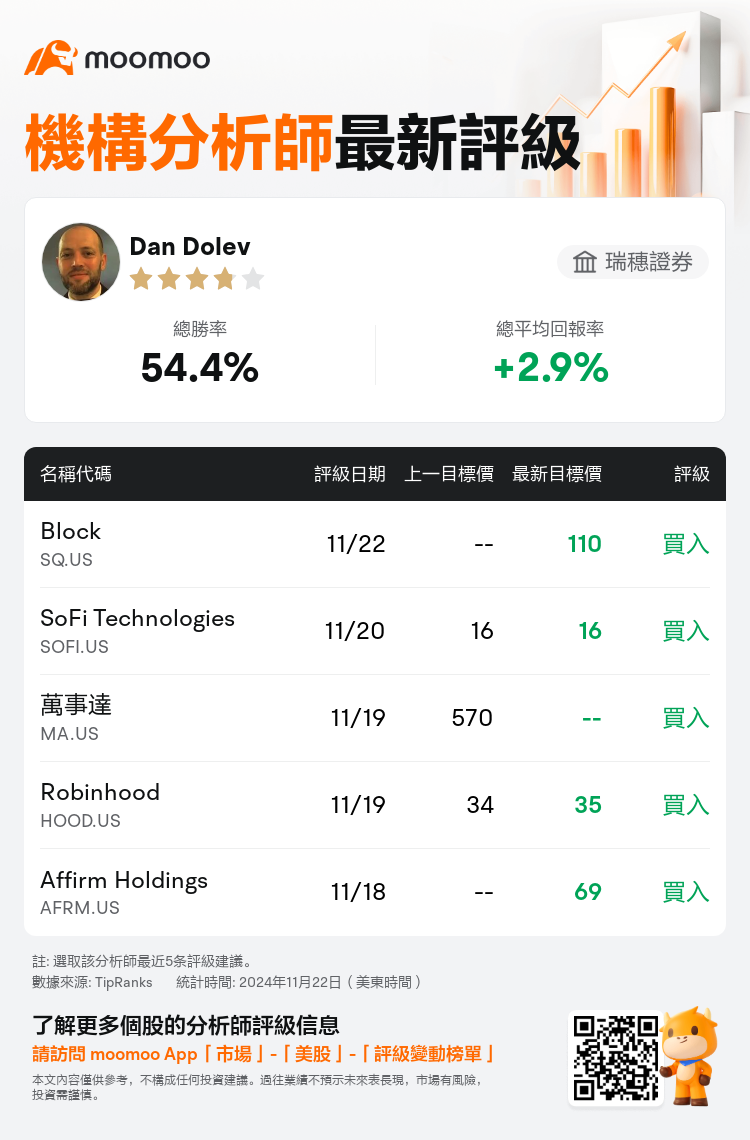

瑞穗證券分析師Dan Dolev維持$Block (SQ.US)$買入評級,目標價110美元。

根據TipRanks數據顯示,該分析師近一年總勝率為54.4%,總平均回報率為2.9%。

此外,綜合報道,$Block (SQ.US)$近期主要分析師觀點如下:

此外,綜合報道,$Block (SQ.US)$近期主要分析師觀點如下:

儘管一些投資者對Block到2025年實現不低於15%的利潤增長抱有懷疑態度,但分析表明公司的三大生態系統可能會實現更有利的結果。除了買入現付以外,現金App可能通過增加約100萬的月活躍用戶數,同時調節貨幣化速度增長,每年實現中個位數的利潤增長率。此外,預期的垂直化舉措和簡化商家入駐流程可能使Square的利潤增長12%。此外,公司的買入現付利潤可能在2025年達到高20%的增長率。總體而言,這些評估支撐了至少預計Block在2025年總收益毛利的16%增長。

公司的增長被注意到在最近的股票漲勢之後有所放緩。分析師表達了對現金App更加謹慎的觀點,同時認爲股票在過去一個月的漲勢後對共識估值存在輕微下行風險。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Block (SQ.US)$近期主要分析師觀點如下:

此外,綜合報道,$Block (SQ.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of