Wall Street's Most Accurate Analysts Give Their Take On 3 Industrials Stocks With Over 3% Dividend Yields

Wall Street's Most Accurate Analysts Give Their Take On 3 Industrials Stocks With Over 3% Dividend Yields

華爾街最精準的分析師對三隻股息收益率超過3%的工業股票發表看法

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定的時期,許多投資者會轉向股息收益股,這些通常是具有較高的自由現金流並以高紅利派息獎勵股東的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的讀者可以通過訪問分析師股票評級頁面,查看他們最喜歡的股票的最新分析師觀點。交易員可以瀏覽Benzinga龐大的分析師評級數據庫,包括按照分析師準確度排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the industrials sector.

以下是在工業板塊中三隻高收益股票最準確的分析師評級。

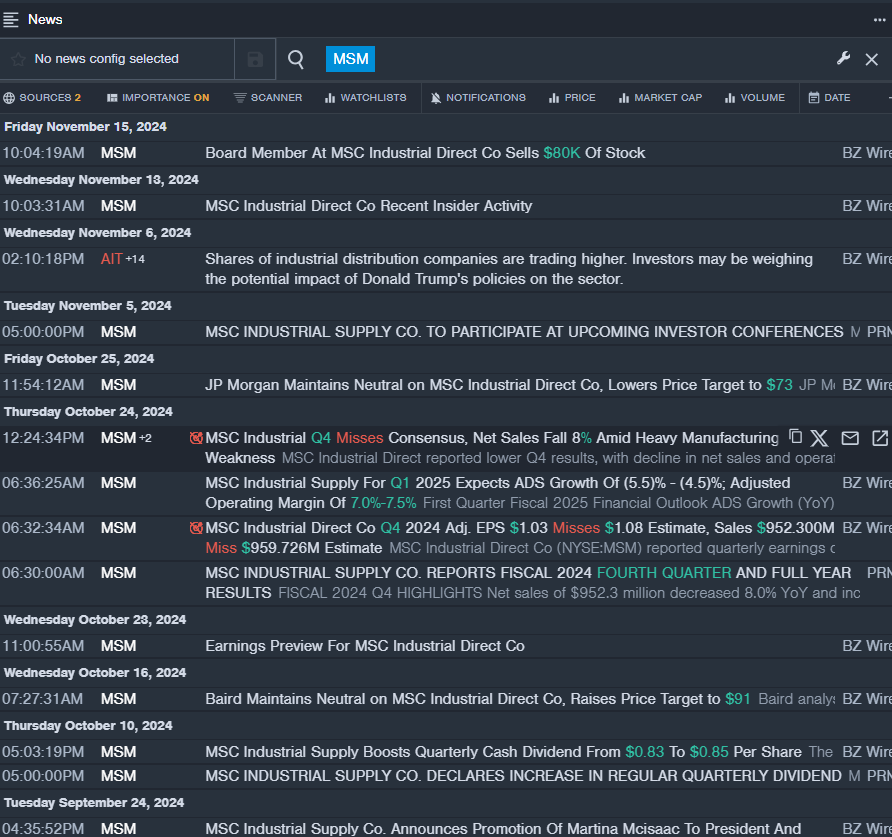

MSC Industrial Direct Co., Inc. (NYSE:MSM)

msc industrial direct有限公司(紐交所代碼:MSM)

- Dividend Yield: 4.04%

- Baird analyst David Manthey maintained a Neutral rating and raised the price target from $84 to $91 on Oct. 16. This analyst has an accuracy rate of 82%.

- Loop Capital analyst Chris Dankert maintained a Hold rating and cut the price target from $80 to $75 on July 3. This analyst has an accuracy rate of 78%.

- Recent News: On Oct. 24, MSC Industrial Direct Company reported fourth-quarter results. Net sales declined 8.0% year-over-year to $952.3 million, missing the consensus of $959.7 million..

- Benzinga Pro's real-time newsfeed alerted to latest MSM news

- 股息收益率:4.04%

- 貝爾德分析師大衛·曼特希維持中立評級,並在10月16日將目標價從84萬億美元上調至910億美元。該分析師的準確率爲82%。

- Loop Capital分析師克里斯·丹克特維持持有評級,並在7月3日將目標價從80美元下調至75美元。該分析師的準確率爲78%。

- 最新資訊:在10月24日,msc industrial direct公司發佈了第四季度業績報告。淨銷售額同比下降8.0%,降至95230萬美元,未達到預期的95970萬美元。

- Benzinga Pro的實時資訊提醒了最新的MSm資訊

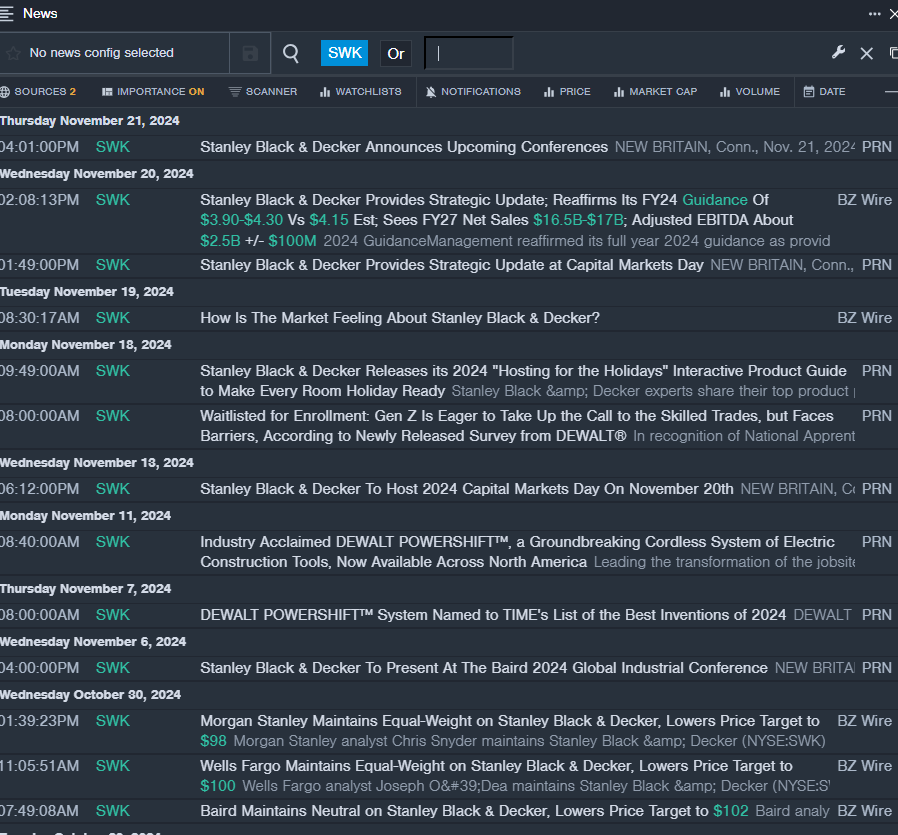

Stanley Black & Decker, Inc. (NYSE:SWK)

斯坦利·布萊克及戴克爾公司(NYSE:SWK)

- Dividend Yield: 3.74%

- Morgan Stanley analyst Chris Snyder maintained an Equal-Weight rating and cut the price target from $107 to $98 on Oct. 30. This analyst has an accuracy rate of 74%.

- Goldman Sachs analyst Joe Ritchie maintained a Neutral rating and raised the price target from $94 to $107 on Oct. 10. This analyst has an accuracy rate of 75%.

- Recent News: On Nov. 20, Stanley Black & Decker issued a strategic update, reaffirming its FY24 earnings guidance of $3.90-$4.30 per share.

- Benzinga Pro's real-time newsfeed alerted to latest SWK news

- 股息收益率:3.74%

- 摩根士丹利分析師Chris Snyder維持了持平評級,並將價格目標從107萬億降至98萬億,調整於10月30日。這位分析師的準確率爲74%。

- 高盛分析師Joe Ritchie維持了中立評級,並將價格目標從94萬億上調至107萬億,調整於10月10日。這位分析師的準確率爲75%。

- 最新資訊:11月20日,Stanley Black & Decker發佈了戰略更新,重申其2024財年的每股收益指導爲3.90-4.30美元。

- Benzinga Pro的實時資訊提醒了最新的SWk資訊

United Parcel Service, Inc. (NYSE:UPS)

聯合包裹服務公司(NYSE: UPS)

- Dividend Yield: 4.96%

- Citigroup analyst Ariel Rosa maintained a Buy rating and cut the price target from $163 to $158 on Nov. 12. This analyst has an accuracy rate of 76%.

- JP Morgan analyst Brian Osssenbeck maintained a Neutral rating and cut the price target from $140 to $139 on Oct. 25. This analyst has an accuracy rate of 73%.

- Recent News: On Oct. 24, United Parcel Service reported better-than-expected third-quarter financial results.

- Benzinga Pro's charting tool helped identify the trend in UPS stock.

- 股息收益率:4.96%

- 花旗集團分析師阿里爾·羅莎在11月12日維持了買入評級,並將目標價從163美元下調至158美元。該分析師的準確率爲76%。

- 摩根大通分析師布賴恩·奧森貝克在10月25日維持了中立評級,並將目標價從140萬億下調至139美元。該分析師的準確率爲73%。

- 最新資訊:在10月24日,聯合包裹報告了超出預期的第三季度財務業績。

- Benzinga Pro的圖表工具有助於識別聯合包裹股票的趨勢。

Read More:

閱讀更多:

- Dow Surges Over 450 Points As Nvidia Climbs Post-Earnings, Google, Amazon Slip: Fear Index Shifts To 'Greed' Zone

- 道瓊斯指數在英偉達業績後勁升逾450點,谷歌和亞馬遜下滑:恐懼指數轉向「貪婪」區間