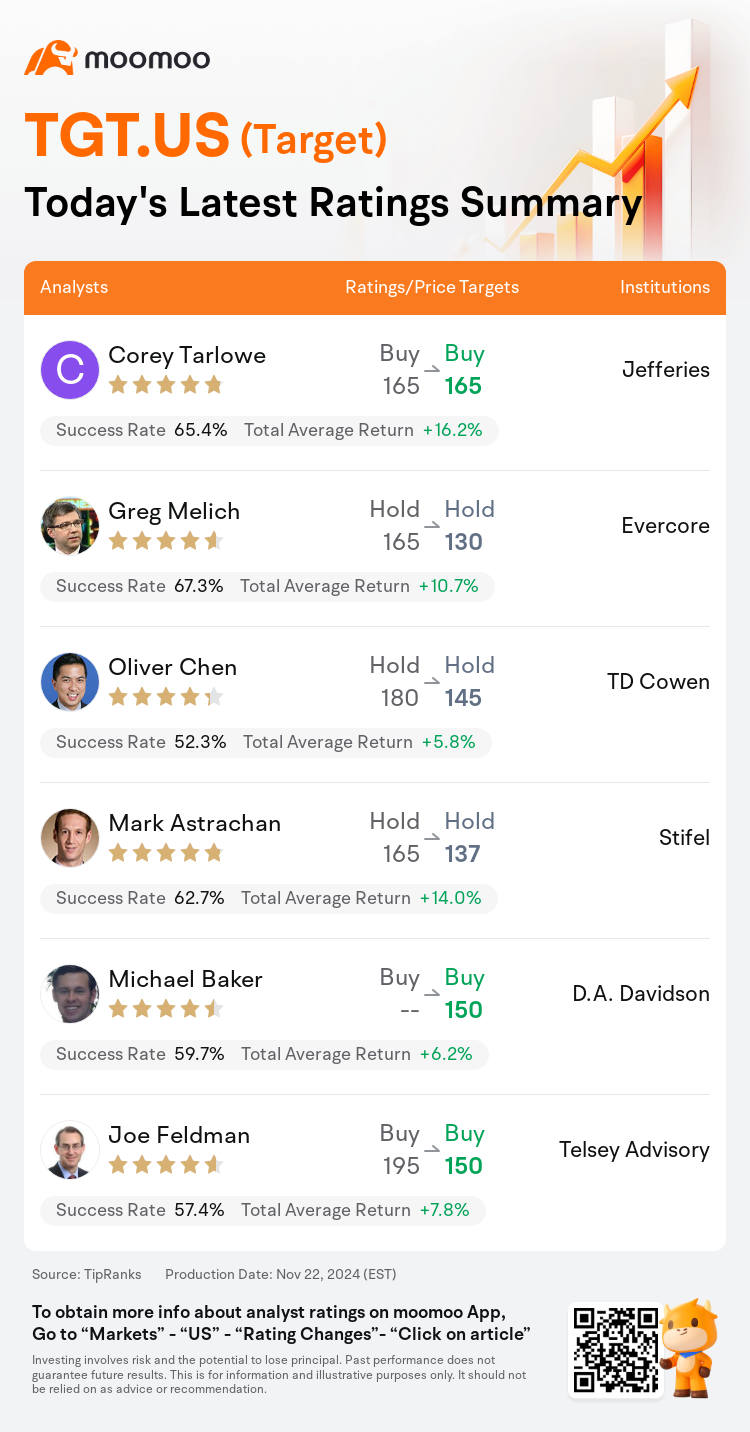

On Nov 22, major Wall Street analysts update their ratings for $Target (TGT.US)$, with price targets ranging from $130 to $165.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and maintains the target price at $165.

Evercore analyst Greg Melich maintains with a hold rating, and adjusts the target price from $165 to $130.

TD Cowen analyst Oliver Chen maintains with a hold rating, and adjusts the target price from $180 to $145.

TD Cowen analyst Oliver Chen maintains with a hold rating, and adjusts the target price from $180 to $145.

Stifel analyst Mark Astrachan maintains with a hold rating, and adjusts the target price from $165 to $137.

D.A. Davidson analyst Michael Baker maintains with a buy rating, and sets the target price at $150.

Furthermore, according to the comprehensive report, the opinions of $Target (TGT.US)$'s main analysts recently are as follows:

Following the company's weaker than expected Q3 earnings and subdued future guidance, forecasts for FY25 earnings per share have been reduced. This adjustment stems from the Q3 performance and anticipations of persistent challenges in the fourth quarter. It is noted that the continued slowdown in discretionary spending and specific calendar effects are expected to persist, impacting the forecasts for the upcoming quarter. Additionally, the pressures from cost headwinds experienced in Q3 are also expected to affect future quarters.

Target's third-quarter outcomes underperformed expectations regarding margins due to accumulated inventories from early receipts, alongside intensified discounting efforts. This situation was exacerbated by a significant amount of sales occurring during promotional periods and the impact of warm weather on apparel sales. It is suggested that these represent mostly cyclical challenges, putting pressure on the company to demonstrate operational resilience.

Target's Q3 report highlighted major concerns including weaker sales, diminished gross margins, and escalated SG&A costs, which significantly impacted stock performance today. Despite these issues seeming like a case of 'wrong place, wrong time', they also amplify discussions regarding market share and the trajectory towards improved revenue outcomes. The situation underscores a critical juncture in the company's narrative, where a rebound in sales is necessary, although it was not observed in Q3, it might be anticipated in Q4.

Target needs to address negative trends in home, apparel, hardlines segments, and improve digital channel profitability, as well as consistency outside of seasonal and promotional periods.

Target's Q3 outcomes fell below the reduced expectations, impacted by a cautious consumer stance and a negative outlook on margins heading into Q4, coupled with necessary investments to stabilize traffic amidst intensified competition from major players. Recent surveys have demonstrated a noticeable divide between those gaining market share and those struggling, with strong renewal intentions observed for some, while others work to ensure they are not sidelined by their dominant competitors.

Here are the latest investment ratings and price targets for $Target (TGT.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月22日,多家華爾街大行更新了$塔吉特 (TGT.US)$的評級,目標價介於130美元至165美元。

富瑞集團分析師Corey Tarlowe維持買入評級,維持目標價165美元。

Evercore分析師Greg Melich維持持有評級,並將目標價從165美元下調至130美元。

TD Cowen分析師Oliver Chen維持持有評級,並將目標價從180美元下調至145美元。

TD Cowen分析師Oliver Chen維持持有評級,並將目標價從180美元下調至145美元。

斯迪富分析師Mark Astrachan維持持有評級,並將目標價從165美元下調至137美元。

戴維森信託分析師Michael Baker維持買入評級,目標價150美元。

此外,綜合報道,$塔吉特 (TGT.US)$近期主要分析師觀點如下:

由於公司第三季度業績低於預期且未來指引疲軟,2025財年的每股收益預測已被下調。這一調整源自第三季度的表現和對第四季度持續挑戰的預期。值得注意的是,消費者可支配支出的持續放緩和特定日曆效應預計將持續,影響即將到來的季度的預測。此外,第三季度經歷的成本壓力預計也將影響未來的幾個季度。

由於早期收貨導致庫存積壓以及折扣力度加大,塔吉特第三季度的業績未能達到關於利潤率的預期。這種情況因大量銷售發生在促銷期以及溫暖天氣對服裝銷售的影響而加劇。有人指出,這主要代表週期性挑戰,給公司展示運營韌性施加壓力。

塔吉特的第三季度報告突出了主要問題,包括銷售疲軟、毛利下降和SG&A成本上升,這些大幅影響了今天的股市表現。儘管這些問題似乎是'時機不對,地點不對'的情況,但它們也加劇了關於市場份額和改善營業收入預期的討論。這個情況突顯了公司敘事中的關鍵時刻,銷售的反彈是必要的,儘管在第三季度沒有觀察到,但在第四季度可能有所期待。

塔吉特需要解決家居、服裝、硬件部門的負面趨勢,並改善數字渠道的盈利能力,以及在季節性和促銷時期之外保持一致性。

塔吉特的第三季度業績低於下調的預期,受到謹慎消費態度和進入第四季度時毛利負面展望的影響,再加上在主要競爭對手的激烈競爭中穩定客流所需的投資。最近的調查顯示,在一些市場份額增持者和陷入困境者之間存在明顯差距,強烈的續約意向在某些公司中得到體現,而其他公司則努力確保不被占主導地位的競爭對手邊緣化。

以下爲今日6位分析師對$塔吉特 (TGT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師Oliver Chen維持持有評級,並將目標價從180美元下調至145美元。

TD Cowen分析師Oliver Chen維持持有評級,並將目標價從180美元下調至145美元。

TD Cowen analyst Oliver Chen maintains with a hold rating, and adjusts the target price from $180 to $145.

TD Cowen analyst Oliver Chen maintains with a hold rating, and adjusts the target price from $180 to $145.