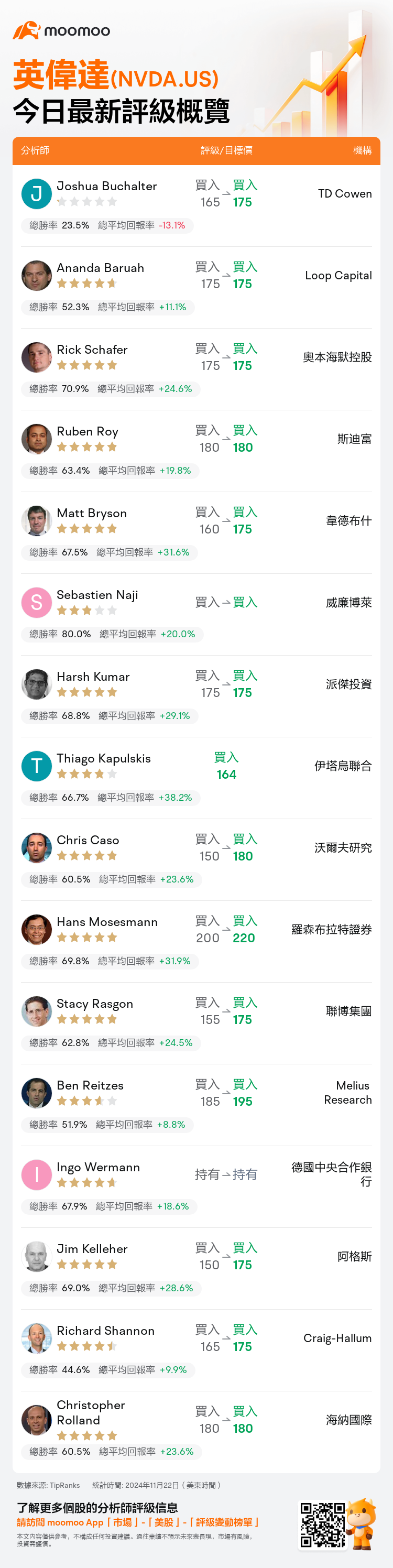

On Nov 22, major Wall Street analysts update their ratings for $NVIDIA (NVDA.US)$, with price targets ranging from $164 to $220.

TD Cowen analyst Joshua Buchalter maintains with a buy rating, and adjusts the target price from $165 to $175.

Loop Capital analyst Ananda Baruah maintains with a buy rating, and maintains the target price at $175.

Oppenheimer analyst Rick Schafer maintains with a buy rating, and maintains the target price at $175.

Oppenheimer analyst Rick Schafer maintains with a buy rating, and maintains the target price at $175.

Stifel analyst Ruben Roy maintains with a buy rating, and maintains the target price at $180.

Wedbush analyst Matt Bryson maintains with a buy rating, and adjusts the target price from $160 to $175.

Furthermore, according to the comprehensive report, the opinions of $NVIDIA (NVDA.US)$'s main analysts recently are as follows:

The company delivered another outstanding quarter that exceeded expectations. Analysts noted that Nvidia's performance is impressively strong and shows significant growth in comparison to historical data, yet this optimistic outlook is already accounted for in its current share value.

Nvidia surpassed quarterly expectations with robust performance in data center compute activities, which compensated for a surprising drop in data center networking. Despite a Q4 revenue outlook that met expectations and immediate gross margin challenges linked to Blackwell expected to continue through the April quarter, there is anticipation of increased demand for artificial intelligence infrastructure across various customer groups. Furthermore, improvements in supply and a normalization in gross margins in the latter half of 2025 are projected to foster robust sequential earnings growth and lead to positive revisions in analyst expectations throughout the following year.

Nvidia reported October quarter results that surpassed consensus estimates and, from a higher revenue base, forecasted a 7% sequential increase for the January quarter, aligning with consensus yet slightly trailing market expectations. Analysts highlight that Nvidia maintains a significant lead over competitors with its advanced silicon, hardware, and software platforms, and they consider the earnings report robust due to ongoing demand for artificial intelligence.

Following Nvidia's Q3 report, it was highlighted that the 'modest' guidance and gross margin commentary are positioning the next two quarters more favorably as the company emphasizes on ramping up Blackwell. It was noted that Nvidia is excelling in its transition.

The firm noted that Nvidia's results were somewhat more modest than previous quarters due to supply constraints, yet they still surpassed expectations, maintaining a pattern familiar to investors. While there were minor concerns regarding the scale and margins, the overall sentiment is positive as the new leadership phase commences.

Here are the latest investment ratings and price targets for $NVIDIA (NVDA.US)$ from 16 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月22日,多家華爾街大行更新了$英偉達 (NVDA.US)$的評級,目標價介於164美元至220美元。

TD Cowen分析師Joshua Buchalter維持買入評級,並將目標價從165美元上調至175美元。

Loop Capital分析師Ananda Baruah維持買入評級,維持目標價175美元。

奧本海默控股分析師Rick Schafer維持買入評級,維持目標價175美元。

奧本海默控股分析師Rick Schafer維持買入評級,維持目標價175美元。

斯迪富分析師Ruben Roy維持買入評級,維持目標價180美元。

韋德布什分析師Matt Bryson維持買入評級,並將目標價從160美元上調至175美元。

此外,綜合報道,$英偉達 (NVDA.US)$近期主要分析師觀點如下:

該公司交出了又一個超出預期的出色季度業績。分析師指出,英偉達的表現令人印象深刻,與歷史數據相比顯示了顯著增長,但這一樂觀前景已經體現在其當前的分享價值中。

英偉達在數據中心計算活動中以強勁的表現超越了季度預期,彌補了數據中心網絡出現意外下跌的情況。儘管第四季度的營業收入前景達到了預期,且與Blackwell相關的毛利率挑戰將在四月季度繼續存在,但各個客戶群體對人工智能基礎設施的需求增加的期待依然存在。此外,預計2025年下半年供給改善及毛利率的正常化將會促進強勁的季度盈利增長,並在接下來的年份內對分析師的預期進行積極修正。

英偉達報告了超出市場共識預期的十月季度業績,並且在更高的營業收入基礎上,預計一月季度將實現7%的環比增長,符合共識但略微落後於市場預期。分析師強調,英偉達憑藉其先進的硅芯片、硬件和軟件平台在競爭中保持了顯著的領先地位,他們認爲由於對人工智能持續的需求,該公司的盈利報告表現強勁。

在英偉達發佈第三季度報告後,強調了'溫和'的指引和毛利率評論使得接下來的兩個季度變得更加有利,因爲公司專注於加快Blackwell的進展。有人指出,英偉達在轉型中表現出色。

該公司表示,由於供應限制,英偉達的業績相比之前的幾個季度略顯溫和,然而仍然超出了預期,保持了投資者熟悉的模式。儘管對規模和毛利率存在小幅擔憂,但總體情緒對於新領導階段的開始仍然積極。

以下爲今日16位分析師對$英偉達 (NVDA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

奧本海默控股分析師Rick Schafer維持買入評級,維持目標價175美元。

奧本海默控股分析師Rick Schafer維持買入評級,維持目標價175美元。

Oppenheimer analyst Rick Schafer maintains with a buy rating, and maintains the target price at $175.

Oppenheimer analyst Rick Schafer maintains with a buy rating, and maintains the target price at $175.