On Nov 22, major Wall Street analysts update their ratings for $Palo Alto Networks (PANW.US)$, with price targets ranging from $291 to $455.

Morgan Stanley analyst Hamza Fodderwala maintains with a buy rating, and maintains the target price at $446.

Goldman Sachs analyst Gabriela Borges maintains with a buy rating, and adjusts the target price from $425 to $421.

Citi analyst Fatima Boolani maintains with a buy rating, and maintains the target price at $432.

Citi analyst Fatima Boolani maintains with a buy rating, and maintains the target price at $432.

Deutsche Bank analyst Brad Zelnick maintains with a buy rating, and adjusts the target price from $395 to $415.

Jefferies analyst Joseph Gallo maintains with a buy rating, and maintains the target price at $450.

Furthermore, according to the comprehensive report, the opinions of $Palo Alto Networks (PANW.US)$'s main analysts recently are as follows:

Palo Alto Networks exhibited solid remaining performance obligation and annual recurring revenue which surpassed expectations, according to analysts. The performance was deemed sufficient to constitute a respectable financial disclosure. The company acknowledged a more constructive outlook on its products, robust prospects for Cortex, and significant renewal cycles expected in fiscal 2026 and 2027, which are anticipated to support ongoing positive revisions to estimates.

Palo Alto Networks reported a strong quarter, highlighted by better-than-expected NGS ARR, product revenue growth, and free cash flow generation. While estimates were increased, it is believed that the current multiple already reflects the company's strong results, and sees limited upside for the stock.

Palo Alto Networks continues to perform strongly as more customers consolidate on its platform. Although there was a weaker performance in billings, the underlying demand trends appear to be stable. Additionally, the existing QRadar customer base provides a significant conversion opportunity for Palo Alto Networks moving forward.

Palo Alto Networks reported robust F1Q25 outcomes, featuring a 40% growth in Next Generation Security ARR and a 20% increase in RPO. The continued platformization is driving ARR expansion, leading the company to raise its 2025 guidance.

Palo Alto Networks has exhibited a robust start to FY25, marked by performance metrics like revenue, annual recurring revenue, remaining performance obligation, and profitability surpassing consensus expectations. The company's continuous advancement in platformization has been noteworthy, particularly with the addition of over 70 customers in the first quarter.

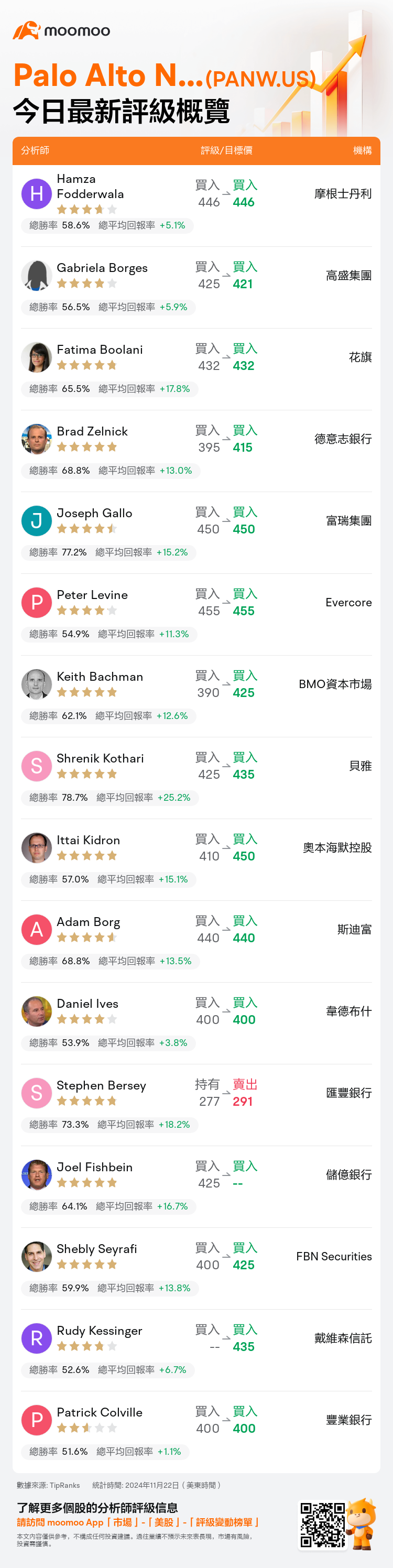

Here are the latest investment ratings and price targets for $Palo Alto Networks (PANW.US)$ from 16 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月22日,多家華爾街大行更新了$Palo Alto Networks (PANW.US)$的評級,目標價介於291美元至455美元。

摩根士丹利分析師Hamza Fodderwala維持買入評級,維持目標價446美元。

高盛集團分析師Gabriela Borges維持買入評級,並將目標價從425美元下調至421美元。

花旗分析師Fatima Boolani維持買入評級,維持目標價432美元。

花旗分析師Fatima Boolani維持買入評級,維持目標價432美元。

德意志銀行分析師Brad Zelnick維持買入評級,並將目標價從395美元上調至415美元。

富瑞集團分析師Joseph Gallo維持買入評級,維持目標價450美元。

此外,綜合報道,$Palo Alto Networks (PANW.US)$近期主要分析師觀點如下:

palo alto networks展示了良好的剩餘履約義務和超過預期的年度經常性營業收入,分析師認爲這一表現足以構成令人尊重的財務披露。公司承認對於其產品的前景更加樂觀,Cortex的強大前景,以及預計在2026和2027財政年度將出現的重要續約週期,這被期待能支持持續的樂觀估計修正。

palo alto networks報告了一個強勁的季度,突顯出超出預期的NGS年經常性收入、產品營收增長和自由現金流生成。雖然預估有所增加,但認爲當前的倍數已經反映了公司的強勁業績,認爲股票的上行空間有限。

palo alto networks繼續表現強勁,越來越多的客戶在其平台上進行整合。儘管賬單表現較弱,但基本需求趨勢似乎穩定。此外,現有的QRadar客戶基礎爲palo alto networks提供了重要的轉型機會。

palo alto networks報告了強勁的F1Q25結果,呈現出40%的下一代安防年經常性收入增長和20%的剩餘履約義務增長。持續的平台化推動了年經常性收入的擴展,導致公司提高了2025年的指導預期。

palo alto networks在FY25的開始表現強勁,表現指標如營業收入、年度經常性營業收入、剩餘履約義務和盈利能力均超過共識預期。公司的平台化持續推進尤其值得注意,第一季度新增了超過70個客戶。

以下爲今日16位分析師對$Palo Alto Networks (PANW.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

花旗分析師Fatima Boolani維持買入評級,維持目標價432美元。

花旗分析師Fatima Boolani維持買入評級,維持目標價432美元。

Citi analyst Fatima Boolani maintains with a buy rating, and maintains the target price at $432.

Citi analyst Fatima Boolani maintains with a buy rating, and maintains the target price at $432.