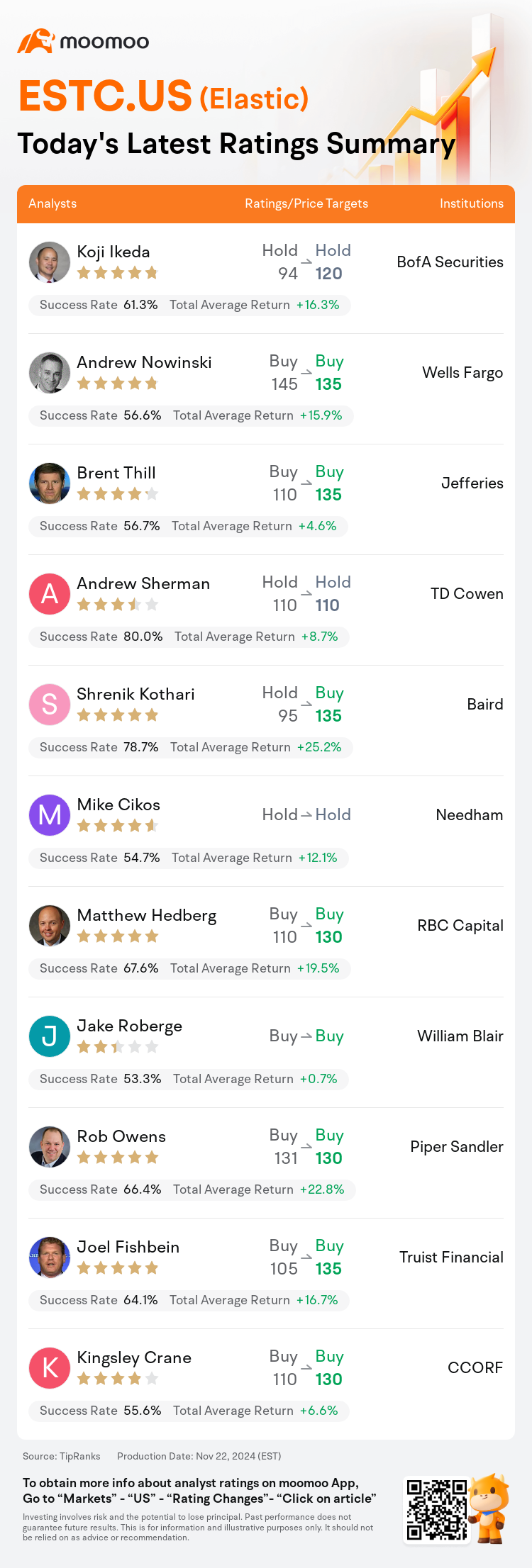

On Nov 22, major Wall Street analysts update their ratings for $Elastic (ESTC.US)$, with price targets ranging from $110 to $135.

BofA Securities analyst Koji Ikeda maintains with a hold rating, and adjusts the target price from $94 to $120.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and adjusts the target price from $145 to $135.

Jefferies analyst Brent Thill maintains with a buy rating, and adjusts the target price from $110 to $135.

Jefferies analyst Brent Thill maintains with a buy rating, and adjusts the target price from $110 to $135.

TD Cowen analyst Andrew Sherman maintains with a hold rating, and maintains the target price at $110.

Baird analyst Shrenik Kothari upgrades to a buy rating, and adjusts the target price from $95 to $135.

Furthermore, according to the comprehensive report, the opinions of $Elastic (ESTC.US)$'s main analysts recently are as follows:

Elastic's recent quarterly results were better than anticipated, hinting that the shifts within its sales organization may have caused less disruption than initially feared. Nevertheless, there remains a cautionary note regarding its stability as a potential risk. The company's forecast for FY25 suggests a revenue growth of 10%-13% year-over-year by the end of FY25, which, while prudent, might not fully resonate excitement given the dynamic fields of gen-AI, security, and observability where Elastic operates.

Elastic's Q2 results were slightly better than expected, and the changes in management were seen as a positive development after some recent challenges in execution.

Elastic demonstrated a rebound quarter with over 3% top-line upside, attributed to a recovery in the go-to-market efforts leading to robust sales execution involving multi-year commitments, along with healthy consumption trends especially among its largest customers. The improvement in sales execution, strong consumption patterns, the significant opportunity presented by General AI, and continued operational efficiencies are believed to position Elastic for relative outperformance in the upcoming quarters.

Elastic's fiscal Q2 performance surpassed all key metrics, leading to optimistic Q3 forecasts and an uplift in full-year expectations by the sum of Q2 and Q3 improvements. This quarter's exceptional results were attributed to widespread improvements in consumption patterns and the successful closure of most transactions that had been delayed from Q1, indicating positive prospects for future consumption.

The company's recovery from a Q1 setback was notable with a significant beat-and-raise in fiscal Q2, accompanied by a record operating margin. Strength in enterprise consumption trends, acceleration of the search business driven by GenAI demand, and an improving pipeline build were highlighted. However, it was noted that peers might be experiencing a quicker backlog acceleration.

Here are the latest investment ratings and price targets for $Elastic (ESTC.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月22日,多家華爾街大行更新了$Elastic (ESTC.US)$的評級,目標價介於110美元至135美元。

美銀證券分析師Koji Ikeda維持持有評級,並將目標價從94美元上調至120美元。

富國集團分析師Andrew Nowinski維持買入評級,並將目標價從145美元下調至135美元。

富瑞集團分析師Brent Thill維持買入評級,並將目標價從110美元上調至135美元。

富瑞集團分析師Brent Thill維持買入評級,並將目標價從110美元上調至135美元。

TD Cowen分析師Andrew Sherman維持持有評級,維持目標價110美元。

貝雅分析師Shrenik Kothari上調至買入評級,並將目標價從95美元上調至135美元。

此外,綜合報道,$Elastic (ESTC.US)$近期主要分析師觀點如下:

Elastic最近的季度業績好於預期,暗示其銷售組織內部的變化可能造成的干擾少於最初擔心的那樣。然而,對於其穩定性仍然存在警示,作爲潛在風險。公司對FY25的預測顯示,到FY25結束時,營業收入年增長率爲10%-13%,儘管謹慎,但在Elastic所運營的生成人工智能、安防-半導體和可觀察性等動態領域,可能並不會引起充分的興奮。

Elastic的第二季度業績略好於預期,對管理層的變化被視爲在近期執行挑戰之後的積極發展。

Elastic在這一季度表現出復甦,營業收入超過3%的增長,歸因於市場推廣工作的恢復,推動了堅實的銷售執行,涉及多年的承諾,尤其是其最大客戶的健康消費趨勢。銷售執行的改善、強勁的消費模式、生成人工智能帶來的重大機會,以及持續的運營效率被認爲使Elastic在未來幾個季度具有相對優異的表現。

Elastic的財務第二季度表現超越了所有關鍵指標,導致對第三季度樂觀的預測以及基於第二和第三季度改善的全年預期上調。本季度的優秀結果歸因於消費模式的廣泛改善以及大多數在第一季度延遲的交易的成功關閉,這表明未來消費的積極前景。

公司從第一季度的挫折中恢復顯著,在財務第二季度實現了重大超額和提升,伴隨創紀錄的營業利潤率。企業消費趨勢的強勁、由生成人工智能需求驅動的搜索業務的加速以及改進的項目管道得到了突出。然而,指出同行可能經歷更快的積壓加速。

以下爲今日11位分析師對$Elastic (ESTC.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師Brent Thill維持買入評級,並將目標價從110美元上調至135美元。

富瑞集團分析師Brent Thill維持買入評級,並將目標價從110美元上調至135美元。

Jefferies analyst Brent Thill maintains with a buy rating, and adjusts the target price from $110 to $135.

Jefferies analyst Brent Thill maintains with a buy rating, and adjusts the target price from $110 to $135.