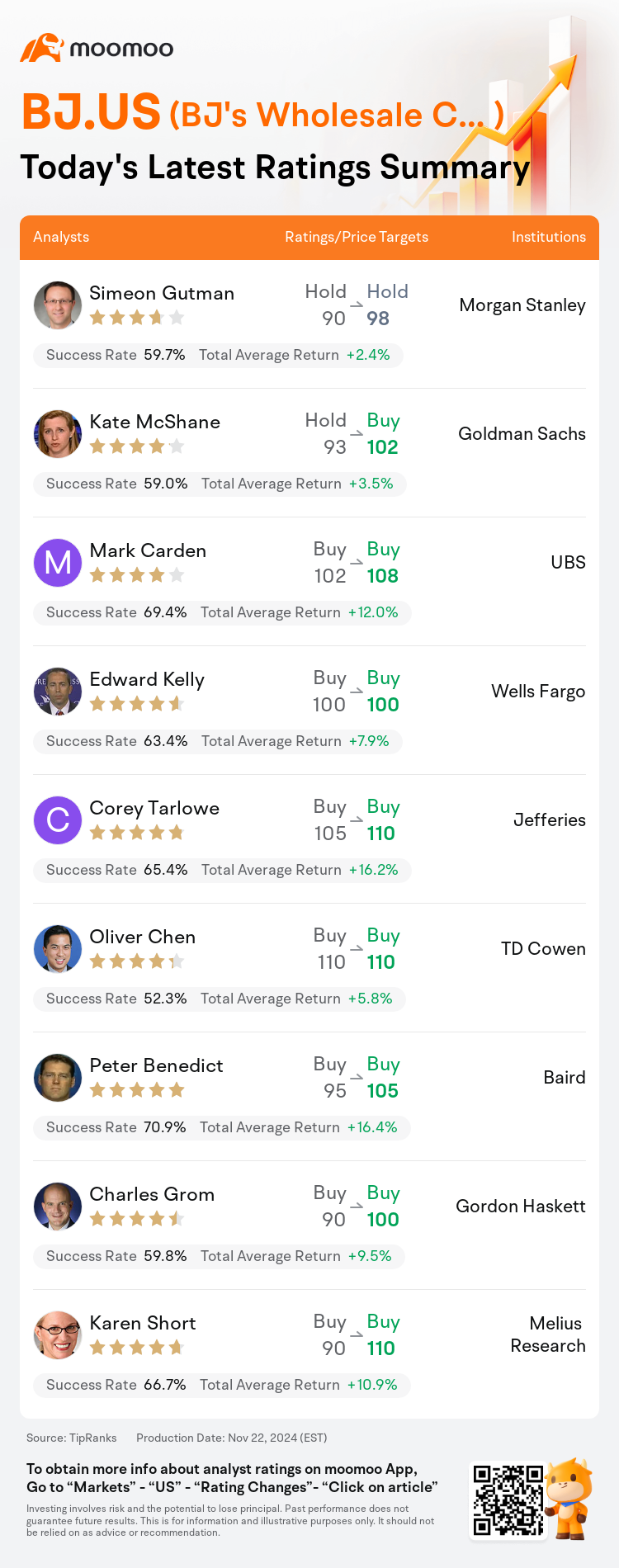

On Nov 22, major Wall Street analysts update their ratings for $BJ's Wholesale Club Holdings (BJ.US)$, with price targets ranging from $98 to $110.

Morgan Stanley analyst Simeon Gutman maintains with a hold rating, and adjusts the target price from $90 to $98.

Goldman Sachs analyst Kate McShane upgrades to a buy rating, and adjusts the target price from $93 to $102.

UBS analyst Mark Carden maintains with a buy rating, and adjusts the target price from $102 to $108.

UBS analyst Mark Carden maintains with a buy rating, and adjusts the target price from $102 to $108.

Wells Fargo analyst Edward Kelly maintains with a buy rating, and maintains the target price at $100.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and adjusts the target price from $105 to $110.

Furthermore, according to the comprehensive report, the opinions of $BJ's Wholesale Club Holdings (BJ.US)$'s main analysts recently are as follows:

BJ's Wholesale demonstrated several positives in their third quarter earnings results, notably with core same-store sales surpassing expectations and robust member engagement. Although the decision not to adjust earnings for a one-time legal settlement might optically challenge high single to low double-digit earnings growth in the upcoming year, the long-term financial goals for fiscal 2025 are still considered achievable on an underlying basis.

BJ's Wholesale exhibited a strong Q3 performance, which appears to contrast with its relatively conservative Q4 margin guidance. Analysts are optimistic about the company's continued momentum in membership and the recent fee increase. Additionally, new club openings, digital growth, and the Fresh 2.0 initiatives are anticipated to necessitate additional labor, which may constrain margin expansion.

Improvements in margins, fee increases, and associated reinvestment opportunities in club growth, alongside successful digital initiatives and various merchandise enhancements, are posited as promising drivers for growth.

The firm attributes its adjustment to BJ's Wholesale's announcement about its first membership fee increase in seven years. Additionally, consumer stock-up behavior due to recent major storms, where BJ's has approximately 3% of its total stores, contributed a 1% increase to its core Same Store Sales (SSS) in Q3. Even excluding this lift, the core comp growth of 3.8% exceeded expectations by approximately 80 basis points.

While there were some irregularities in BJ's Wholesale's third-quarter headline results, the underlying performance exceeded expectations. Additionally, critical membership Key Performance Indicators (KPIs) remain consistent with those of leading industry peers like Costco.

Here are the latest investment ratings and price targets for $BJ's Wholesale Club Holdings (BJ.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

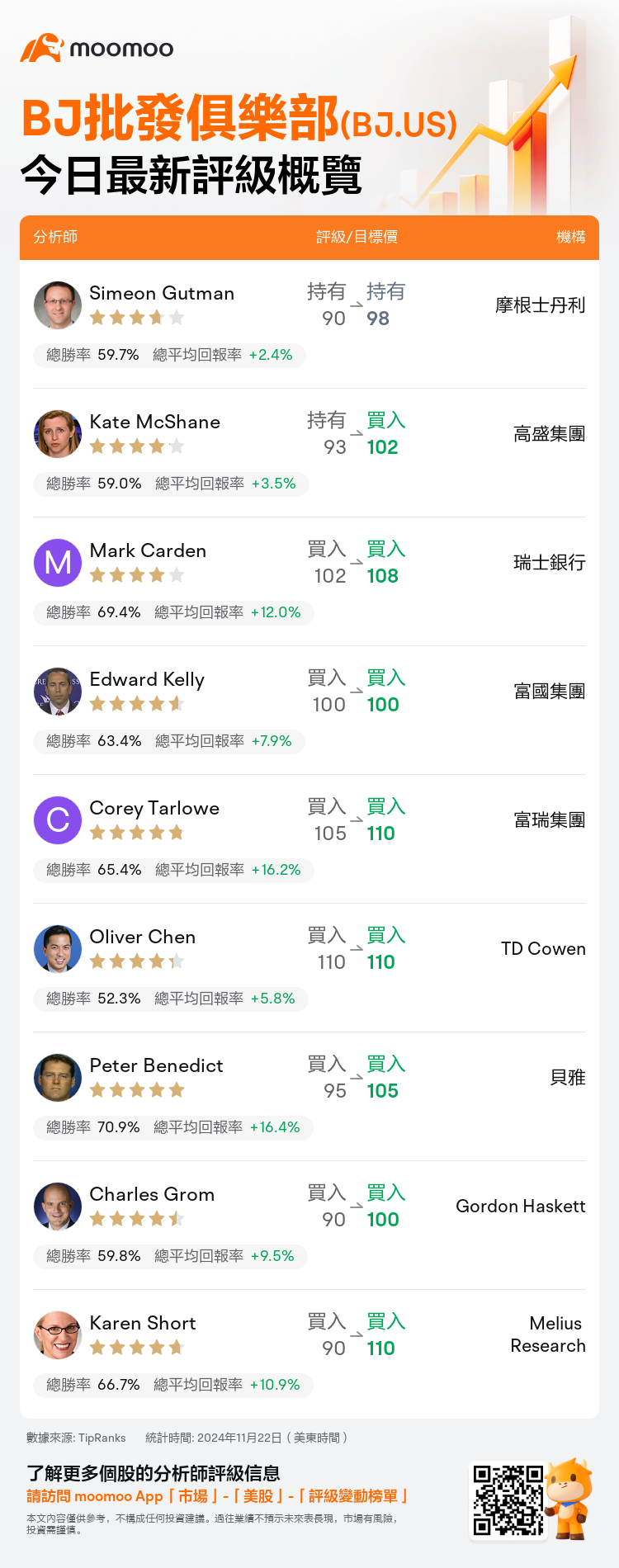

美東時間11月22日,多家華爾街大行更新了$BJ批發俱樂部 (BJ.US)$的評級,目標價介於98美元至110美元。

摩根士丹利分析師Simeon Gutman維持持有評級,並將目標價從90美元上調至98美元。

高盛集團分析師Kate McShane上調至買入評級,並將目標價從93美元上調至102美元。

瑞士銀行分析師Mark Carden維持買入評級,並將目標價從102美元上調至108美元。

瑞士銀行分析師Mark Carden維持買入評級,並將目標價從102美元上調至108美元。

富國集團分析師Edward Kelly維持買入評級,維持目標價100美元。

富瑞集團分析師Corey Tarlowe維持買入評級,並將目標價從105美元上調至110美元。

此外,綜合報道,$BJ批發俱樂部 (BJ.US)$近期主要分析師觀點如下:

BJ的Wholesale在第三季度的業績結果中展現了幾個積極因素,尤其是核心同店銷售超出預期,會員參與度強勁。儘管決定不調整盈利以應對一次性法律解決方案在視覺上可能對未來一年的高個位數到低兩位數盈利增長構成挑戰,但截至2025財年的長期財務目標仍被認爲是可行的。

BJ的Wholesale展示了強勁的第三季度業績,這與其相當保守的第四季度毛利率指引形成對比。分析師對該公司在會員數量及最近費用上漲方面持續勢頭表示樂觀。此外,新店開業、數字增長和Fresh 2.0計劃預計將需要額外勞動力,可能限制毛利擴張。

邊際改善、費用增加以及與商店增長相關的再投資機會,加上成功的數字化舉措和各種商品增強,被認爲是推動增長的有前景的因素。

該公司將其調整歸因於BJ的Wholesale宣佈了七年來首次會員費的增加。此外,由於最近的重大風暴,BJ在其總店面積中約佔3%的情況下,消費者備貨行爲爲第三季度核心同店銷售(SSS)貢獻了1%的增長。即使排除了這部分增長,3.8%的核心同比增長也超出了大約80個點子的預期。

儘管BJ的Wholesale第三季度的頭條業績存在一些不規則性,但潛在的表現超出了預期。此外,重要的會員關鍵績效指標(KPI)仍與像好市多這樣的行業領先同行保持一致。

以下爲今日9位分析師對$BJ批發俱樂部 (BJ.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師Mark Carden維持買入評級,並將目標價從102美元上調至108美元。

瑞士銀行分析師Mark Carden維持買入評級,並將目標價從102美元上調至108美元。

UBS analyst Mark Carden maintains with a buy rating, and adjusts the target price from $102 to $108.

UBS analyst Mark Carden maintains with a buy rating, and adjusts the target price from $102 to $108.