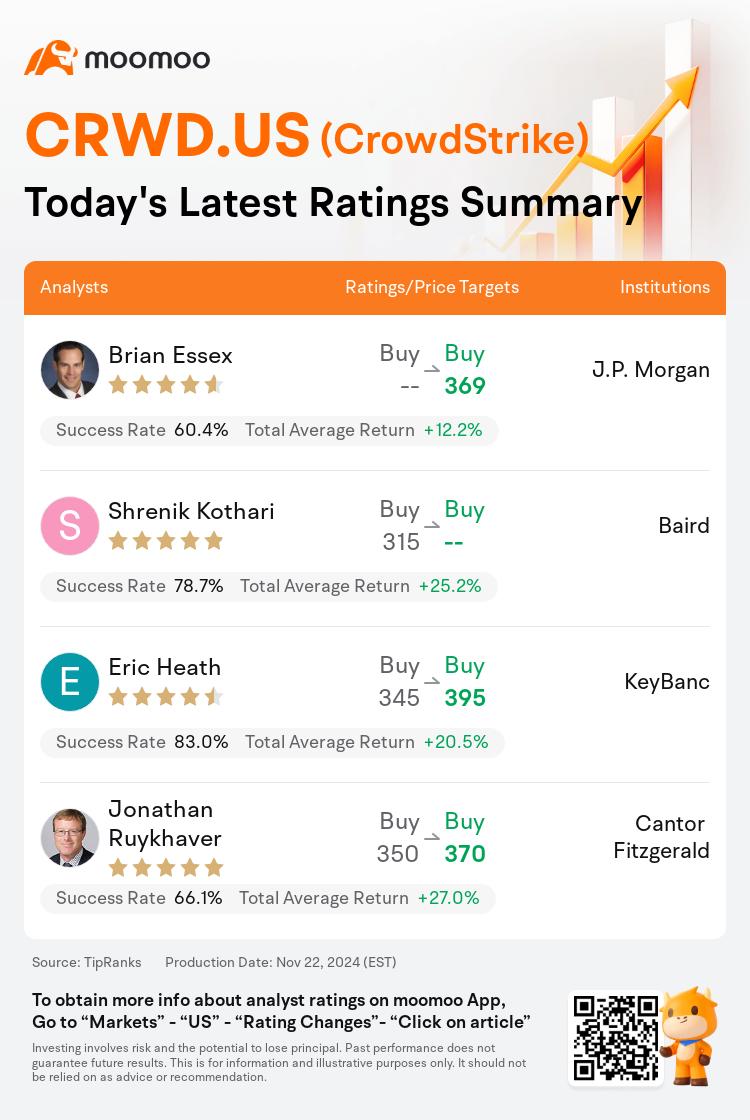

On Nov 22, major Wall Street analysts update their ratings for $CrowdStrike (CRWD.US)$, with price targets ranging from $369 to $395.

J.P. Morgan analyst Brian Essex maintains with a buy rating, and sets the target price at $369.

Baird analyst Shrenik Kothari maintains with a buy rating.

KeyBanc analyst Eric Heath maintains with a buy rating, and adjusts the target price from $345 to $395.

KeyBanc analyst Eric Heath maintains with a buy rating, and adjusts the target price from $345 to $395.

Cantor Fitzgerald analyst Jonathan Ruykhaver maintains with a buy rating, and adjusts the target price from $350 to $370.

Furthermore, according to the comprehensive report, the opinions of $CrowdStrike (CRWD.US)$'s main analysts recently are as follows:

Expectations for Crowdstrike's upcoming third-quarter report on November 26 might surpass predictions, as previously revised forecasts were substantially reduced. Moreover, guidance has set fairly conservative and broad benchmarks for performance following significant events.

Despite challenges such as the July incident and current headwinds, the situation is looking more favorable with easier comparisons in the second half for ARR/revenue. Channel feedback indicates minimal gross churn and successful early renewals, bolstered by important strategic initiatives.

The firm observes a demanding outlook for October security reporters, underscored by robust stock performance even amidst generally tepid Q3 security earnings. Their assessments indicate stable performance, highlighted by strong results for Crowdstrike. Notably, numerous partners acknowledged a rebound this quarter for Crowdstrike, with no indications of customers shifting away from their services.

Recent detailed assessments have been initiated to gauge the repercussions of CrowdStrike's July faulty update on various aspects such as quarterly performance, future guidance, competition, forthcoming opportunities, and legal risks. These evaluations indicate varying trends among resellers. Despite earlier concerns, these findings increasingly suggest that the faulty update's negative effects are lessening and that CrowdStrike is poised to strengthen its position, enhancing confidence in its future market prospects.

Here are the latest investment ratings and price targets for $CrowdStrike (CRWD.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

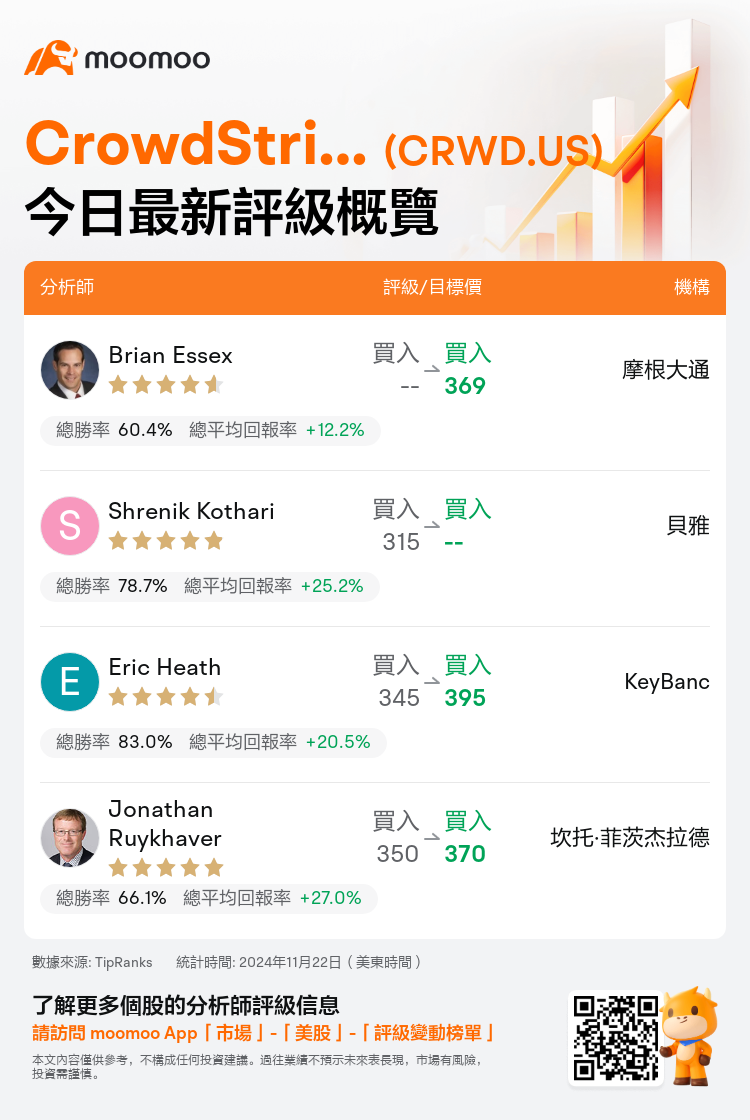

美東時間11月22日,多家華爾街大行更新了$CrowdStrike (CRWD.US)$的評級,目標價介於369美元至395美元。

摩根大通分析師Brian Essex維持買入評級,目標價369美元。

貝雅分析師Shrenik Kothari維持買入評級。

KeyBanc分析師Eric Heath維持買入評級,並將目標價從345美元上調至395美元。

KeyBanc分析師Eric Heath維持買入評級,並將目標價從345美元上調至395美元。

坎托·菲茨杰拉德分析師Jonathan Ruykhaver維持買入評級,並將目標價從350美元上調至370美元。

此外,綜合報道,$CrowdStrike (CRWD.US)$近期主要分析師觀點如下:

人們對crowdstrike即將於11月26日發佈的第三季度報告的期待可能會超出預測,因爲之前的修訂預測大幅降低。此外,指導方針爲未來的業績設定了相對保守和廣泛的基準,這一切都發生在重大事件之後。

儘管面臨7月事件和當前逆風等挑戰,但在下半年,ARR/營業收入的比較變得更加有利。渠道反饋顯示,客戶流失率極小,早期續約成功,並受到重要戰略舉措的支持。

該公司觀察到10月安防-半導體報告者面臨嚴峻的前景,即使在第三季度安防-半導體收益普遍疲軟的情況下,股票表現仍然強勁。他們的評估顯示出穩定的表現,crowdstrike的業績尤爲突出。值得注意的是,許多合作伙伴確認crowdstrike在本季度復甦,並沒有跡象顯示客戶轉向其他服務。

最近已開始進行詳細評估,以評估crowdstrike在7月錯誤更新對季度業績、未來指導、競爭、即將到來的機會和法律風險等各個方面的影響。這些評估顯示出轉售商之間的不同趨勢。儘管之前存在憂慮,這些發現越來越表明,錯誤更新的負面影響正在減弱,crowdstrike正準備鞏固其地位,增強信懇智能對其未來市場前景的信心。

以下爲今日4位分析師對$CrowdStrike (CRWD.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

KeyBanc分析師Eric Heath維持買入評級,並將目標價從345美元上調至395美元。

KeyBanc分析師Eric Heath維持買入評級,並將目標價從345美元上調至395美元。

KeyBanc analyst Eric Heath maintains with a buy rating, and adjusts the target price from $345 to $395.

KeyBanc analyst Eric Heath maintains with a buy rating, and adjusts the target price from $345 to $395.