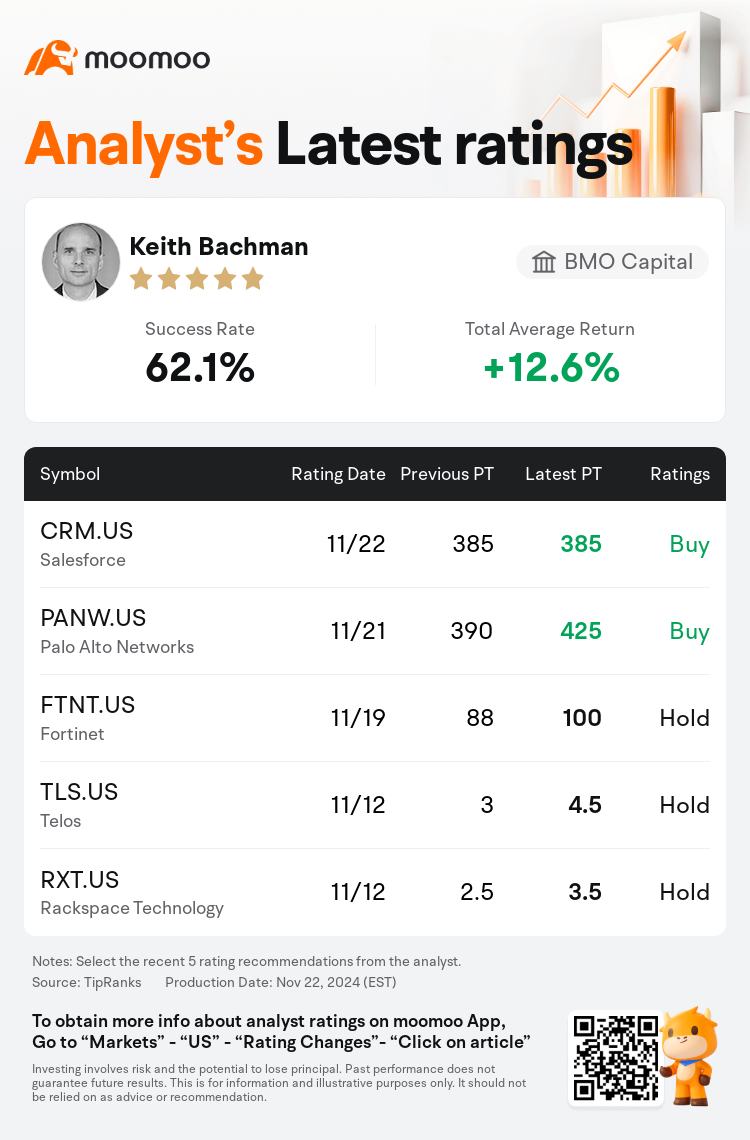

BMO Capital analyst Keith Bachman maintains $Salesforce (CRM.US)$ with a buy rating, and maintains the target price at $385.

According to TipRanks data, the analyst has a success rate of 62.1% and a total average return of 12.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Consultants took a distinctly positive tone on Agentforce, noting it as a meaningful improvement with genuine customer interest. Despite a challenging macro environment impacting all software companies, Salesforce's business model is described as bending but not breaking. There is an anticipation of potential gains as the company shifts towards an efficiency playbook, balancing slower growth with enhanced profitability and free cash flow, alongside the integration of generative AI capabilities into its services.

The firm is optimistic about the early reception of Agentforce and the potential for a more robust AI-driven product cycle. However, there is a belief that expectations may be overly optimistic, necessitating a period of patience to observe significant impacts.

According to recent assessments, the third quarter's financial risk for Salesforce is slightly positive based on diverse research findings. Analyses of recent hiring data and earnings previews suggest that Salesforce consistently exhibits strong earnings per share growth. Moreover, stability in the third quarter's financial reports and a favorable outlook for the fourth quarter are anticipated, likely boosted by increased IT budgets.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

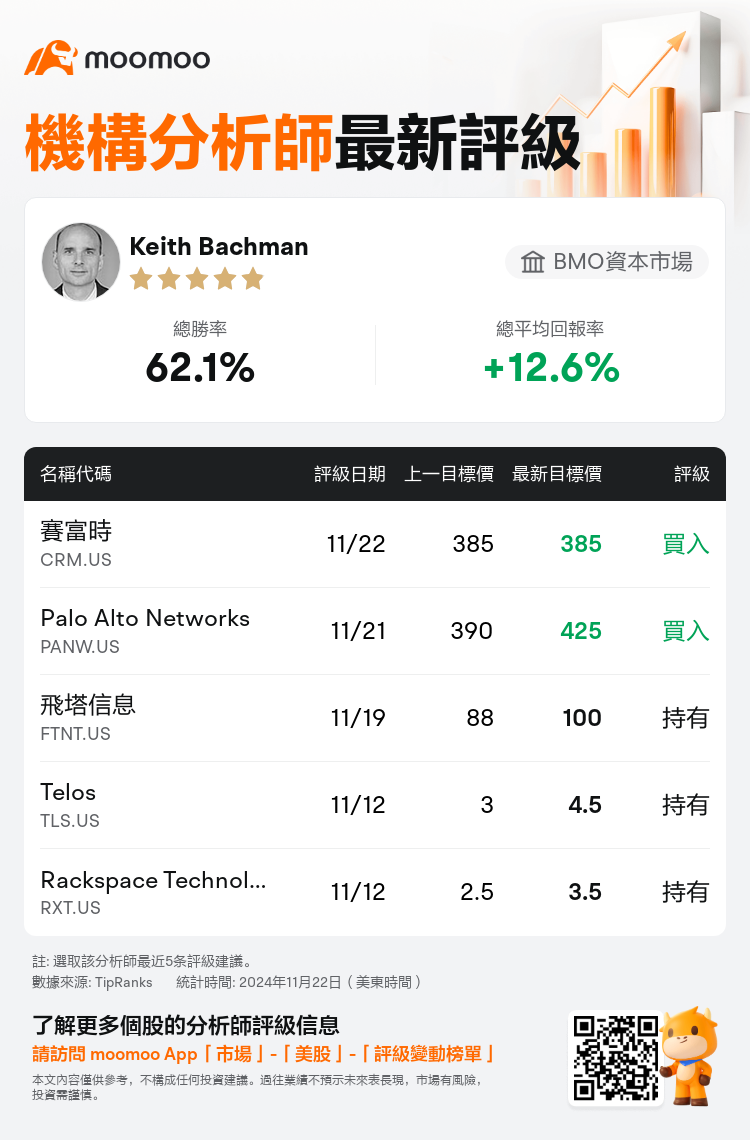

BMO資本市場分析師Keith Bachman維持$賽富時 (CRM.US)$買入評級,維持目標價385美元。

根據TipRanks數據顯示,該分析師近一年總勝率為62.1%,總平均回報率為12.6%。

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

顧問對Agentforce持有明顯積極的態度,認爲這是一個有意義的改進,並且得到了真正的客戶關注。儘管宏觀環境對所有軟件公司都造成了挑戰,但賽富時的商業模式被描述爲彎曲但不破裂。隨着公司逐步轉向高效執行手冊,預期將實現潛在的收益,平衡較慢的增長與更高的盈利能力和自由現金流,同時將生成性人工智能能力整合到其服務中。

該公司對Agentforce的早期反應和更強大的人工智能驅動產品週期的潛力持樂觀態度。然而,存在一個信念,認爲預期可能過於樂觀,需耐心觀察顯著的影響。

根據最近的評估,賽富時第三季度的財務風險略顯正面,基於多項研究發現。對最近的招聘數據和收益預覽的分析表明,賽富時的每股收益持續表現出強勁的增長。此外,預計第三季度的財務報告將保持穩定,並對第四季度的前景持樂觀態度,這可能得益於IT預算的增加。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of