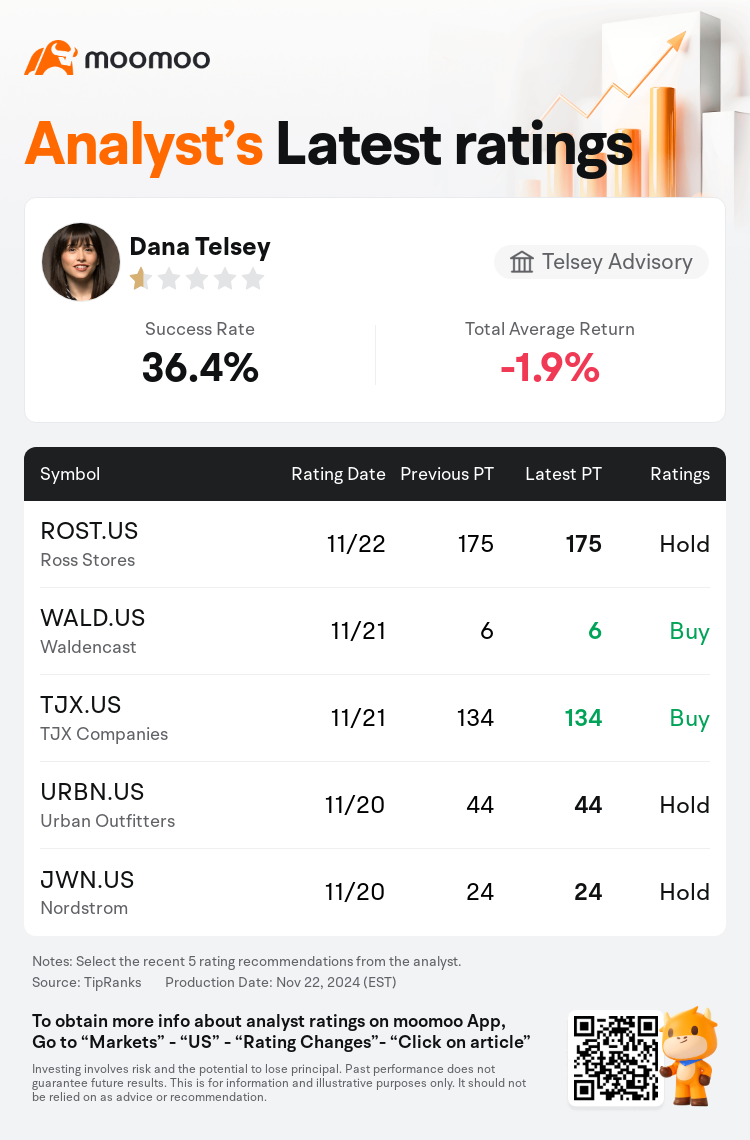

Telsey Advisory analyst Dana Telsey maintains $Ross Stores (ROST.US)$ with a hold rating, and maintains the target price at $175.

According to TipRanks data, the analyst has a success rate of 36.4% and a total average return of -1.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Ross Stores (ROST.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Ross Stores (ROST.US)$'s main analysts recently are as follows:

While missing top-line expectations, Ross Stores reported third quarter earnings per share of $1.48, which surpassed consensus estimates. It has been noted that pressures on merchandise margins have been a prominent challenge affecting earnings per share for 2024. These pressures are expected to diminish considerably in 2025, potentially enabling a second consecutive year wherein margin contributions exceed long-term targets. However, it is essential for Ross to demonstrate that its refined merchandising strategy can address the prolonged lag in same-store sales growth compared to Marmaxx in order to reduce its current valuation gap with TJX.

Ross Stores delivered EPS above consensus, notwithstanding a slight shortfall in comps attributed to weather conditions and some operational challenges. Trends improved as adverse weather effects mitigated, and their forecasts for the fourth fiscal quarter suggest an acceleration, reflecting positively on the management's proven performance record.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

泰爾西諮詢分析師Dana Telsey維持$羅斯百貨 (ROST.US)$持有評級,維持目標價175美元。

根據TipRanks數據顯示,該分析師近一年總勝率為36.4%,總平均回報率為-1.9%。

此外,綜合報道,$羅斯百貨 (ROST.US)$近期主要分析師觀點如下:

此外,綜合報道,$羅斯百貨 (ROST.US)$近期主要分析師觀點如下:

儘管未能達到營業收入的預期,羅斯百貨報告第三季度每股收益爲1.48美元,超出了市場共識預期。有人指出,商品利潤率面臨的壓力是影響2024年每股收益的主要挑戰。這些壓力預計在2025年會顯著減輕,這可能使利潤貢獻連續第二年超過長期目標。然而,羅斯必須展示其精煉的商品策略能解決與Marmaxx同店銷售增長長期滯後的問題,以降低其與TJX之間的當前估值差距。

羅斯百貨的每股收益超出市場共識,儘管由於天氣條件和一些運營挑戰而出現了輕微的同店銷售下降。隨着不利天氣影響的減輕,趨勢有所好轉,他們對第四財季的預測顯示出加速的趨勢,這對管理層的業績記錄產生了積極的反響。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$羅斯百貨 (ROST.US)$近期主要分析師觀點如下:

此外,綜合報道,$羅斯百貨 (ROST.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of