Markets Weekly Update (November 22): Bitcoin ETFs Reach $100B with Massive Inflows in 2024.

Markets Weekly Update (November 22): Bitcoin ETFs Reach $100B with Massive Inflows in 2024.

Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

歡迎收看《市場每週更新》,該專欄致力於提供本週的重要投資見解以及可能在未來一週推動市場的關鍵事件。

Macro Matters

宏觀很重要

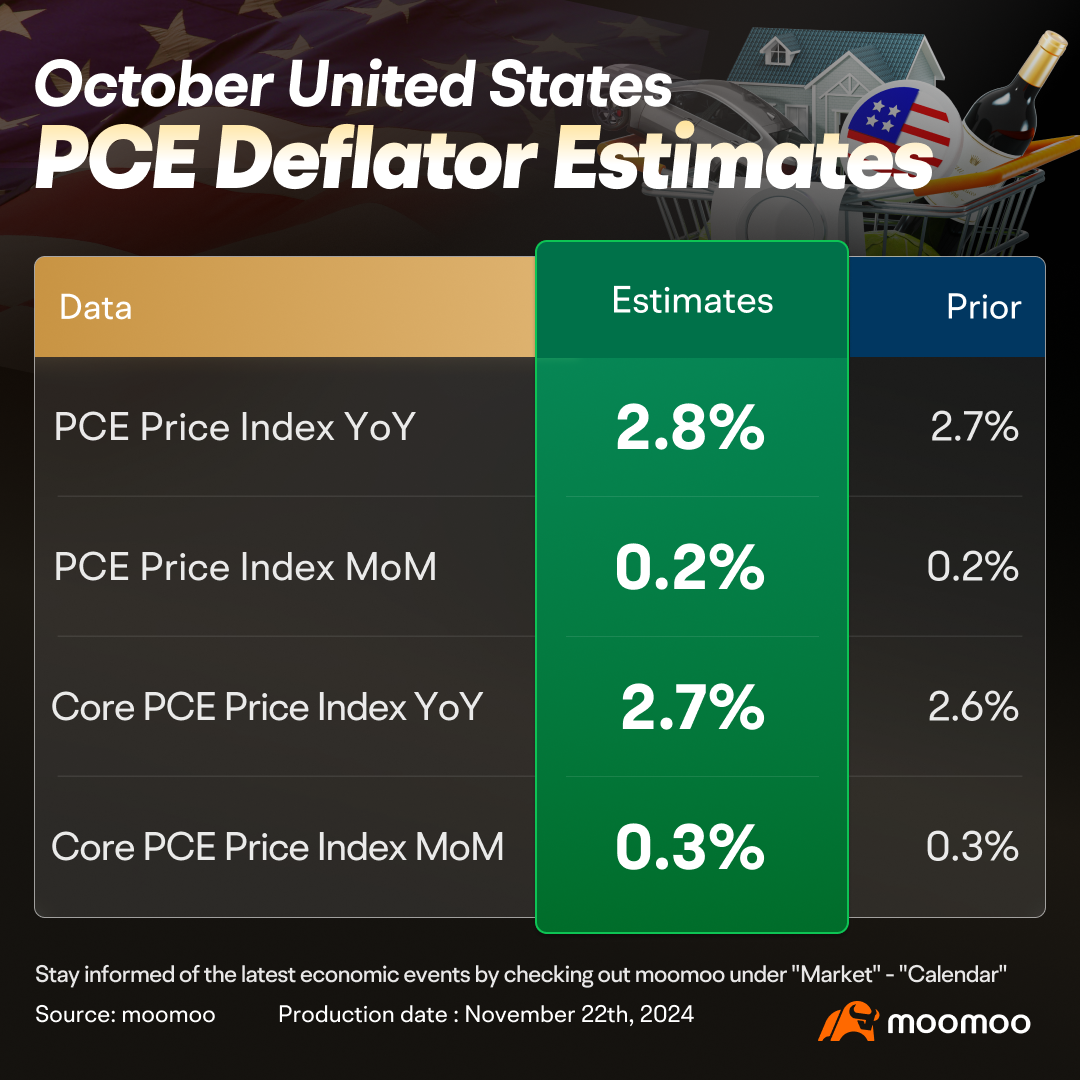

Economists Expect Core PCE Deflator in October to Rise

經濟學家預計,10月份核心個人消費支出平減指數將上升

Economists anticipate that the core PCE deflator, which is the preferred inflation measure of the Federal Reserve, increased by 0.30% in October on a month-over-month basis, compared to a 0.25% increase previously. This rise is expected to push the annual rate to 2.8%, up from 2.7%, moving further from the Fed's target of 2%. The upcoming report, scheduled for release on November 27, along with projections of a potential increase to 2.9% in the annual rate in the coming months amid an equity market rally, might lead the Fed to decelerate its pace of rate cuts.

經濟學家預計,作爲聯儲局首選通脹指標的核心個人消費支出平減指數在10月份同比增長0.30%,而之前的增長率爲0.25%。預計這一上漲將把年利率從2.7%推高至2.8%,進一步偏離聯儲局設定的2%的目標。即將發佈的報告定於11月27日發佈,以及在股市上漲的情況下未來幾個月年利率可能升至2.9%的預測,可能會導致聯儲局放慢減息步伐。

Fed to Release Nov. FOMC Minutes, Detailing Economic Outlook & Policy Decisions Next Week

聯儲局將於下週發佈11月聯邦公開市場委員會會議紀要,詳細介紹經濟前景和政策決定

On November 26, the Federal Reserve is set to publish the minutes from its FOMC meeting held on November 6-7. At this meeting, officials decided to cut the federal funds rate by 25 basis points, a move that was largely anticipated but less than the 50-basis point reduction at their previous session.

11月26日,聯儲局將公佈其於11月6日至7日舉行的聯邦公開市場委員會會議紀要。在這次會議上,官員們決定將聯邦基金利率下調25個點子,這一舉措在很大程度上是預料之中的,但低於前一屆會議的50個點子的下調幅度。

The meeting commenced shortly after the U.S. election, but it is unlikely that the minutes will discuss the election results or their potential impact on monetary policy. The minutes are expected to indicate that both staff and policymakers saw reduced downside risks to economic activity and employment, based on data available during the period between meetings. Additionally, a higher core PCE inflation rate observed in the interim probably caused an upward adjustment in the year-end inflation forecast. Consequently, the tone of policymakers since the November meeting has suggested a more cautious approach to further easing.

會議在美國大選後不久開始,但會議紀要不太可能討論選舉結果或其對貨幣政策的潛在影響。根據閉會期間獲得的數據,預計會議紀要將表明,工作人員和決策者都認爲經濟活動和就業的下行風險有所降低。此外,在此期間觀察到的較高的核心個人消費支出通貨膨脹率可能導致年終通脹預測向上調整。因此,自11月會議以來,決策者的基調錶明,對進一步寬鬆採取更加謹慎的態度。

Smart Money Flow

智能資金流

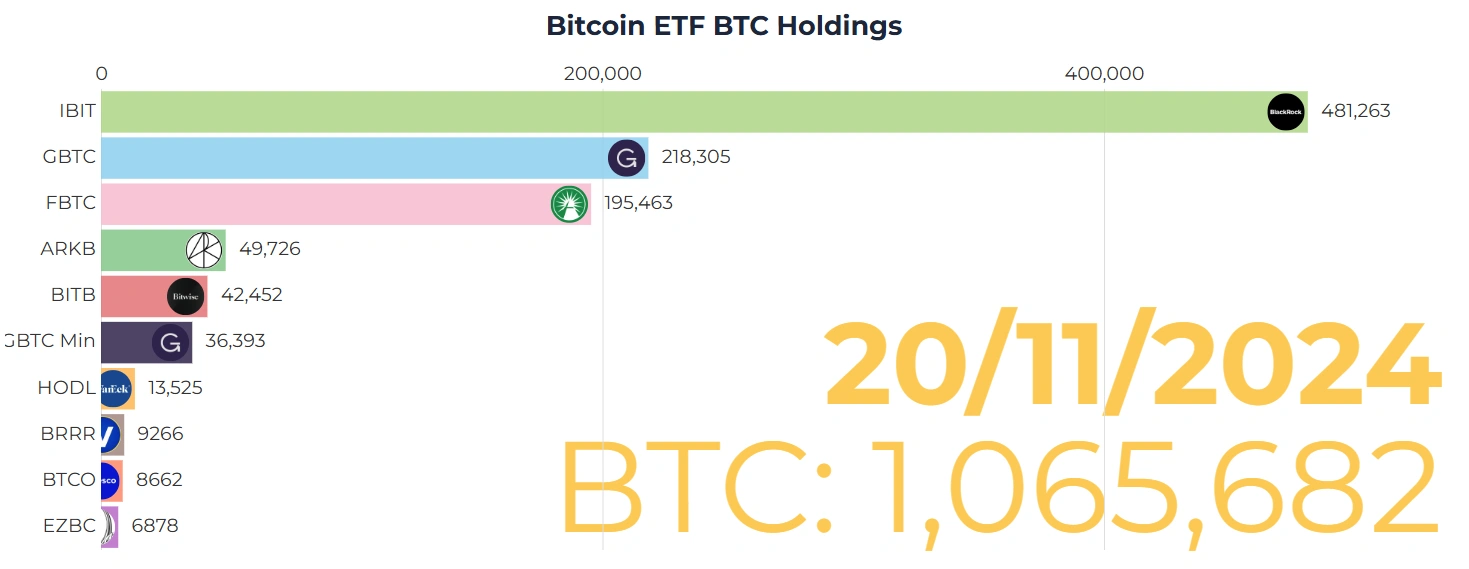

Bitcoin ETFs Reach $100B with Massive Inflows in 2024.

比特幣ETF將在2024年達到1000億美元,資金大量流入。

Bitcoin exchange-traded funds (ETFs) have surged past $100 billion in total assets, marking a significant milestone just 10 months after their debut in January. This group of 12 Bitcoin ETFs, issued by major financial institutions such as BlackRock and Fidelity Investments, has seen rapid growth, becoming one of the most successful fund category launches in recent history.

比特幣交易所交易基金(ETF)的總資產已飆升至1000億美元以上,在1月份首次亮相僅10個月後,就標誌着一個重要的里程碑。這組12只比特幣ETF由貝萊德和富達投資等主要金融機構發行,增長迅速,成爲近代歷史上最成功的基金類別之一。

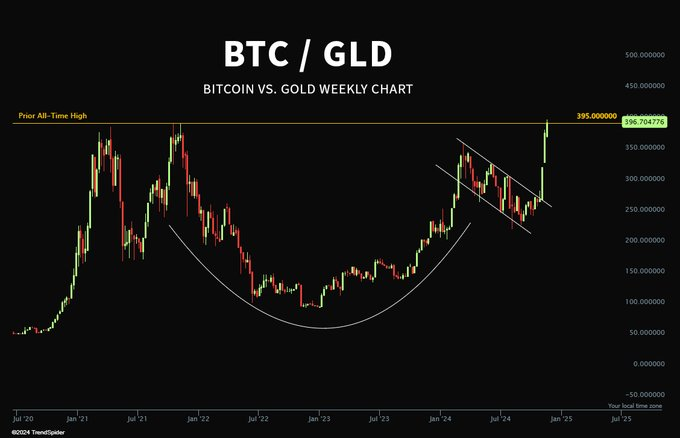

Bitcoin made a new all-time high relative to Gold on Friday.

週五,比特幣相對於黃金創下歷史新高。

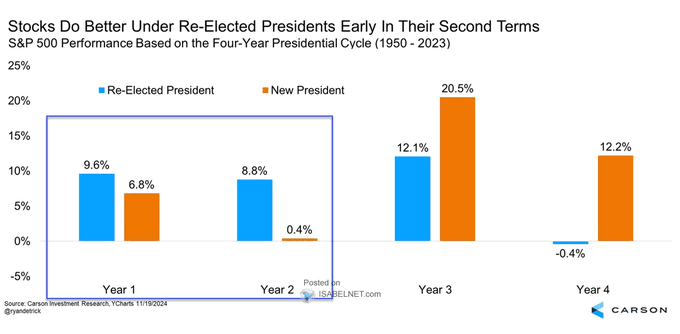

US stock markets generally perform better in the initial two years when a President is re-elected versus when a new President takes office.

與新總統上任相比,美國股市在總統連任的最初兩年中通常表現更好。

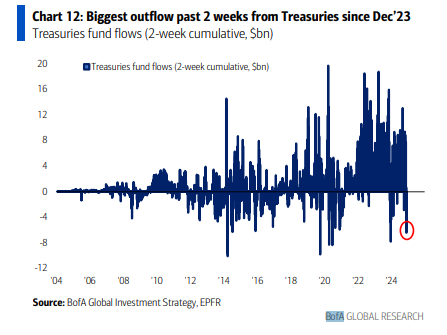

BoA: The past 2 weeks have seen the biggest outflows from US Treasuries this year.

BoA:在過去的兩週中,今年美國國債流出量最大。

Top Corporate News

熱門企業新聞

Nvidia Says New Chip Remains on Track, Helping Soothe Investors.

英偉達表示,新芯片仍步入正軌,有助於安撫投資者。

Nvidia Corp. assured investors that its new product lineup will continue to fuel an artificial intelligence-driven growth run, while also signaling that the rush to get chips out the door is proving costlier than expected. Speaking after the release of quarterly results, Chief Executive Officer Jensen Huang said that Nvidia’s highly anticipated Blackwell products will ship this quarter amid “very strong” demand. But the production and engineering costs of the chips will weigh on profit margins, and Nvidia’s sales forecast for the current period didn’t match some of Wall Street’s more optimistic projections.

Nvidia Corp. 向投資者保證,其新產品陣容將繼續推動人工智能驅動的增長,同時也表明急於推出芯片的成本要高於預期。首席執行官黃延森在公佈季度業績後表示,在 「非常強勁」 的需求下,英偉達備受期待的布萊克韋爾產品將在本季度上市。但是芯片的生產和工程成本將壓制利潤率,英偉達本期的銷售預測與華爾街一些更樂觀的預測不符。

Huang said that Blackwell is now in “full production,” and there’s still an appetite for Hopper, the previous design. “Blackwell is now in the hands of all of our major partners,” he said during the conference call.

黃說,布萊克韋爾現在正在 「全面生產」,人們對之前的設計Hopper仍然有興趣。他在電話會議上說:「布萊克韋爾現在掌握在我們所有的主要合作伙伴手中。」

MicroStrategy Tumbles After Citron Research Shorts the Stock.

Citron Research做空股票後,微策略暴跌。

MicroStrategy Inc shares tumbled after Andrew Left’s Citron Research said in a post on X that it’s betting against the software company, which has effectively transformed itself into a Bitcoin investment fund.

安德魯·萊夫特的Citron Research在X上的一篇文章中表示,它將押注這家軟件公司,該公司實際上已經轉型爲比特幣投資基金,此後,微策略公司的股價暴跌。

The stock fell 16% to close at about $397, reversing a gain of nearly 15% from earlier in the session. The slump marked the stock’s worst day since April 30 and came despite the extended rally in Bitcoin, which rose to a record high.

該股下跌16%,收於約397美元,逆轉了該交易日早些時候近15%的漲幅。暴跌是該股自4月30日以來最糟糕的一天,儘管比特幣持續上漲,升至歷史新高。

Temu-Owner PDD’s Shares Dive After Warning of Worsening Profit.

Temu的所有者PDD的股價在警告利潤惡化後下跌。

PDD Holdings Inc.’s shares plunged after warning that its profitability will trend downward over time because of intensifying competition in its home market of China.

PDD Holdings Inc.的股價暴跌,此前該公司警告說,由於中國本土市場的競爭加劇,其盈利能力將隨着時間的推移而呈下降趨勢。

PDD, which competes with Alibaba Group Holding Ltd., said its team was struggling to catch up with unspecified rivals because of a lack of expertise. Executives also reiterated the company’s guidance from August that sales and profit growth will slow going forward. Its stock slid as much as 10% in early US trading.

與阿里巴巴集團控股有限公司競爭的PDD表示,由於缺乏專業知識,其團隊正在努力趕上未指明的競爭對手。高管們還重申了該公司自8月份以來的指導方針,即未來銷售和利潤增長將放緩。其股票在美國早盤交易中下跌了10%。