Trump Media's TruthFi Gamble Tests Bulls And Bears

Trump Media's TruthFi Gamble Tests Bulls And Bears

Trump Media & Technology Group Corp (NASDAQ:DJT) boasts an 82.88% gain over the past year. Yet recent months have tested the resolve of its bulls, with a 30.17% dip over six months and a 9.45% slide in the last month.

特朗普媒體與科技集團corp (納斯達克:DJT) 在過去一年中獲得了82.88%的收益。然而,最近幾個月考驗了其看好的決心,六個月內下降了30.17%,而上個月下滑了9.45%。

The Truth Social parent company is now exploring a cryptocurrency payment service, TruthFi, as reported by the Financial Times.

《真相社交》的母公司現在正在探索一種數字貨幣支付服務TruthFi,正如《金融時報》所報道的。

Is this the diversification move the stock needs to regain its upward momentum?

這是股票需要的多元化舉措,能夠重新獲得上升動力嗎?

Read Also: Trump Media Trademark Filing For 'TruthFi' Hints At Potential Digital Wallets, Asset Trading

另見:特朗普媒體的商標申請'TruthFi'暗示潛在的數字錢包和資產交易。

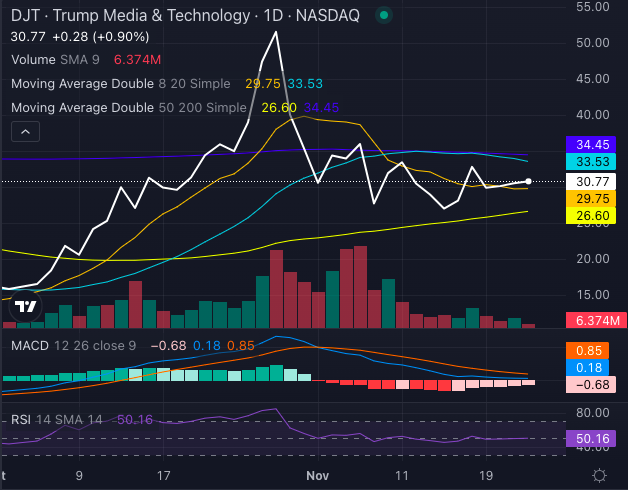

DJT Stock Chart: Bulls & Bears Playing Tug-O-War

DJT股票圖表:多頭與空頭在進行拔河。

DJT's technical indicators paint a mixed picture.

DJT的技術因子描繪出複雜的局面。

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

DJT stock, at $30.77, sits above its eight-day simple moving average (SMA) of $29.75, offering a short-term bullish signal.

DJt股票目前價格爲30.77美元,高於其八日簡單移動平均線(SMA)的29.75美元,發出短期看好的信號。

Yet, its 20-day SMA of $33.53 looms as a resistance point, giving a bearish signal. The 50-day SMA at $26.60 reinforces a bullish undertone for the intermediate term, but the 200-day SMA at $34.45 suggests broader bearish pressure.

然而,20日SMA的33.53美元則是一個支撐位,發出看淡信號。50日SMA的26.60美元則增強了中期的看好基調,但200日SMA的34.45美元則暗示出更廣泛的看淡壓力。

Momentum indicators add complexity: the moving average convergence/divergence (MACD) indicator sits at 0.18, a bullish signal, while the relative strength index (RSI) at 50.16 hovers in neutral territory.

動量因子則增加了複雜性:移動平均收斂/發散(MACD)因子爲0.18,這是一個看好的信號,而相對強弱指數(RSI)爲50.16則處於中立區域。

DJT stock traders are likely watching closely for any confirmation of a breakout or breakdown from these levels.

DJt股票交易者可能會密切關注這些水平的突破或跌破確認。

TruthFi: Crypto Catalyst Or Diversification Dilemma?

TruthFi:數字貨幣催化劑還是多樣化困境?

Trump Media's trademark application for TruthFi hints at ambitions to leverage the crypto wave. If launched, TruthFi could extend beyond payment processing to include trading and asset management, positioning DJT as more than a social media play. The nascent nature of these plans — compounded by broader market skepticism — leaves the timeline and impact uncertain.

特朗普媒體對TruthFi的商標申請暗示了利用數字貨幣浪潮的雄心。如果推出,TruthFi可能不僅限於支付處理,還包括交易和資產管理,使DJt的定位不再僅僅是社交媒體。計劃的初步性——加上更廣泛市場的懷疑——使得時間表和影響不確定。

Trump Media is also reportedly interested in buying Bakkt. Shares of the crypto custody startup skyrocketed 160% on the rumors, but no concrete deal has materialized.

特朗普媒體據報道也對收購Bakkt感興趣。該數字貨幣託管初創公司的股票在謠言傳出後飆升了160%,但沒有具體的交易達成。

President-elect Donald Trump's signaling of crypto-friendly regulation will likely benefit DJT stock as well.

當選總統特朗普對數字貨幣友好監管的信號也可能使DJt股票受益。

What's Next For DJT Stock?

DJt股票的下一步是什麼?

While bulls may see Trump Media's entry into crypto as the next growth catalyst, bears argue the stock's technical resistance and uncertain fundamentals warrant caution.

雖然看好者認爲特朗普媒體進入數字貨幣將成爲下一個增長催化劑,但看淡者認爲該股票的技術支撐位和不確定的基本面需要保持謹慎。

For now, traders find themselves at an inflection point, waiting to see whether TruthFi's promise can materialize into profits — and whether DJT can move the needle in either direction.

目前,交易者發現自己處於一個轉折點,等待看到TruthFi的承諾是否能轉化爲利潤 — 以及DJt是否能在任何方向上產生影響。

- A Hedge Fund Hit Big On Trump's Rumored Crypto Acquisition And Could Be Up $14.15 Million

- 一家對特朗普傳聞中的加密貨幣收購進行投資的對沖基金獲利頗豐,可能賺取了1415萬元。

Image: Shutterstock

圖片:shutterstock