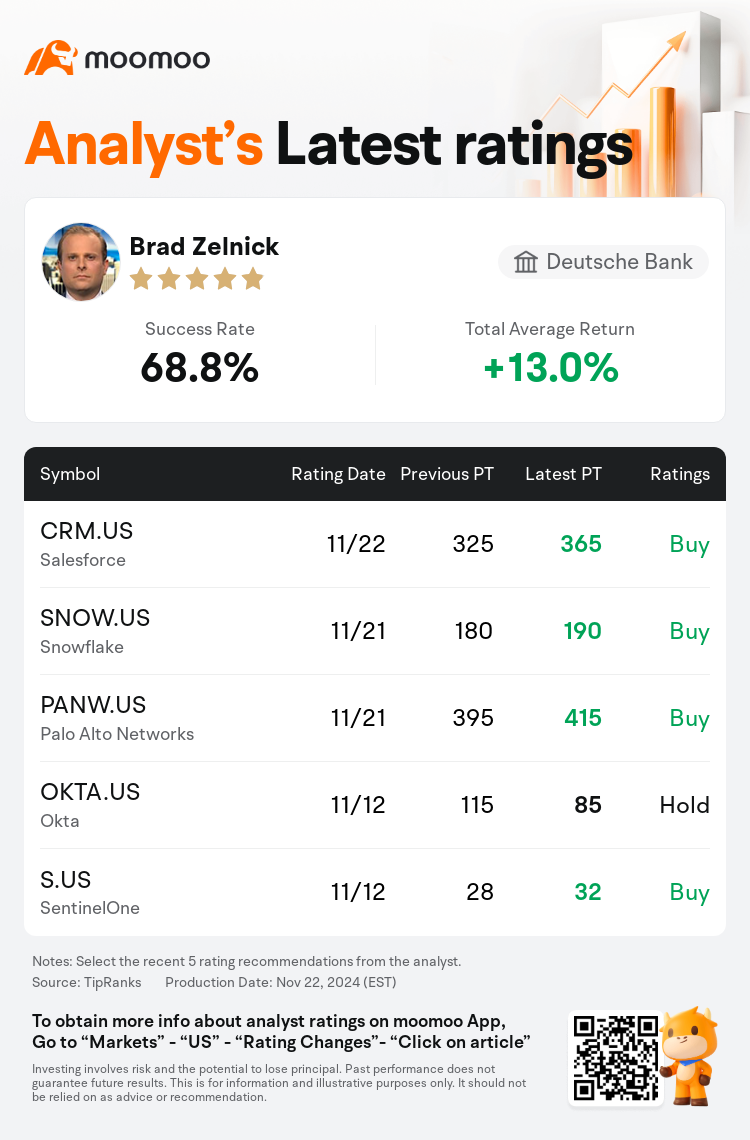

Deutsche Bank analyst Brad Zelnick maintains $Salesforce (CRM.US)$ with a buy rating, and adjusts the target price from $325 to $365.

According to TipRanks data, the analyst has a success rate of 68.8% and a total average return of 13.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

The potential for Salesforce's new Agentforce offering and the broader opportunities surrounding sales of artificial intelligence agents for customer support tasks have been highlighted by analysts.

Consultants report a 'distinctly positive tone' toward Agentforce, noting it as a 'meaningful improvement' with genuine customer interest. Salesforce is described as operating a resilient business model, capable of enduring even amidst a challenging broader macro environment affecting software companies. The expectation is for Salesforce to realize potential upside as it shifts towards maximizing efficiency, managing slower growth alongside profitability and free cash flow enhancements, and integrating generative AI into its offerings.

The firm previewed the quarterly results for Salesforce and expressed encouragement with the early reception around Agentforce and the potential for a stronger new AI-driven product cycle. However, they noted that expectations might have escalated too much and a period of patience could be necessary to observe meaningful impacts.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

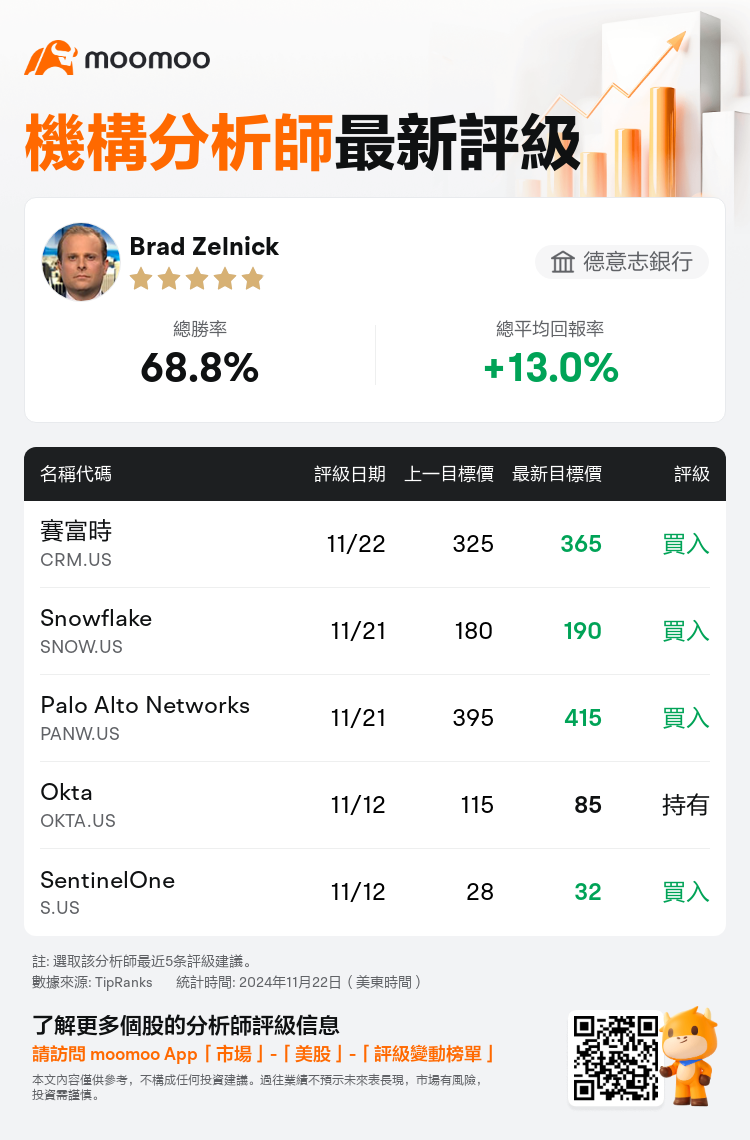

德意志銀行分析師Brad Zelnick維持$賽富時 (CRM.US)$買入評級,並將目標價從325美元上調至365美元。

根據TipRanks數據顯示,該分析師近一年總勝率為68.8%,總平均回報率為13.0%。

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

分析師們強調了賽富時的新產品Agentforce的潛力,以及圍繞爲客戶支持任務銷售人工智能代理的更廣泛機會。

顧問報告對Agentforce持有「明顯積極的態度」,稱其爲「有意義的改善」,並且客戶表現出真正的興趣。賽富時被描述爲運營一個具有韌性的業務模式,能夠在影響軟件公司的挑戰性宏觀環境中生存。預期賽富時會實現潛在的上行空間,因爲它正在轉向最大化效率,管理逐漸放緩的增長,同時提升盈利能力和自由現金流,並將生成性人工智能整合到其產品中。

該公司預覽了賽富時的季度業績,並對Agentforce周圍的早期反響表示鼓勵,以及一個更強大的新人工智能驅動產品週期的潛力。然而,他們指出期望可能過高,因此可能需要一段耐心的時間來觀察有意義的影響。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of