Intel Unusual Options Activity

Intel Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Intel.

有大量資金的鯨魚對英特爾持有明顯看好態度。

Looking at options history for Intel (NASDAQ:INTC) we detected 14 trades.

查看英特爾(納斯達克:INTC)期權歷史,我們檢測到了14筆交易。

If we consider the specifics of each trade, it is accurate to state that 64% of the investors opened trades with bullish expectations and 35% with bearish.

如果考慮每筆交易的具體情況,可以準確地說,64%的投資者持看好期望開倉,35%持看淡。

From the overall spotted trades, 2 are puts, for a total amount of $89,850 and 12, calls, for a total amount of $430,148.

在所有發現的交易中,有2筆看跌期權,總金額爲$89,850,有12筆看漲期權,總金額爲$430,148。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $3.0 and $55.0 for Intel, spanning the last three months.

經過評估交易量和未平倉合約,顯而易見的是市場主要的推手正在關注英特爾的價格區間,在$3.0和$55.0之間,跨越了過去三個月。

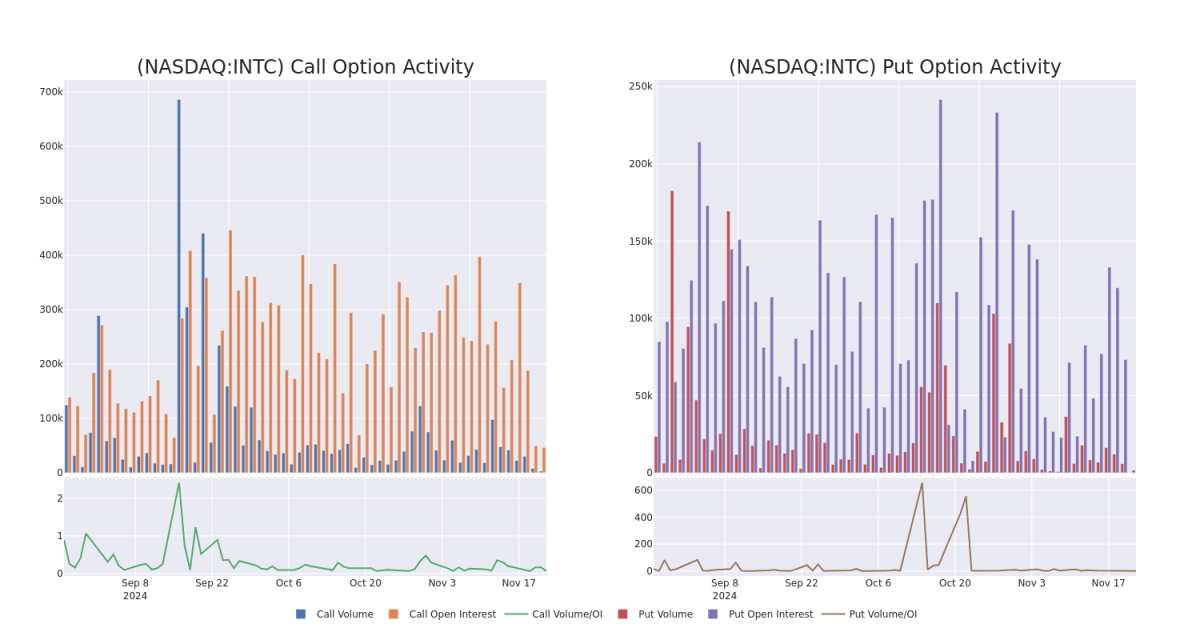

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Intel's options for a given strike price.

這些數據可以幫助您跟蹤給定行權價下的英特爾期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intel's whale activity within a strike price range from $3.0 to $55.0 in the last 30 days.

以下,我們可以觀察到在過去30天內,英特爾所有大宗交易活動中,看漲和看跌期權的成交量和未平倉量的演變情況,涵蓋了從$3.0到$55.0的行權價格區間。

Intel Call and Put Volume: 30-Day Overview

英特爾看漲和看跌期權成交量:30天總覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | CALL | TRADE | BEARISH | 01/15/27 | $7.2 | $7.15 | $7.15 | $25.00 | $71.5K | 3.9K | 106 |

| INTC | PUT | TRADE | BEARISH | 01/17/25 | $30.5 | $29.9 | $30.5 | $55.00 | $64.0K | 107 | 21 |

| INTC | CALL | SWEEP | BULLISH | 03/21/25 | $5.7 | $5.6 | $5.68 | $20.00 | $56.8K | 5.2K | 100 |

| INTC | CALL | TRADE | BULLISH | 01/15/27 | $21.95 | $21.6 | $21.9 | $3.00 | $43.8K | 678 | 24 |

| INTC | CALL | TRADE | BEARISH | 01/15/27 | $22.5 | $21.5 | $21.79 | $3.00 | $32.6K | 678 | 44 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 英特爾-t | 看漲 | 交易 | 看淡 | 01/15/27 | $7.2 | $7.15 | $7.15 | $25.00 | $71.5千美元 | 3.9千 | 106 |

| 英特爾-t | 看跌 | 交易 | 看淡 | 01/17/25 | $30.5 | $29.9 | $30.5 | $55.00 | $64.0千美元 | 107 | 21 |

| 英特爾-t | 看漲 | SWEEP | BULLISH | 03/21/25 | $5.7 | $5.6 | $5.68 | $20.00 | 56.8K美元 | 5.2K | 100 |

| 英特爾-t | 看漲 | 交易 | BULLISH | 01/15/27 | $21.95 | $21.6 | $21.9 | $3.00 | $43.8千美元 | 678 | 24 |

| 英特爾-t | 看漲 | 交易 | 看淡 | 01/15/27 | 22.5 | 21.5美元 | $21.79 | $3.00 | $32.6K | 678 | 44 |

About Intel

關於英特爾

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

英特爾是一家領先的數字芯片製造商,專注於爲全球個人電腦和數據中心市場設計和製造微處理器。英特爾率先提出了微處理器的x86架構,並是Moore's law在半導體制造方面的主要支持者。英特爾在PC和服務器終端市場的中央處理單元方面保持市場份額領先地位。英特爾還擴展到了新的附加領域,如通信基礎設施、汽車和物聯網。此外,英特爾希望利用其芯片製造能力進入外包晶圓廠模式,在此模式下爲他人構建芯片。

Following our analysis of the options activities associated with Intel, we pivot to a closer look at the company's own performance.

在分析與英特爾相關的期權活動之後,我們將轉向更仔細地觀察公司的表現。

Current Position of Intel

英特爾的現狀

- With a volume of 19,803,350, the price of INTC is up 0.35% at $24.52.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 62 days.

- 英特爾的成交量爲19,803,350,股價上漲0.35%,報24.52美元。

- RSI指標暗示該股票可能要超買了。

- 下一次盈利預計將在62天內發佈。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intel with Benzinga Pro for real-time alerts.

期權交易涉及更大的風險,但也提供更高利潤的潛力。 精明的交易員通過持續的教育、策略性的交易調整、利用各種因子並保持對市場動態的敏感來減輕這些風險。 通過Benzinga Pro實時警報及時了解英特爾的最新期權交易。

From the overall spotted trades, 2 are puts, for a total amount of $89,850 and 12, calls, for a total amount of $430,148.

From the overall spotted trades, 2 are puts, for a total amount of $89,850 and 12, calls, for a total amount of $430,148.