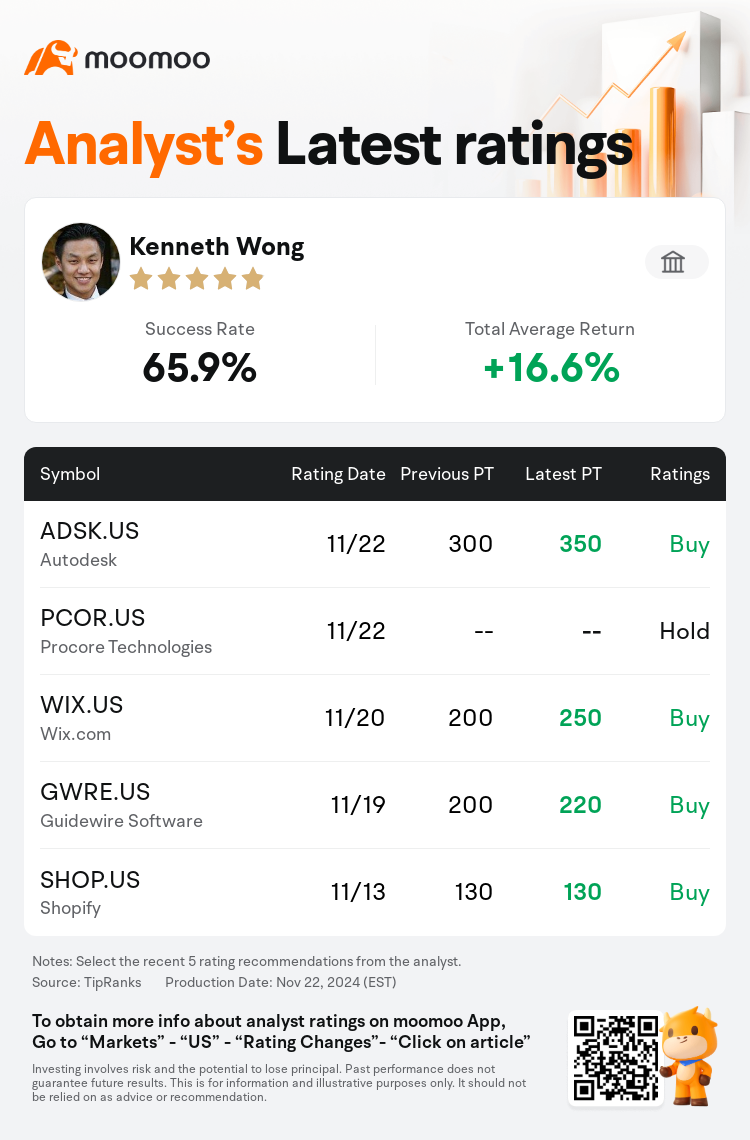

Oppenheimer analyst Kenneth Wong maintains $Autodesk (ADSK.US)$ with a buy rating, and adjusts the target price from $300 to $350.

According to TipRanks data, the analyst has a success rate of 65.9% and a total average return of 16.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Autodesk (ADSK.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Autodesk (ADSK.US)$'s main analysts recently are as follows:

Stable checks support expectations for approximately 12% revenue growth in Q3 and guidance that aligns with Q4 projections. While it is noted that patience may be required from investors regarding clarifications on growth and margin opportunities until a new CFO is appointed, the current assessment shows an attractive entry point and favorable risk/reward.

A recent reseller survey linked to Autodesk revealed improved quota achievements and an anticipation of stronger growth over the upcoming year. Additionally, political concerns that had previously caused some project delays have been mitigated following the conclusion of the election, with leading macro indicators now showing more positive trends.

Conversations with partners indicate that Autodesk is positioned to accelerate its revenue growth and aims to reach a 30% free cash flow margin by FY26. Early model transition efforts are expected to contribute to improved results in the coming year.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

奧本海默控股分析師Kenneth Wong維持$歐特克 (ADSK.US)$買入評級,並將目標價從300美元上調至350美元。

根據TipRanks數據顯示,該分析師近一年總勝率為65.9%,總平均回報率為16.6%。

此外,綜合報道,$歐特克 (ADSK.US)$近期主要分析師觀點如下:

此外,綜合報道,$歐特克 (ADSK.US)$近期主要分析師觀點如下:

穩定的檢查支撐了對第三季度約12%營業收入增長的預期,以及與第四季度預測相符的指導。雖然有指出投資者可能需要耐心等待關於增長和利潤機會的澄清,直到新任CFO被任命,目前的評估顯示了一個有吸引力的入場點和有利的風險/回報。

最近一項與歐特克相關的轉售商調查顯示出配額達成情況改善,並預計未來一年將實現更強勁的增長。此外,之前導致一些項目延遲的政治擔憂在選舉結束後得到了緩解,領先的宏觀因子現在顯示出更積極的趨勢。

與合作伙伴的對話表明,歐特克已準備好加速其營業收入增長,並計劃到2026財年實現30%的自由現金流利潤率。早期的模型轉換努力預計將在未來一年內促進改善結果。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$歐特克 (ADSK.US)$近期主要分析師觀點如下:

此外,綜合報道,$歐特克 (ADSK.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of