The Five-year Loss for Sunway (SHSE:603333) Shareholders Likely Driven by Its Shrinking Earnings

The Five-year Loss for Sunway (SHSE:603333) Shareholders Likely Driven by Its Shrinking Earnings

It is doubtless a positive to see that the Sunway Co., Ltd. (SHSE:603333) share price has gained some 72% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. The share price has failed to impress anyone , down a sizable 52% during that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. Of course, this could be the start of a turnaround.

While the last five years has been tough for Sunway shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

We don't think that Sunway's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last five years Sunway saw its revenue shrink by 0.3% per year. That's not what investors generally want to see. The share price decline of 9% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

In the last five years Sunway saw its revenue shrink by 0.3% per year. That's not what investors generally want to see. The share price decline of 9% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

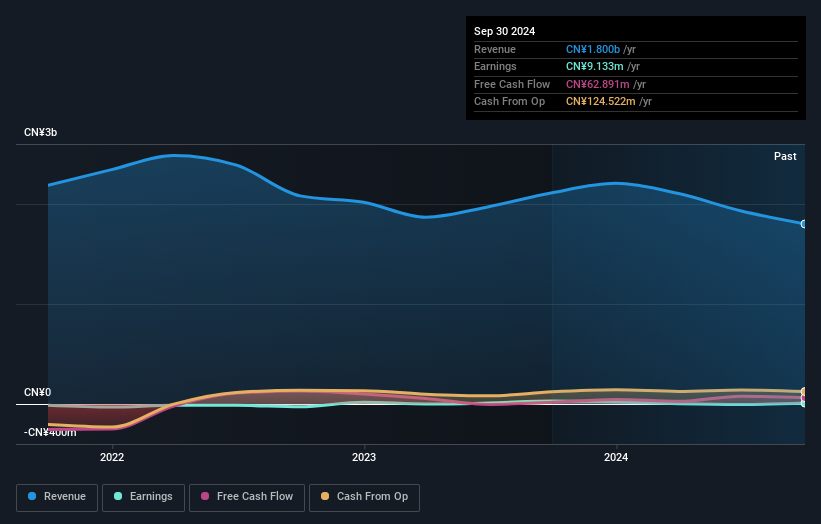

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Sunway shareholders are up 3.0% for the year (even including dividends). Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 9% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Sunway has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.