Subdued Growth No Barrier To Tungkong Inc. (SZSE:002117) With Shares Advancing 30%

Subdued Growth No Barrier To Tungkong Inc. (SZSE:002117) With Shares Advancing 30%

Tungkong Inc. (SZSE:002117) shares have continued their recent momentum with a 30% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 5.0% isn't as impressive.

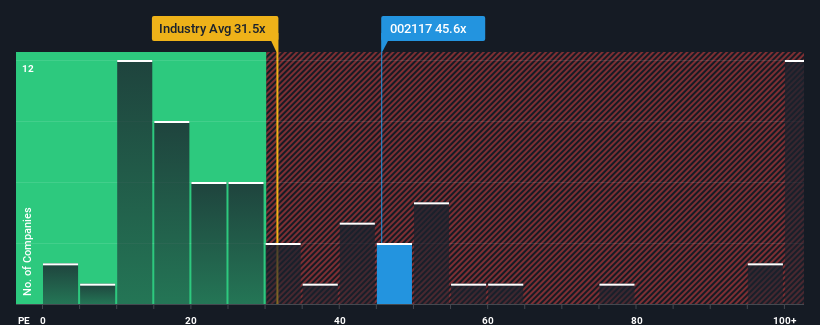

After such a large jump in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 35x, you may consider Tungkong as a stock to potentially avoid with its 45.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Tungkong's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

Tungkong's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Tungkong's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 40% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 39% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Tungkong is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Tungkong shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Tungkong currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Tungkong (of which 1 is a bit concerning!) you should know about.

If you're unsure about the strength of Tungkong's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.