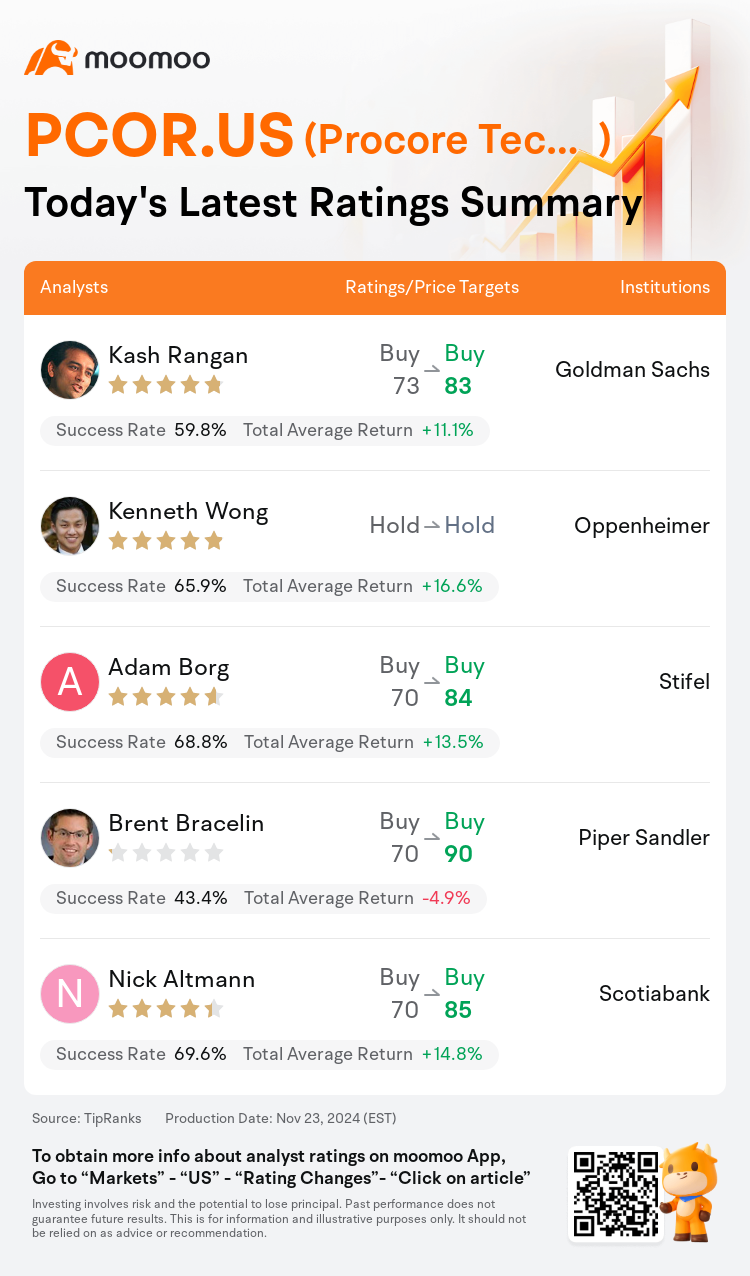

On Nov 23, major Wall Street analysts update their ratings for $Procore Technologies (PCOR.US)$, with price targets ranging from $83 to $90.

Goldman Sachs analyst Kash Rangan maintains with a buy rating, and adjusts the target price from $73 to $83.

Oppenheimer analyst Kenneth Wong maintains with a hold rating.

Stifel analyst Adam Borg maintains with a buy rating, and adjusts the target price from $70 to $84.

Stifel analyst Adam Borg maintains with a buy rating, and adjusts the target price from $70 to $84.

Piper Sandler analyst Brent Bracelin maintains with a buy rating, and adjusts the target price from $70 to $90.

Scotiabank analyst Nick Altmann maintains with a buy rating, and adjusts the target price from $70 to $85.

Furthermore, according to the comprehensive report, the opinions of $Procore Technologies (PCOR.US)$'s main analysts recently are as follows:

The company's Analyst Day presentation outlined a strong strategic approach aimed at steadily boosting growth and expanding margins over the medium term, despite the challenging macroeconomic environment. Analysts are appreciative of the product and market prospects for Procore as it integrates technical and geographic sales resources that are in line with its recent updates.

The firm's increased confidence in the company's competitive advantages is bolstered by insights from customer and partner conversations experienced during its analyst day.

Procore's investor day emphasized growth driving efficiency and improvement in free cash flow per share. The company's projection of a 25% to 40%+ free cash flow margin trajectory was noted to surpass expectations. Additionally, their new go-to-market model is poised to accelerate top-line growth.

Following Procore's Investor Day and user conference, the sentiment remains incrementally positive, influenced by potential pricing and packaging changes, the efficacy of its 'swarming' motion, and strong morale. These factors bolster confidence that any disruption may be more contained than initially anticipated. Additionally, the outlook for medium- and long-term free cash flow margin targets of 25%+ and 40%+ respectively, further strengthens this view.

Here are the latest investment ratings and price targets for $Procore Technologies (PCOR.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月23日,多家華爾街大行更新了$Procore Technologies (PCOR.US)$的評級,目標價介於83美元至90美元。

高盛集團分析師Kash Rangan維持買入評級,並將目標價從73美元上調至83美元。

奧本海默控股分析師Kenneth Wong維持持有評級。

斯迪富分析師Adam Borg維持買入評級,並將目標價從70美元上調至84美元。

斯迪富分析師Adam Borg維持買入評級,並將目標價從70美元上調至84美元。

派傑投資分析師Brent Bracelin維持買入評級,並將目標價從70美元上調至90美元。

豐業銀行分析師Nick Altmann維持買入評級,並將目標價從70美元上調至85美元。

此外,綜合報道,$Procore Technologies (PCOR.US)$近期主要分析師觀點如下:

公司的分析師日演示概述了一個強大的戰略方法,旨在在中期內穩步推動增長並擴大利潤空間,儘管當前挑戰較大的宏觀經濟環境。分析師對Procore的產品和市場前景表示讚賞,因爲它整合了技術和地理銷售資源,與其最近的更新保持一致。

公司對該公司競爭優勢的信懇智能增強,得益於客戶和合作夥伴在分析師日活動中的深入交流所帶來的見解。

Procore的投資者日強調了促進效率和改善每股自由現金流的增長。公司預計自由現金流利潤率軌跡將達到25%至40%以上,超出預期。此外,他們的新市場推廣模式有望加速銷售收入增長。

在Procore的投資者日和用戶大會之後,情緒保持逐步向好,受可能的定價和打包變化、『集群』動作的有效性以及強烈士氣的影響。這些因素增強了對於任何潛在干擾可能比最初預期更受限制的信心。此外,中期和長期自由現金流利潤率目標分別爲25%+和40%+,進一步加強了這一觀點。

以下爲今日5位分析師對$Procore Technologies (PCOR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

斯迪富分析師Adam Borg維持買入評級,並將目標價從70美元上調至84美元。

斯迪富分析師Adam Borg維持買入評級,並將目標價從70美元上調至84美元。

Stifel analyst Adam Borg maintains with a buy rating, and adjusts the target price from $70 to $84.

Stifel analyst Adam Borg maintains with a buy rating, and adjusts the target price from $70 to $84.