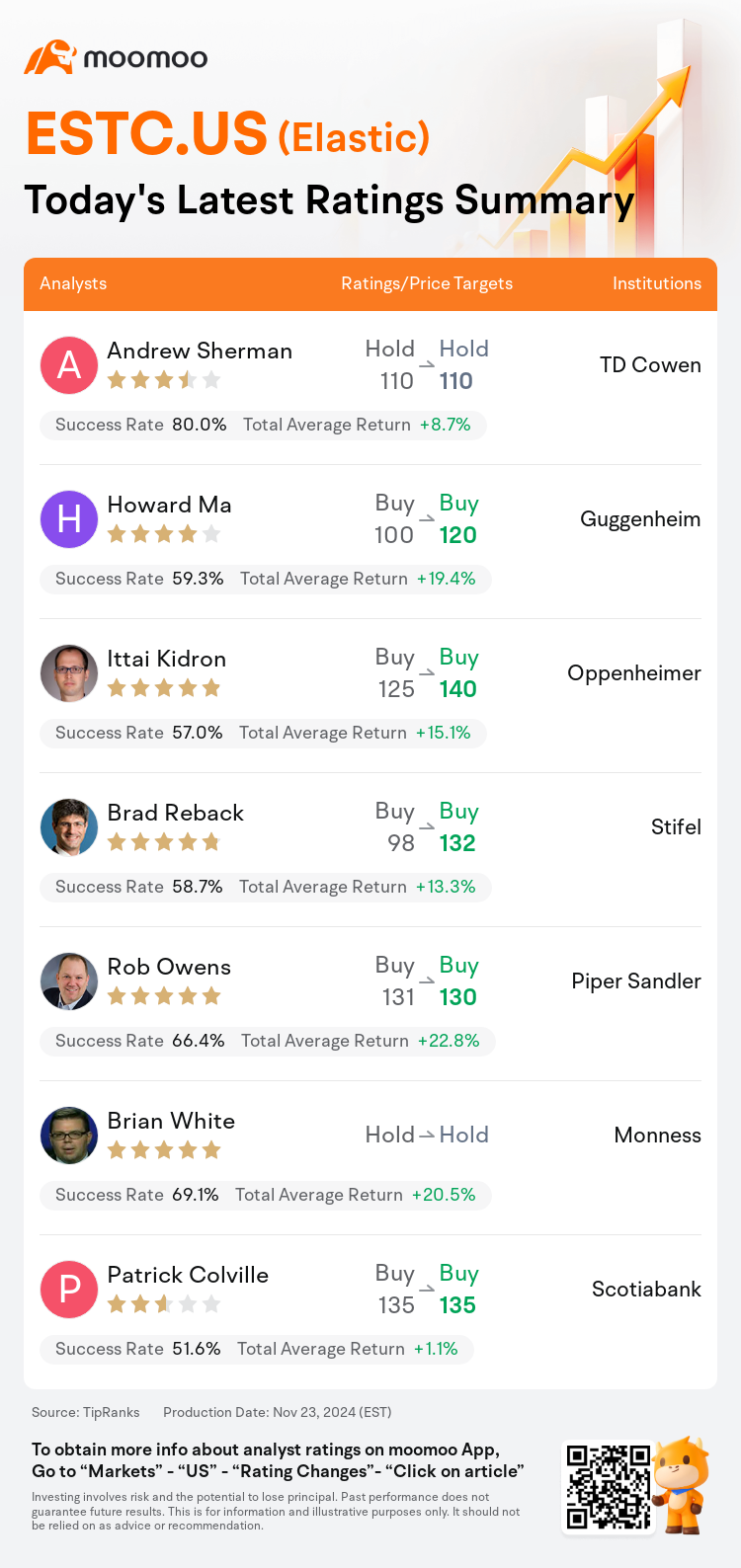

On Nov 23, major Wall Street analysts update their ratings for $Elastic (ESTC.US)$, with price targets ranging from $110 to $140.

TD Cowen analyst Andrew Sherman maintains with a hold rating, and maintains the target price at $110.

Guggenheim analyst Howard Ma maintains with a buy rating, and adjusts the target price from $100 to $120.

Oppenheimer analyst Ittai Kidron maintains with a buy rating, and adjusts the target price from $125 to $140.

Oppenheimer analyst Ittai Kidron maintains with a buy rating, and adjusts the target price from $125 to $140.

Stifel analyst Brad Reback maintains with a buy rating, and adjusts the target price from $98 to $132.

Piper Sandler analyst Rob Owens maintains with a buy rating, and adjusts the target price from $131 to $130.

Furthermore, according to the comprehensive report, the opinions of $Elastic (ESTC.US)$'s main analysts recently are as follows:

Elastic's recent quarterly outcomes suggest that the changes in the sales organization might not have been as disruptive as initially anticipated, though risks still persist. Additionally, while the company's revised guidance for FY25 forecasts a revenue growth of 10%-13% year-over-year by the end of FY25, this projection is perceived with a degree of conservatism and appears somewhat unexciting given the dynamic end-markets such as gen-AI, security, and observability that Elastic operates within.

The company's results showed an improvement compared to its first quarter performance, and the management's overall tone remained positive. Early indicators suggest that the changes made to the go-to-market strategy in Q1 are beginning to positively impact key customer metrics, particularly in commitments towards GenAI technologies, despite the company's cautious forward outlook.

Following a less impressive fiscal first quarter, Elastic exhibited stronger than anticipated performance in the third quarter, driven by widespread demand and enhanced sales execution. The guidance presented seems conservative, potentially establishing targets that are achievable or exceedable.

Elastic's Q2 results slightly exceeded expectations, and the changes in management were seen as a positive influence following recent challenges in execution.

Elastic reported a robust rebound in its recent quarter, surpassing top-line expectations by over 3%. This improvement was facilitated by a revitalized go-to-market strategy, which paved the way for effective sales execution marked by multi-year commitments. Moreover, noteworthy consumption trends, particularly amongst Elastic's major clients, contributed to this performance. The expectations of sustained sales effectiveness, increasing client consumption, opportunities in the growing GenAI sector, and continued operational efficiency, are seen as catalysts for Elastic's expected outperformance in the upcoming quarters.

Here are the latest investment ratings and price targets for $Elastic (ESTC.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

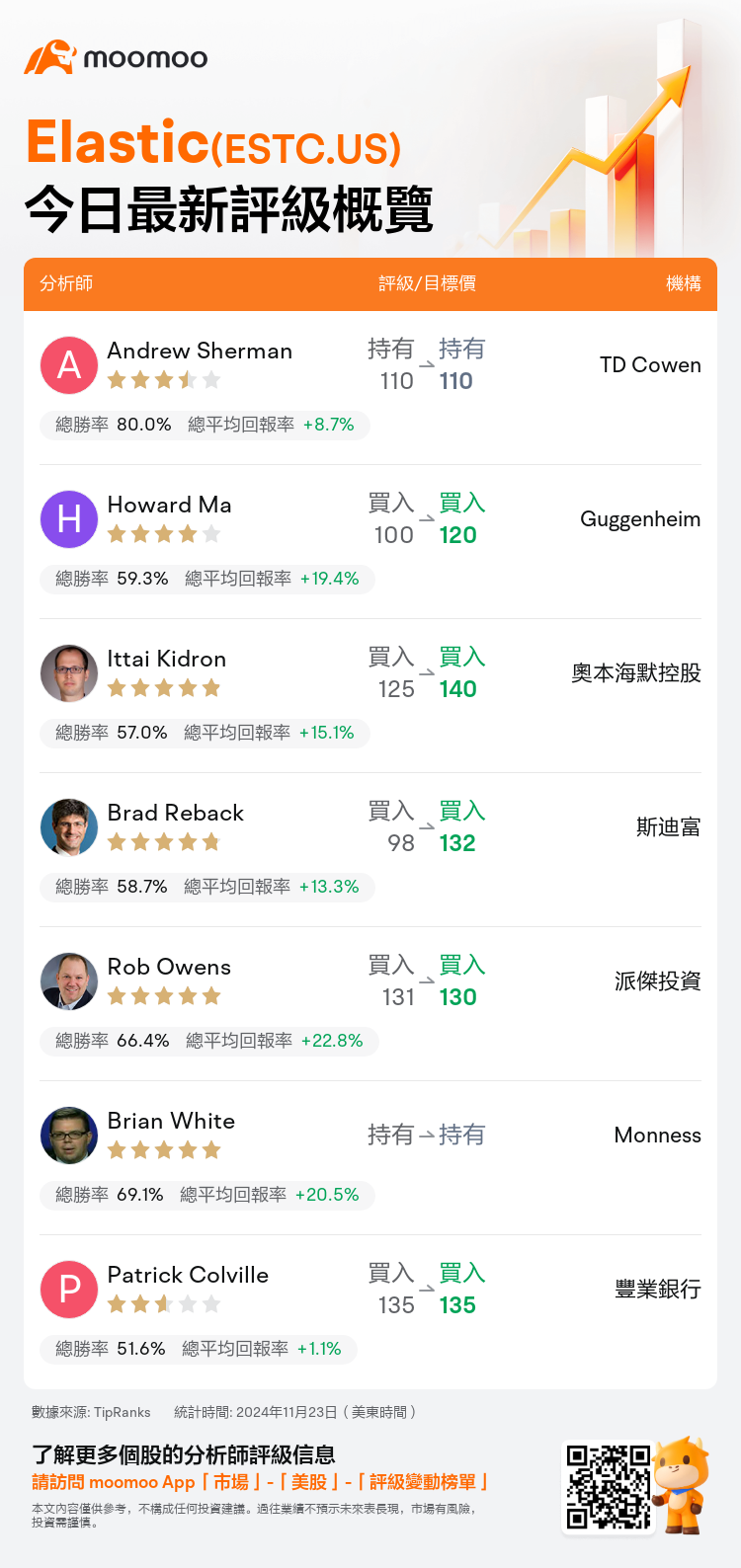

美東時間11月23日,多家華爾街大行更新了$Elastic (ESTC.US)$的評級,目標價介於110美元至140美元。

TD Cowen分析師Andrew Sherman維持持有評級,維持目標價110美元。

Guggenheim分析師Howard Ma維持買入評級,並將目標價從100美元上調至120美元。

奧本海默控股分析師Ittai Kidron維持買入評級,並將目標價從125美元上調至140美元。

奧本海默控股分析師Ittai Kidron維持買入評級,並將目標價從125美元上調至140美元。

斯迪富分析師Brad Reback維持買入評級,並將目標價從98美元上調至132美元。

派傑投資分析師Rob Owens維持買入評級,並將目標價從131美元下調至130美元。

此外,綜合報道,$Elastic (ESTC.US)$近期主要分析師觀點如下:

Elastic最近的季度業績表明,銷售組織的變化可能並沒有像最初預期的那樣具有破壞性,儘管風險仍然存在。此外,儘管公司對FY25年的營業收入增長指導預測爲年同比10%-13%,但這一預測被認爲具有一定保守性,並且在Elastic所處的活躍終端市場,如gen-AI、安防-半導體和可觀察性,顯得有些乏味。

公司的業績與首季相比有所改善,管理層整體態度仍然積極。早期指標表明,在第一季度對市場策略所做的改變開始對關鍵客戶指標產生積極影響,特別是在承諾使用GenAI技術方面,儘管公司對未來持謹慎態度。

經歷了不太令人印象深刻的財政第一季度後,Elastic在第三季度表現出超出預期的強勁業績,這是由普遍需求和增強的銷售執行力推動的。提供的指導看似保守,可能確立了可實現或可超越的目標。

Elastic的Q2業績略高於預期,並且管理層的變化被視爲對最近執行挑戰的積極影響。

Elastic在最近一個季度報告了強勁的反彈,超過了3%的頂線預期。這一改善得益於重振的市場策略,爲跨年度承諾所標誌的有效銷售執行鋪平了道路。此外,尤其是在Elastic的主要客戶中,顯著的消費趨勢也促成了這一表現。持續的銷售有效性預期、增加的客戶消費、成長中的GenAI板塊的機遇,以及持續的運營效率,被視爲Elastic在接下來的幾個季度中預期超額表現的催化劑。

以下爲今日7位分析師對$Elastic (ESTC.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

奧本海默控股分析師Ittai Kidron維持買入評級,並將目標價從125美元上調至140美元。

奧本海默控股分析師Ittai Kidron維持買入評級,並將目標價從125美元上調至140美元。

Oppenheimer analyst Ittai Kidron maintains with a buy rating, and adjusts the target price from $125 to $140.

Oppenheimer analyst Ittai Kidron maintains with a buy rating, and adjusts the target price from $125 to $140.