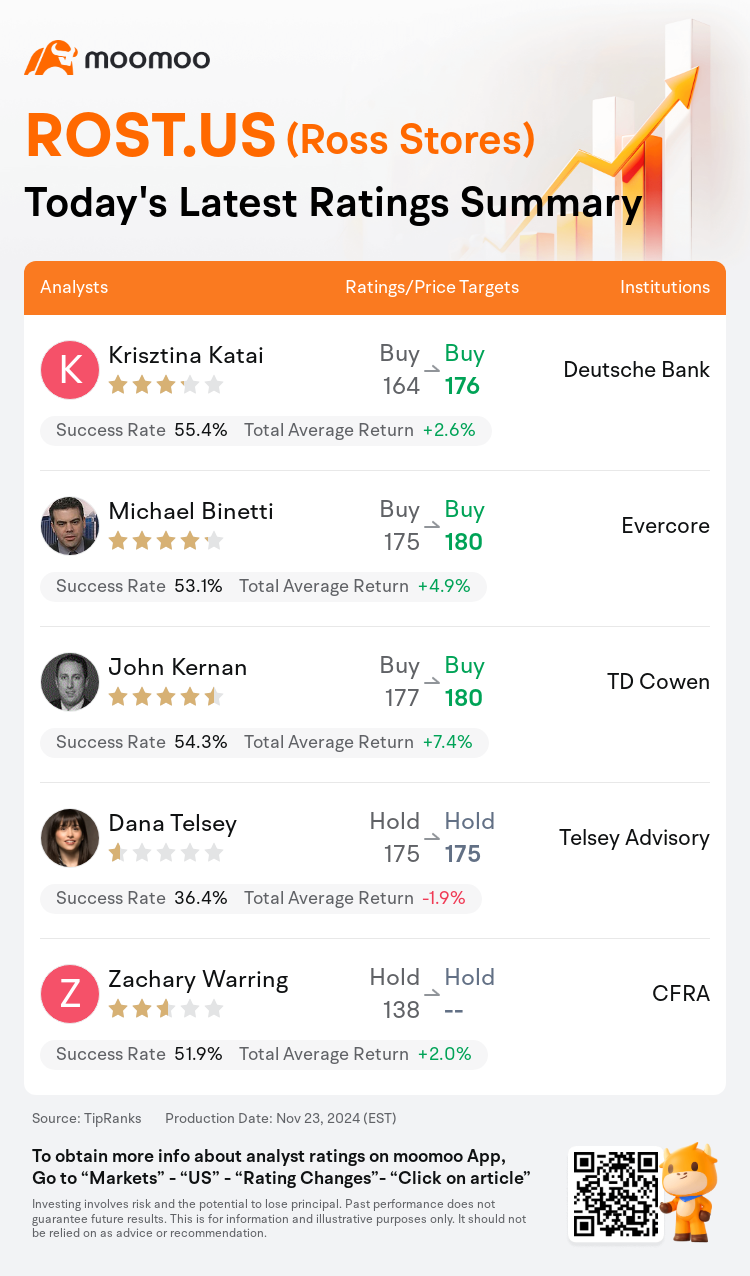

On Nov 23, major Wall Street analysts update their ratings for $Ross Stores (ROST.US)$, with price targets ranging from $175 to $180.

Deutsche Bank analyst Krisztina Katai maintains with a buy rating, and adjusts the target price from $164 to $176.

Evercore analyst Michael Binetti maintains with a buy rating, and adjusts the target price from $175 to $180.

TD Cowen analyst John Kernan maintains with a buy rating, and adjusts the target price from $177 to $180.

TD Cowen analyst John Kernan maintains with a buy rating, and adjusts the target price from $177 to $180.

Telsey Advisory analyst Dana Telsey maintains with a hold rating, and maintains the target price at $175.

CFRA analyst Zachary Warring maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Ross Stores (ROST.US)$'s main analysts recently are as follows:

Following a 'mixed' Q3 report for Ross Stores, prospects appear favorable for the company's category penetration heading into the holiday season.

Despite missing initial revenue expectations, Ross Stores achieved a third-quarter EPS of $1.48, surpassing the expected $1.40. The primary challenge to earnings per share has been merchandise margin pressure, which is anticipated to lessen significantly in 2025, potentially facilitating another year of margin improvement surpassing long-term projections. Nonetheless, for Ross to narrow its valuation gap with TJX, it must demonstrate that its enhanced merchandise strategy can begin to bridge the multi-year lag in same-store sales growth compared to Marmaxx.

Ross Stores reported earnings per share ahead of consensus, despite a modest shortfall on comparable store sales, attributed to weather conditions and some execution challenges; this is in line with softer performance observed during the quarter. However, trends show improvement as weather-related impediments have eased. The company's outlook includes an acceleration expected in the fourth fiscal quarter, which reflects a positive signal of confidence considering the management's historical performance.

Here are the latest investment ratings and price targets for $Ross Stores (ROST.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

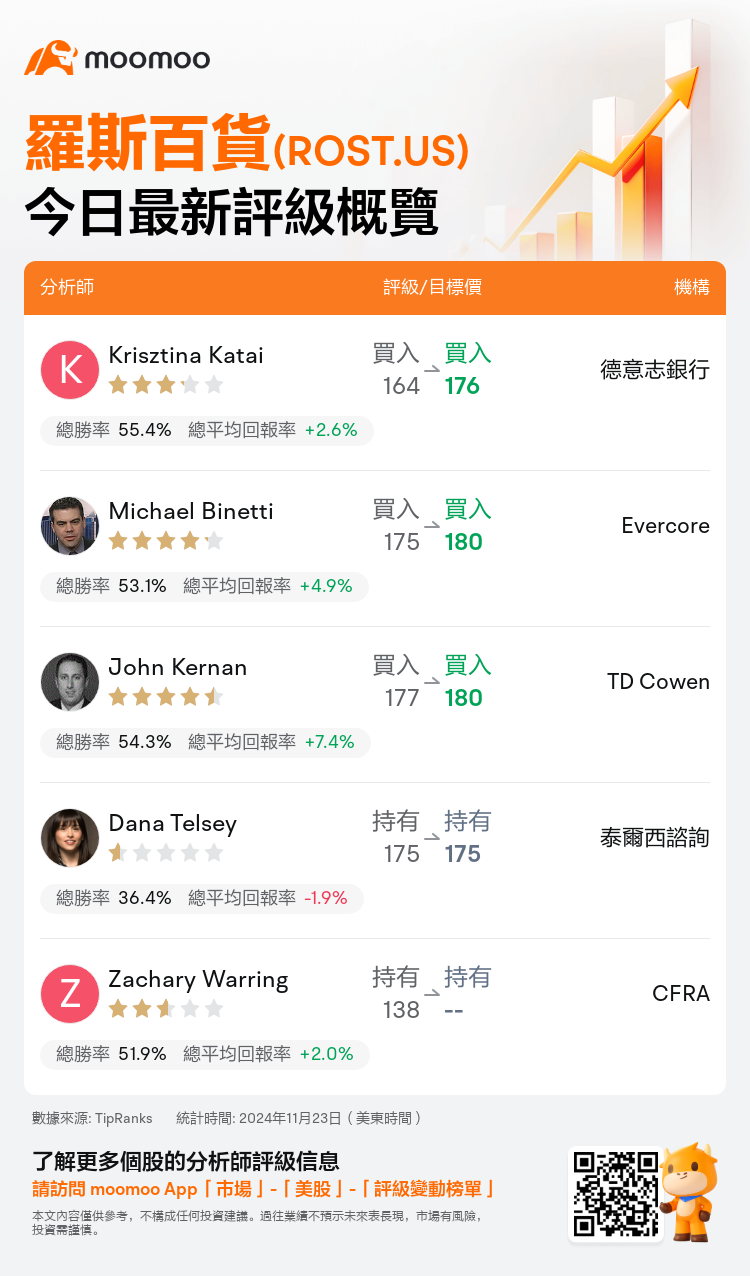

美東時間11月23日,多家華爾街大行更新了$羅斯百貨 (ROST.US)$的評級,目標價介於175美元至180美元。

德意志銀行分析師Krisztina Katai維持買入評級,並將目標價從164美元上調至176美元。

Evercore分析師Michael Binetti維持買入評級,並將目標價從175美元上調至180美元。

TD Cowen分析師John Kernan維持買入評級,並將目標價從177美元上調至180美元。

TD Cowen分析師John Kernan維持買入評級,並將目標價從177美元上調至180美元。

泰爾西諮詢分析師Dana Telsey維持持有評級,維持目標價175美元。

CFRA分析師Zachary Warring維持持有評級。

此外,綜合報道,$羅斯百貨 (ROST.US)$近期主要分析師觀點如下:

在羅斯百貨發佈的'混合'第三季度報告之後,進入假日季節,該公司的品類滲透前景似乎樂觀。

儘管初始營業收入預期未能實現,羅斯百貨在第三季度每股收益達到1.48美元,超出預期的1.40美元。對每股收益的主要挑戰是商品利潤率壓力,預計將在2025年顯著減少,這可能促使另一個超過長期預測的利潤率改善年度。然而,爲了使羅斯的估值差距縮小至TJX,它必須證明其增強的商品策略能夠開始彌補與Marmaxx相比,幾年來同店銷售增長的滯後。

儘管在可比店銷售方面略有短缺,羅斯百貨的每股收益仍超出市場普遍預期,這與天氣條件和一些執行挑戰有關;這符合在季度內觀察到的表現較弱的情況。然而,趨勢顯示出改善,因爲天氣相關的障礙已經減輕。該公司的前景包括預計在第四個財政季度加速,這反映出考慮到管理層的歷史表現,信心的積極信號。

以下爲今日5位分析師對$羅斯百貨 (ROST.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師John Kernan維持買入評級,並將目標價從177美元上調至180美元。

TD Cowen分析師John Kernan維持買入評級,並將目標價從177美元上調至180美元。

TD Cowen analyst John Kernan maintains with a buy rating, and adjusts the target price from $177 to $180.

TD Cowen analyst John Kernan maintains with a buy rating, and adjusts the target price from $177 to $180.