How Good Is Brunswick Corporation (NYSE:BC), When It Comes To ROE?

How Good Is Brunswick Corporation (NYSE:BC), When It Comes To ROE?

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. We'll use ROE to examine Brunswick Corporation (NYSE:BC), by way of a worked example.

我們可以進行的最佳投資之一就是提升自己的知識和技能。考慮到這一點,本文將探討如何利用roe更好地理解某個業務。我們將通過實際例子使用roe來分析brunswick corporation (紐交所:BC)。

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

股東要考慮的關鍵因素之一是淨資產收益率或roe,因爲它告訴他們公司如何有效地重新投資他們的資本。簡單點說,它衡量了公司與股東權益相關的盈利能力。

How Do You Calculate Return On Equity?

如何計算淨資產收益率?

ROE can be calculated by using the formula:

roe可以通過以下公式計算:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

淨資產收益率 = 淨利潤(來自持續經營) ÷ 股東權益

So, based on the above formula, the ROE for Brunswick is:

因此,基於上述公式,brunswick的roe爲:

14% = US$292m ÷ US$2.0b (Based on the trailing twelve months to September 2024).

14% = US$29200萬 ÷ US$20億(基於截至2024年9月的過去十二個月數據)。

The 'return' is the yearly profit. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.14 in profit.

'回報'即爲年利潤。也就是說,對於每1美元的股本,該公司能夠賺取0.14美元的利潤。

Does Brunswick Have A Good Return On Equity?

brunswick corporation的股東權益回報率好嗎?

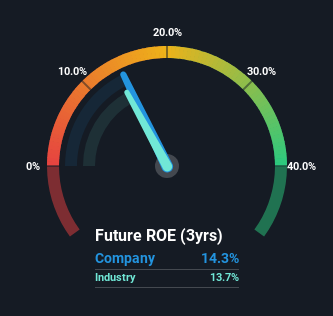

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. If you look at the image below, you can see Brunswick has a similar ROE to the average in the Leisure industry classification (14%).

判斷公司是否擁有良好的股東權益回報率的一個簡單方法是將其與所處行業的平均水平進行比較。這種方法的侷限性在於,一些公司與其他公司存在較大差異,即使在同一行業分類中。如果你查看下面的圖片,你會看到brunswick corporation的roe與休閒行業分類的平均水平(14%)相似。

That isn't amazing, but it is respectable. While at least the ROE is not lower than the industry, its still worth checking what role the company's debt plays as high debt levels relative to equity may also make the ROE appear high. If so, this increases its exposure to financial risk. To know the 2 risks we have identified for Brunswick visit our risks dashboard for free.

這並不算令人驚豔,但也算得上尊重。雖然roe至少沒有低於行業水平,但仍然值得檢查一下公司債務的角色,因爲相比於股東權益的高債務水平可能使roe看上去較高。如果是這樣,這增加了其財務風險。要了解我們爲brunswick corporation識別的兩個風險,請訪問我們的風險特斯拉-儀表,免費查看。

How Does Debt Impact Return On Equity?

債務如何影響股東回報率?

Virtually all companies need money to invest in the business, to grow profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

幾乎所有公司都需要資金來投資業務,以增加利潤。投資資金可以來自前一年的利潤(留存收益)、發行新股或借款。在第一種和第二種情況下,roe將反映這筆用於投資的現金。在後一種情況下,用於增長的債務將改善回報率,但不會影響總權益。因此,債務的使用可以提高roe,儘管在暴風雨的情況下會帶來額外的風險,比喻性地說。

Combining Brunswick's Debt And Its 14% Return On Equity

結合brunswick corporation的債務與14%的roe

Brunswick does use a high amount of debt to increase returns. It has a debt to equity ratio of 1.26. While its ROE is respectable, it is worth keeping in mind that there is usually a limit as to how much debt a company can use. Investors should think carefully about how a company might perform if it was unable to borrow so easily, because credit markets do change over time.

brunswick corporation確實使用大量債務來增加回報。它的債務與股權比率爲1.26。雖然它的roe相當不錯,但值得注意的是,一家公司的債務使用通常是有限制的。投資者應仔細思考,如果公司無法如此輕鬆借款,它會表現如何,因爲信貸市場會隨時間而變化。

Summary

總結

Return on equity is useful for comparing the quality of different businesses. A company that can achieve a high return on equity without debt could be considered a high quality business. All else being equal, a higher ROE is better.

股本回報率在比較不同企業質量時很有用。一家可以在沒有債務的情況下實現高股本回報率的公司可以被認爲是一家高質量的公司。其他條件相同,股本回報率越高,越好。

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So you might want to check this FREE visualization of analyst forecasts for the company.

但ROE只是一個更大的難題中的一部分,因爲高質量的企業往往以高倍數的收益交易。因此,重要的是要考慮其他因素,例如未來的利潤增長以及未來的投資需求。因此,您可能需要查看分析師對該公司的預測的免費可視化。

Of course Brunswick may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

當然,brunswick corporation可能不是最好的買入股票。因此,您可能希望查看這份免費的其他公司集合,它們具有高roe和低債務。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity