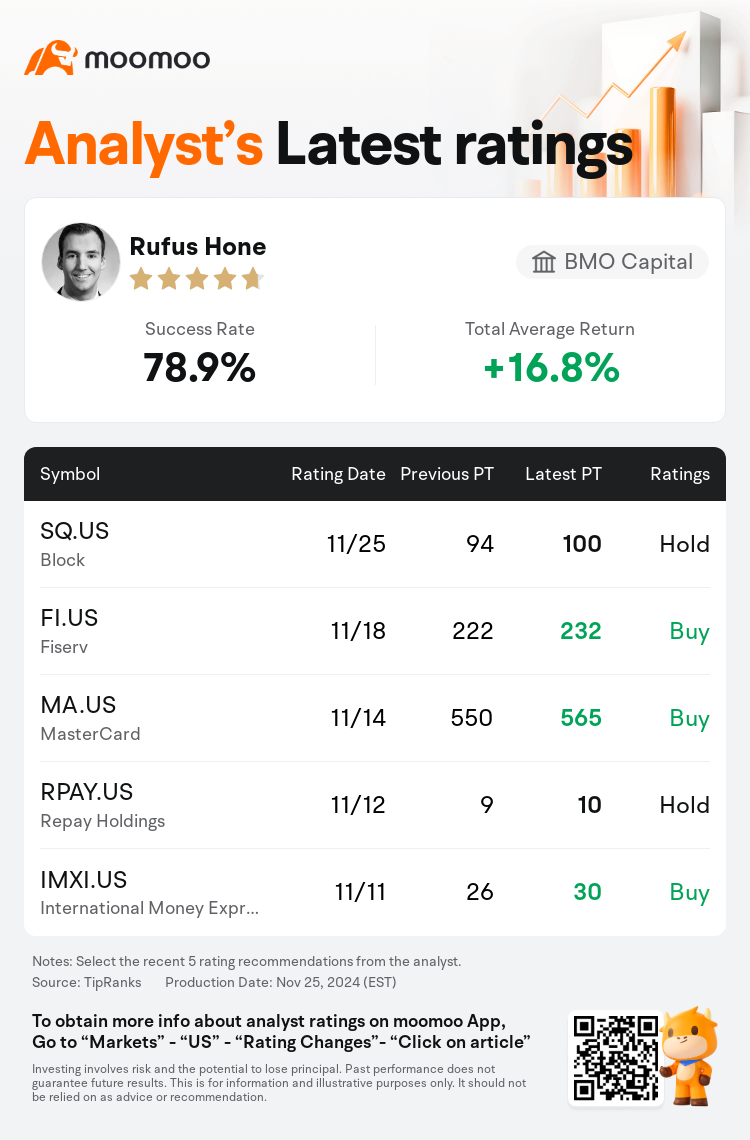

BMO Capital analyst Rufus Hone downgrades $Block (SQ.US)$ to a hold rating, and adjusts the target price from $94 to $100.

According to TipRanks data, the analyst has a success rate of 78.9% and a total average return of 16.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Block (SQ.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Block (SQ.US)$'s main analysts recently are as follows:

It is becoming increasingly difficult to foresee further gross profit improvements for Block. Following a 22% increase in share value since the third-quarter report, maintaining a 'beat/raise cycle' into the years 2025 and 2026 appears challenging. There are concerns surrounding potential risks to the expected gross profit growth of Cash App, and the 'Rule-of-40' target for 2026 sets a high standard for per-employee profitability. This could make it tough for Block to continue enhancing gross profit without increasing its workforce.

Concerns that Block's target for at least 15% profit growth by 2025 might be overly ambitious have been countered by detailed reviews of the company's three key ecosystems. Analysis indicates that the Cash App, excluding the buy-now-pay-later feature, is capable of achieving mid-teens profit growth even with a moderate increase of 1M monthly active users and stable monetization rates. Furthermore, there's optimism that Square's profits could rise by 12% through initiatives like vertical integration and streamlined merchant onboarding processes. Additionally, the buy-now-pay-later segment is expected to see profit growth in the high-20% range by 2025. Collectively, these assessments support a projected growth in total gross profits for Block of at least 16% in 2025.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

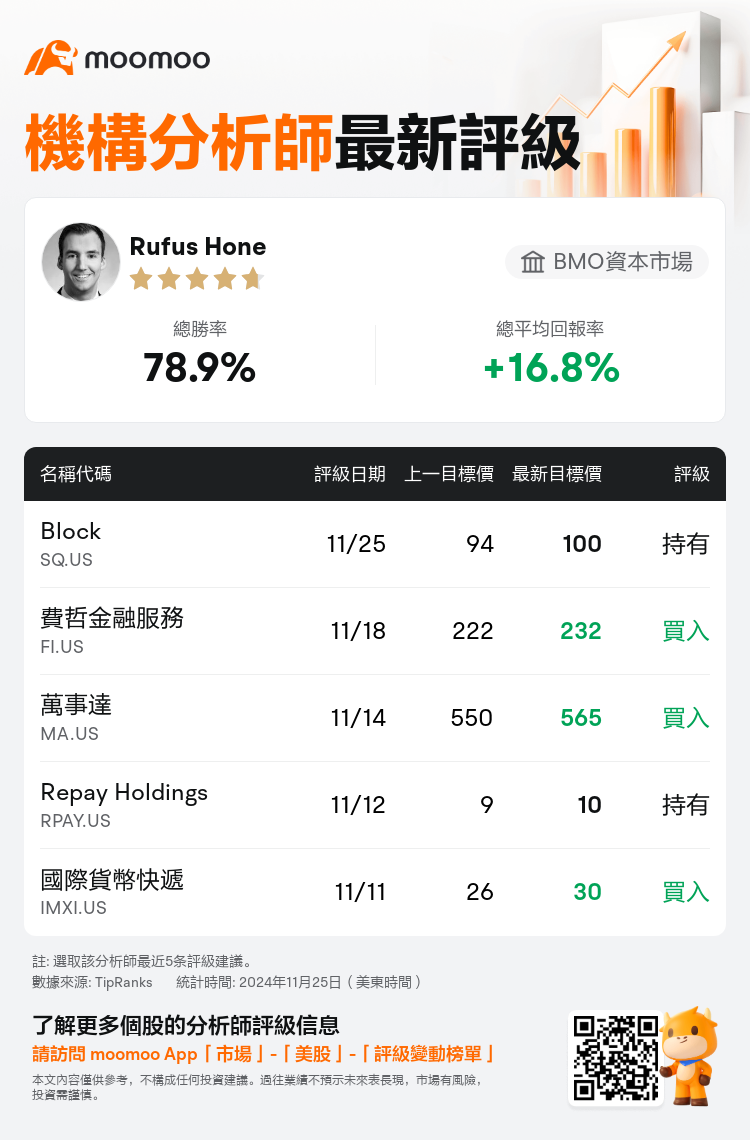

BMO資本市場分析師Rufus Hone下調$Block (SQ.US)$至持有評級,並將目標價從94美元上調至100美元。

根據TipRanks數據顯示,該分析師近一年總勝率為78.9%,總平均回報率為16.8%。

此外,綜合報道,$Block (SQ.US)$近期主要分析師觀點如下:

此外,綜合報道,$Block (SQ.US)$近期主要分析師觀點如下:

目前預測Block的毛利潤進一步增長越來越困難。在第三季度報告後,股價上漲了22%,在2025年和2026年繼續維持『超出預期/提高週期』的目標顯得具有挑戰性。關於現金應用程序預期毛利潤增長的潛在風險存在擔憂,而到2026年的『40法則』目標爲每位員工的盈利能力設定了高標準。這可能使Block在不增加員工人數的情況下繼續提高毛利潤變得困難。

對於Block在2025年前實現至少15%利潤增長的目標過於雄心勃勃的擔憂,通過對公司三大關鍵生態系統的詳細審查得到了反駁。分析表明,現金應用程序在不考慮先買後付功能的情況下,即使月活躍用戶數穩步增加100萬,且貨幣化率保持穩定,仍有能力實現中等的利潤增長。此外,樂觀地認爲,Square的利潤可以通過垂直整合和簡化商戶入駐流程等舉措上升12%。另外,預計到2025年,先買後付板塊的利潤增長將在20%以上。綜合來看,這些評估支持對Block在2025年毛利潤總額至少增長16%的預期。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Block (SQ.US)$近期主要分析師觀點如下:

此外,綜合報道,$Block (SQ.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of