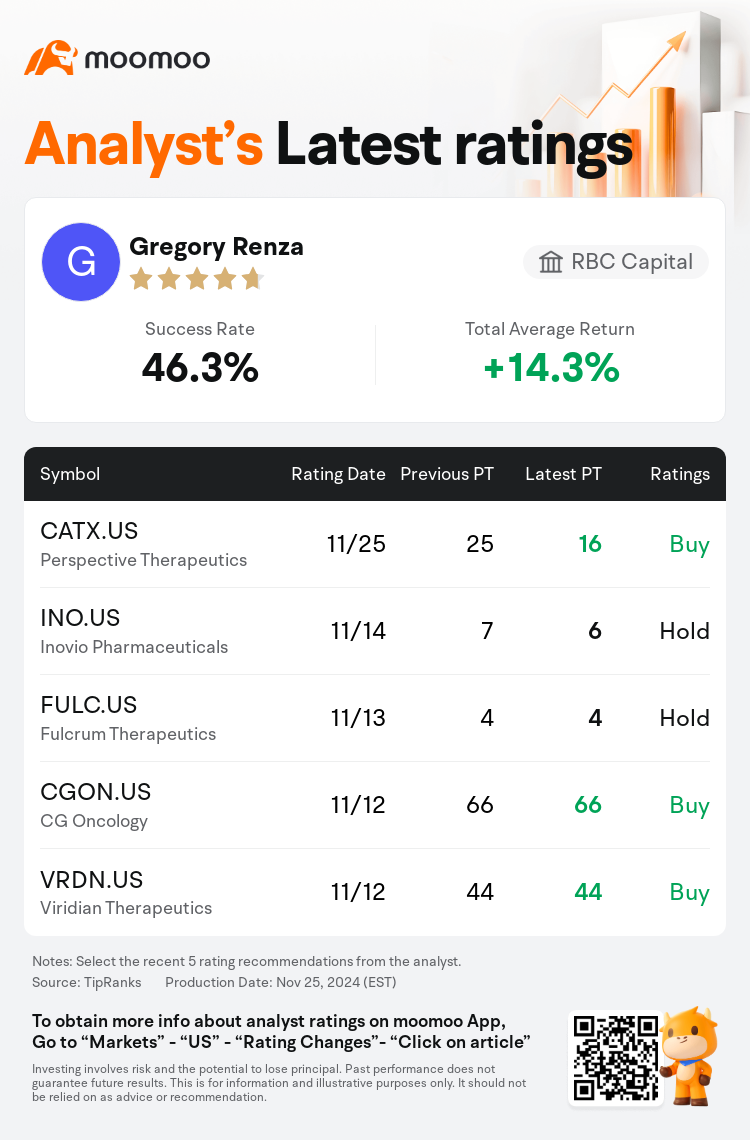

RBC Capital analyst Gregory Renza maintains $Perspective Therapeutics (CATX.US)$ with a buy rating, and adjusts the target price from $25 to $16.

According to TipRanks data, the analyst has a success rate of 46.3% and a total average return of 14.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Perspective Therapeutics (CATX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Perspective Therapeutics (CATX.US)$'s main analysts recently are as follows:

Recent data shared by Perspective Therapeutics for VMT-alpha-NET showed an objective response rate (ORR) that fell short of expectations when compared to rivals. While there is potential for improved outcomes at increased dosage levels, reliable results are not anticipated until late-2025, following the potential FDA approval for advancing the trial to Cohort 3. Furthermore, initial findings for VMT01 in treating melanoma revealed complications related to kidney accumulation, which restricted dosage increments. These issues may continue to impact the company's stock until further studies potentially enhance the data available for VMT01.

Initial data from Cohort 1 and Cohort 2 of VMT-a-NET's phase I/IIa study reveals encouraging signals, alongside a need for patience in dose optimization. There appears to be a path to potential commerciality from Perspective's lead-specific chelator across its pipeline and platform.

The recent selloff in Perspective Therapeutics is seen as an overreaction to the early data from the dose escalation phase of the VMT-alpha-NET program. This data showed clinical activity that corresponds with dose intensity and presented a clean safety profile, which supports further dose escalation. There is a recommendation to consider buying on this weakness, especially with Perspective trading near cash levels.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

加皇資本市場分析師Gregory Renza維持$Perspective Therapeutics (CATX.US)$買入評級,並將目標價從25美元下調至16美元。

根據TipRanks數據顯示,該分析師近一年總勝率為46.3%,總平均回報率為14.3%。

此外,綜合報道,$Perspective Therapeutics (CATX.US)$近期主要分析師觀點如下:

此外,綜合報道,$Perspective Therapeutics (CATX.US)$近期主要分析師觀點如下:

Perspective Therapeutics最近分享的VMT-Alpha-Net數據顯示,與競爭對手相比,客觀反應率(ORR)低於預期。儘管增加劑量水平有可能改善結果,但在美國食品藥品管理局可能批准將該試驗推進到隊列3之後,預計要到2025年底才能獲得可靠的結果。此外,VMT01 治療黑色素瘤的初步發現顯示了與腎臟積累相關的併發症,這限制了劑量增量。這些問題可能會繼續影響公司的股票,直到進一步的研究有可能增強 VMT01 的可用數據。

來自VMT-a-Net的I/IIa期研究隊列1和隊列2的初步數據顯示出令人鼓舞的信號,同時需要耐心進行劑量優化。Perspective的特定鉛螯合劑在其管道和平台上似乎有一條通往潛在商業化的途徑。

Perspective Therapeutics最近的拋售被視爲對VMT-Alpha-Net計劃劑量增加階段的早期數據的過度反應。該數據顯示了與劑量強度相對應的臨床活性,並提供了乾淨的安全性概況,這爲進一步的劑量增加提供了支持。有人建議考慮在這一弱點上買入,尤其是在Perspective交易接近現金水平的情況下。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Perspective Therapeutics (CATX.US)$近期主要分析師觀點如下:

此外,綜合報道,$Perspective Therapeutics (CATX.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of