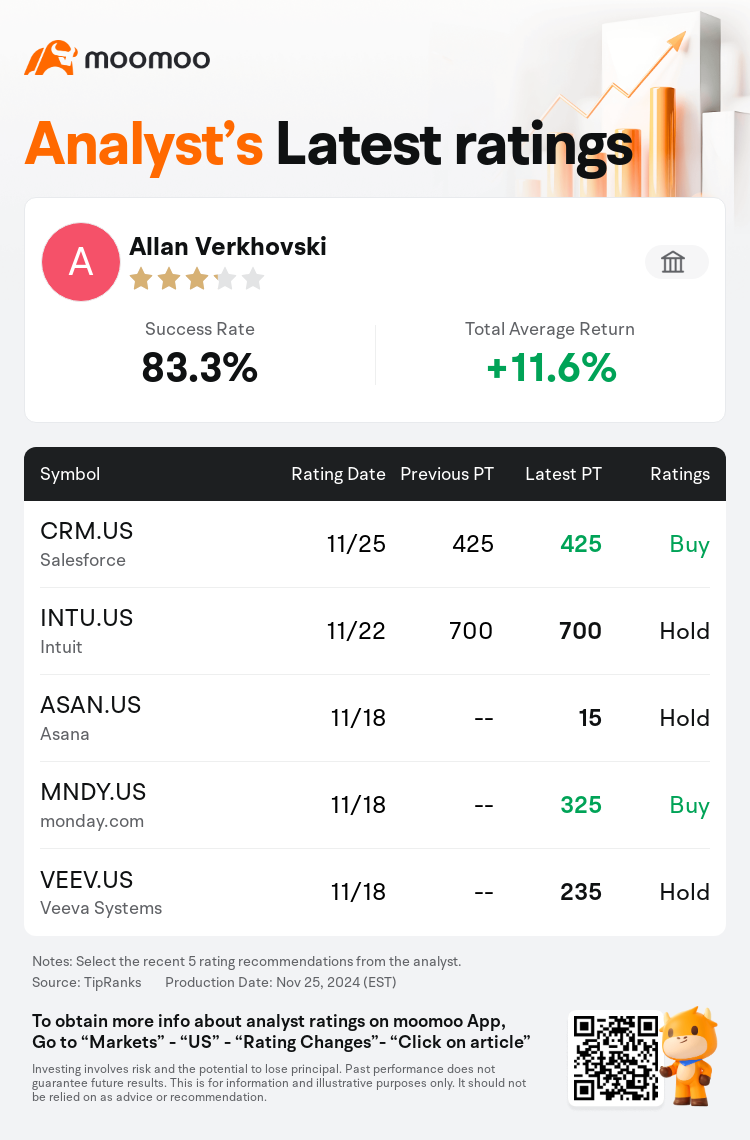

Scotiabank analyst Allan Verkhovski maintains $Salesforce (CRM.US)$ with a buy rating, and maintains the target price at $425.

According to TipRanks data, the analyst has a success rate of 83.3% and a total average return of 11.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

The potential of Salesforce's new Agentforce offering and its capacity to market artificial intelligence agents specifically for customer support tasks have been analyzed, highlighting the broader opportunities within this sector.

The broader software space is poised to significantly benefit from the artificial intelligence revolution, particularly as we approach 2025. Analysts note that the applications for AI are widening, and they expect a major uptake in enterprise use with the introduction of large language models industry-wide. This surge in generative AI adoption is seen as a pivotal growth catalyst for the sector.

Analyst observations indicate optimism regarding Salesforce's early reception around Agentforce and its potential for initiating a robust AI-driven product cycle. However, they maintain a cautious view, suggesting that expectations may be overly ambitious and highlighting the need for patience to observe substantial impacts.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

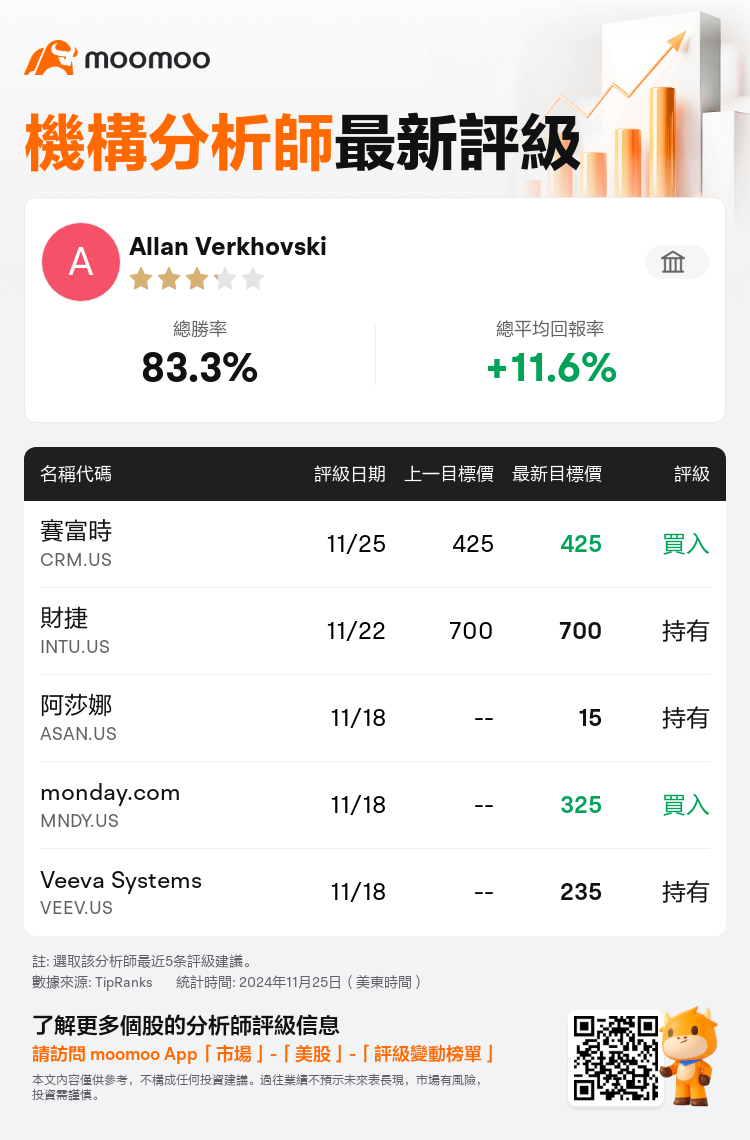

豐業銀行分析師Allan Verkhovski維持$賽富時 (CRM.US)$買入評級,維持目標價425美元。

根據TipRanks數據顯示,該分析師近一年總勝率為83.3%,總平均回報率為11.6%。

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

已經對賽富時的新Agentforce產品及其專門用於客戶支持任務的人工智能代理的營銷潛力進行了分析,突出了該行業板塊內更廣闊的機遇。

更廣泛的軟件領域有望從人工智能革命中獲益,特別是在我們逼近2025年之際。分析師們指出,人工智能的應用正在擴大,並預計隨着大型語言模型在整個行業範圍內的引入,企業使用將大幅增加。這種生成式人工智能採用激增被視爲該行業板塊的關鍵增長催化劑。

分析師觀察表明,關於賽富時早期推出的Agentforce產品及其啓動強大的人工智能驅動產品週期的潛力,市場持樂觀態度。然而,他們保持謹慎觀點,認爲預期可能過於雄心勃勃,並強調需要耐心觀察實質性影響。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of