What to Expect From Icecure Medical's Earnings

What to Expect From Icecure Medical's Earnings

Icecure Medical (NASDAQ:ICCM) will release its quarterly earnings report on Tuesday, 2024-11-26. Here's a brief overview for investors ahead of the announcement.

Icecure醫療(納斯達克: ICCM)將於2024年11月26日星期二發佈季度業績。以下是在公佈之前給投資者的簡要概述。

Analysts anticipate Icecure Medical to report an earnings per share (EPS) of $-0.07.

分析師預計Icecure醫療將報告每股收益(EPS)爲-0.07美元。

The market awaits Icecure Medical's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

市場正在期待Icecure醫療的公告,希望超過預期併爲下個季度提供樂觀的指引。

It's important for new investors to understand that guidance can be a significant driver of stock prices.

新投資者需要明白,指引對股價有重要影響。

Historical Earnings Performance

歷史業績表現

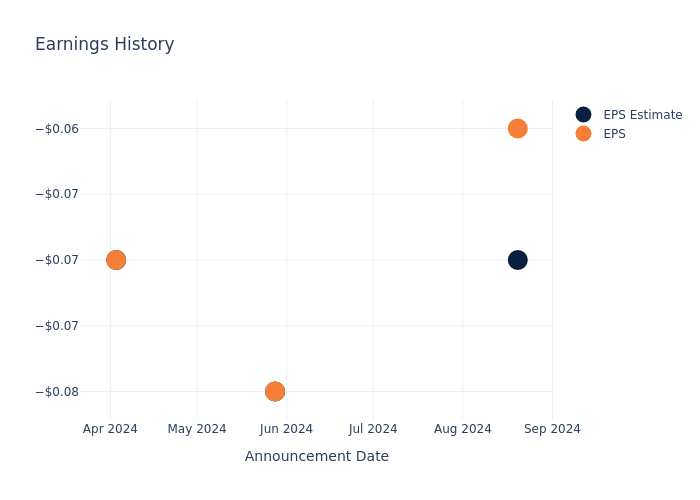

The company's EPS beat by $0.01 in the last quarter, leading to a 0.98% drop in the share price on the following day.

公司上季度每股收益高出0.01美元,導致次日股價下跌了0.98%。

Here's a look at Icecure Medical's past performance and the resulting price change:

讓我們來看一下Icecure醫療的過往表現和導致的股價變動:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.07 | -0.08 | -0.07 | -0.07 |

| EPS Actual | -0.06 | -0.08 | -0.07 | -0.09 |

| Price Change % | -1.0% | -1.0% | 0.0% | -6.0% |

| 季度 | 2024年第二季度 | 2024年第一季度 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| 每股收益預估值 | -0.07 | -0.08 | -0.07 | -0.07 |

| 每股收益實際值 | -0.06 | -0.08 | -0.07 | -0.09 |

| 價格變更% | -1.0% | -1.0% | 0.0% | -6.0% |

Market Performance of Icecure Medical's Stock

Icecure Medical股票的市場表現

Shares of Icecure Medical were trading at $0.7122 as of November 22. Over the last 52-week period, shares are down 39.48%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

截至11月22日,Icecure Medical的股價爲0.7122美元。在過去的52周內,股價下跌了39.48%。鑑於這些回報通常爲負數,長期股東可能會在這次業績發佈前持看淡態度。

To track all earnings releases for Icecure Medical visit their earnings calendar on our site.

要追蹤Icecure Medical的所有業績發佈,請訪問我們網站上的業績日曆。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文是由Benzinga的自動內容引擎生成,並由編輯審核。

It's important for new investors to understand that guidance can be a significant driver of stock prices.

It's important for new investors to understand that guidance can be a significant driver of stock prices.