Market Whales and Their Recent Bets on ABBV Options

Market Whales and Their Recent Bets on ABBV Options

Financial giants have made a conspicuous bearish move on AbbVie. Our analysis of options history for AbbVie (NYSE:ABBV) revealed 13 unusual trades.

金融巨頭在艾伯維公司做出了明顯的看淡舉動。我們對艾伯維公司(紐交所:ABBV)期權歷史進行分析後發現有13筆飛凡的交易。

Delving into the details, we found 38% of traders were bullish, while 53% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $257,880, and 10 were calls, valued at $538,961.

深入細節後,我們發現38%的交易者看好,而53%表現出看淡傾向。在所有我們發現的交易中,有3筆看跌期權,價值257,880美元,而有10筆看漲期權,價值538,961美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $160.0 to $192.5 for AbbVie during the past quarter.

分析這些合約的成交量和未平倉合約,似乎大戶們在過去的一個季度裏一直關注着艾伯維公司的價格區間在160.0至192.5美元之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

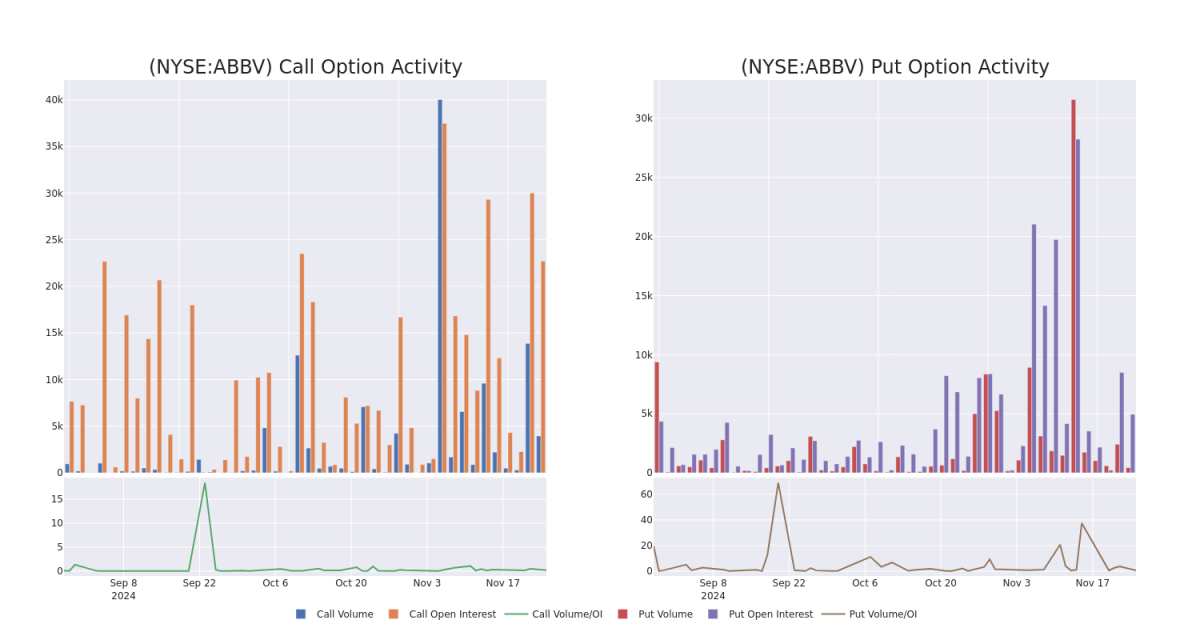

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AbbVie's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AbbVie's significant trades, within a strike price range of $160.0 to $192.5, over the past month.

檢驗成交量和未平倉合約爲股票研究提供了關鍵見解。這些信息對於評估艾伯維公司特定執行價格的期權的流動性和興趣水平至關重要。以下是過去一個月內在160.0至192.5美元執行價格區間內,針對艾伯維公司重要交易的看漲和看跌期權成交量和未平倉合約趨勢的快照。

AbbVie Option Volume And Open Interest Over Last 30 Days

艾伯維期權成交量和未平倉利息過去30天的變化

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | PUT | TRADE | BULLISH | 03/21/25 | $6.55 | $6.3 | $6.3 | $175.00 | $189.0K | 689 | 319 |

| ABBV | CALL | TRADE | BEARISH | 01/17/25 | $14.95 | $14.2 | $14.2 | $165.00 | $142.0K | 4.0K | 107 |

| ABBV | CALL | SWEEP | BEARISH | 01/16/26 | $26.75 | $26.4 | $26.4 | $165.00 | $124.0K | 490 | 47 |

| ABBV | CALL | TRADE | BEARISH | 12/20/24 | $1.92 | $1.78 | $1.8 | $185.00 | $54.0K | 3.6K | 695 |

| ABBV | CALL | SWEEP | BEARISH | 12/20/24 | $3.8 | $3.7 | $3.7 | $180.00 | $36.6K | 4.7K | 328 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | 看跌 | 交易 | BULLISH | 03/21/25 | $6.55 | $6.3 | $6.3 | $175.00 | 189,000美元 | 689 | 319 |

| ABBV | 看漲 | 交易 | 看淡 | 01/17/25 | $14.95 | $14.2 | $14.2 | $165.00 | $142.0K | 4.0K | 107 |

| ABBV | 看漲 | SWEEP | 看淡 | 01/16/26 | 26.75美元 | $26.4 | $26.4 | $165.00 | $124.0K | 490 | 47 |

| ABBV | 看漲 | 交易 | 看淡 | 12/20/24 | $1.92 | $1.78 | $1.8 | $185.00 | $54.0K | 3.6千 | 695 |

| ABBV | 看漲 | SWEEP | 看淡 | 12/20/24 | $3.8 | $3.7 | $3.7 | $180.00 | $36.6千 | 4.7K | 328 |

About AbbVie

關於艾伯維公司

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

AbbVie是一家藥品公司,其在免疫學(包括Humira、Skyrizi和Rinvoq)和腫瘤學(包括Imbruvica和Venclexta)方面擁有強大的業務。該公司於2013年初從Abbott分拆而來。2020年收購雅培使其在美容業務(包括Botox)中新增了一些產品和藥品。

AbbVie's Current Market Status

AbbVie當前市場狀況

- With a trading volume of 3,563,685, the price of ABBV is up by 0.2%, reaching $177.31.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 67 days from now.

- 艾伯維公司的交易量爲3563685,股票價格上漲0.2%,達到177.31美元。

- 目前的RSI值表明該股票目前處於超買和超賣之間的中立狀態。

- 下一次盈利報告將於67天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AbbVie with Benzinga Pro for real-time alerts.

期權交易涉及更大的風險,但也提供了更高利潤的潛力。精明的交易員通過持續的教育、戰略交易調整、利用各種因子,並保持對市場動態的敏銳感來減輕這些風險。通過Benzinga Pro保持最新的艾伯維公司期權交易,即時獲得警報。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AbbVie's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AbbVie's significant trades, within a strike price range of $160.0 to $192.5, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AbbVie's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AbbVie's significant trades, within a strike price range of $160.0 to $192.5, over the past month.