Unpacking the Latest Options Trading Trends in Nike

Unpacking the Latest Options Trading Trends in Nike

Whales with a lot of money to spend have taken a noticeably bearish stance on Nike.

資金雄厚的大戶對耐克採取了明顯的看淡態度。

Looking at options history for Nike (NYSE:NKE) we detected 45 trades.

查看耐克(紐交所:NKE)的期權交易歷史,我們檢測到45筆交易。

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 46% with bearish.

如果我們考慮每筆交易的具體情況,準確地說有42%的投資者帶着看漲期望開展交易,而有46%的投資者帶着看淡期望。

From the overall spotted trades, 10 are puts, for a total amount of $577,519 and 35, calls, for a total amount of $2,225,357.

從總體上看,我們發現10筆買入,總金額爲$577,519,35筆看漲,總金額爲$2,225,357。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $47.5 to $155.0 for Nike over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,似乎鯨魚們已經在過去3個月內將目標價區間定在了$47.5到$155.0之間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

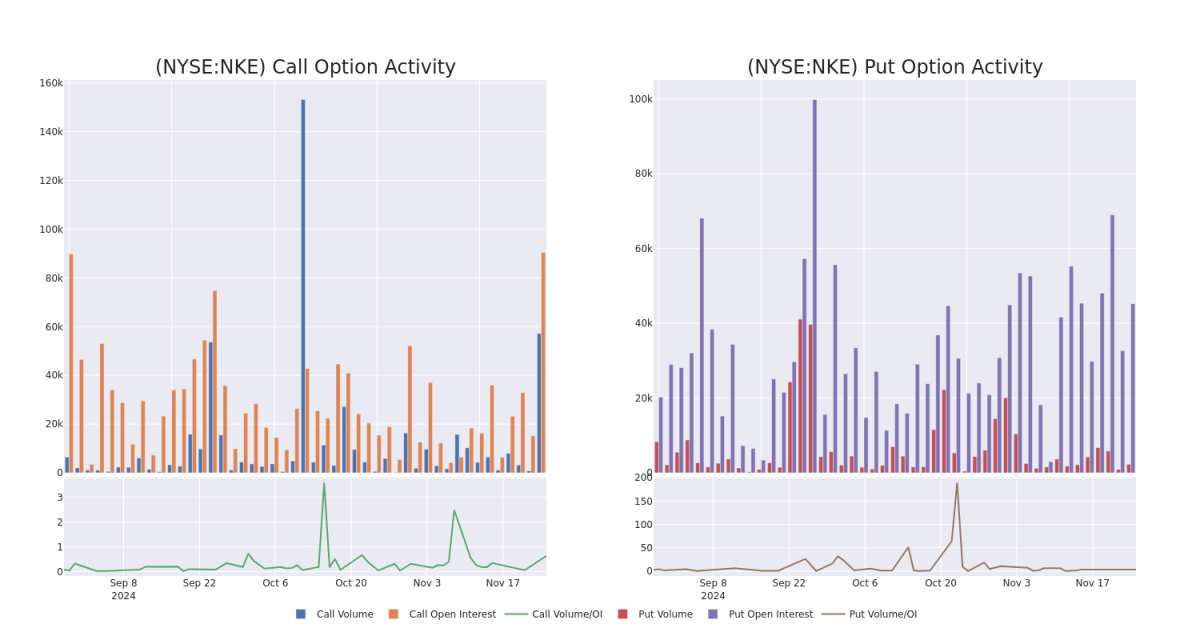

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Nike's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nike's whale trades within a strike price range from $47.5 to $155.0 in the last 30 days.

觀察交易期權時查看成交量和未平倉合約量是一個強有力的舉措。這些數據可以幫助您跟蹤耐克某個行權價對應的期權的流動性和興趣。在下文中,我們可以觀察過去30天內所有在$47.5到$155.0行權價範圍內的耐克鯨魚交易的看漲和看跌成交量和未平倉合約量的變化。

Nike 30-Day Option Volume & Interest Snapshot

Nike 30日期權成交量和持倉量快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | CALL | SWEEP | BEARISH | 07/18/25 | $8.55 | $8.35 | $8.35 | $80.00 | $221.2K | 206 | 271 |

| NKE | CALL | SWEEP | BULLISH | 12/18/26 | $8.45 | $8.2 | $8.45 | $100.00 | $169.0K | 5.6K | 907 |

| NKE | CALL | TRADE | BEARISH | 01/16/26 | $2.58 | $2.48 | $2.52 | $115.00 | $125.7K | 2.4K | 502 |

| NKE | PUT | TRADE | BEARISH | 01/15/27 | $7.75 | $7.65 | $7.75 | $70.00 | $105.4K | 403 | 147 |

| NKE | CALL | SWEEP | BEARISH | 12/20/24 | $4.2 | $4.15 | $4.15 | $78.00 | $103.7K | 635 | 331 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 耐克 | 看漲 | SWEEP | 看淡 | 07/18/25 | $8.55 | $8.35 | $8.35 | $80.00 | 221.2K美元 | 206 | 271 |

| 耐克 | 看漲 | SWEEP | BULLISH | 12/18/26 | $8.45 | $8.2 | $8.45 | $100.00 | $169.0K | 5.6千 | 907 |

| 耐克 | 看漲 | 交易 | 看淡 | 01/16/26 | $2.58 | $2.48 | $2.52 | $115.00 | $125.7K | 2.4K | 502 |

| 耐克 | 看跌 | 交易 | 看淡 | 01/15/27 | $7.75 | $7.65 | $7.75 | $70.00 | $105.4K | 403 | 147 |

| 耐克 | 看漲 | SWEEP | 看淡 | 12/20/24 | $4.2 | $4.15 | $4.15 | $78.00 | $103.7K | 635 | 331 |

About Nike

關於耐克

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

耐克是世界上最大的運動鞋和服裝品牌。主要類別包括籃球,跑步和足球(足球)。鞋類銷售佔據其銷售額的三分之二左右。其品牌包括耐克,喬丹(高檔的運動鞋和服裝)和匡威(休閒鞋類)。耐克通過公司所有的店鋪,特許經營店和第三方零售商在全球銷售產品。該公司還在40多個國家和地區運營電子商務平台。幾乎所有產品都由30多個國家的代工廠商代工生產。耐克成立於1964年,總部位於俄勒岡州比弗頓。

Where Is Nike Standing Right Now?

耐克現在處於什麼位置?

- With a trading volume of 10,629,515, the price of NKE is up by 1.12%, reaching $78.27.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 24 days from now.

- 耐克的交易量爲10,629,515,價格上漲了1.12%,達到78.27美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一次的營收報告計劃在24天后發佈。

What Analysts Are Saying About Nike

關於耐克,分析師們的看法

3 market experts have recently issued ratings for this stock, with a consensus target price of $79.0.

3位市場專家最近對這支股票發表了評級意見,一致的目標價爲79.0美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from TD Cowen has decided to maintain their Hold rating on Nike, which currently sits at a price target of $73. * An analyst from Needham downgraded its action to Buy with a price target of $84. * Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on Nike with a target price of $80.

Benzinga Edge的期權異動板塊能在市場變動發生前識別潛在走勢。了解大資金對您喜愛的股票的持倉。點擊這裏獲取.* 來自TD Cowen的分析師決定維持對耐克的持有評級,目標價爲73美元。* Needham的分析師將其評級下調爲買入,目標價爲84美元。* RBC Capital的分析師保持對耐克的板塊表現評級,並且目標價爲80美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nike with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易員通過持續的教育、戰略性的交易調整、利用各種因子以及保持對市場動態的敏感來減輕這些風險。通過Benzinga Pro實時提醒跟蹤耐克的最新期權交易。

From the overall spotted trades, 10 are puts, for a total amount of $577,519 and 35, calls, for a total amount of $2,225,357.

From the overall spotted trades, 10 are puts, for a total amount of $577,519 and 35, calls, for a total amount of $2,225,357.