Investors Still Aren't Entirely Convinced By Astec Industries, Inc.'s (NASDAQ:ASTE) Revenues Despite 25% Price Jump

Investors Still Aren't Entirely Convinced By Astec Industries, Inc.'s (NASDAQ:ASTE) Revenues Despite 25% Price Jump

Astec Industries, Inc. (NASDAQ:ASTE) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

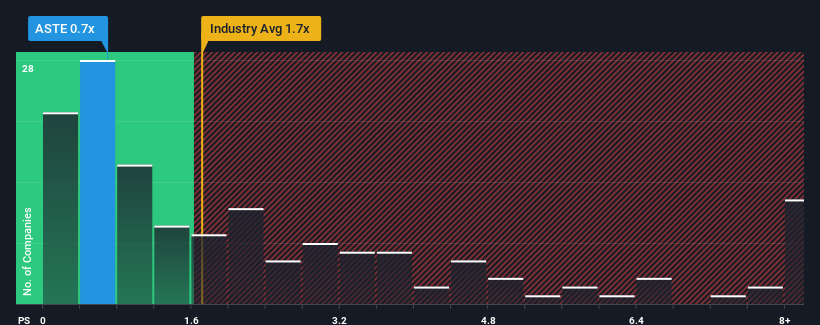

In spite of the firm bounce in price, Astec Industries' price-to-sales (or "P/S") ratio of 0.7x might still make it look like a buy right now compared to the Machinery industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Astec Industries' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Astec Industries' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Astec Industries.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Astec Industries would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Astec Industries would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.0%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 20% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 4.6% during the coming year according to the only analyst following the company. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 0.3%.

With this in consideration, we find it intriguing that Astec Industries' P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Astec Industries' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Astec Industries currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Astec Industries with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Astec Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.