Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio In November

Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio In November

The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

通信服務板塊中超賣次數最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,RSI接近或低於30。

Cumulus Media Inc (NASDAQ:CMLS)

Cumulus Media Inc(納斯達克股票代碼:CMLS)

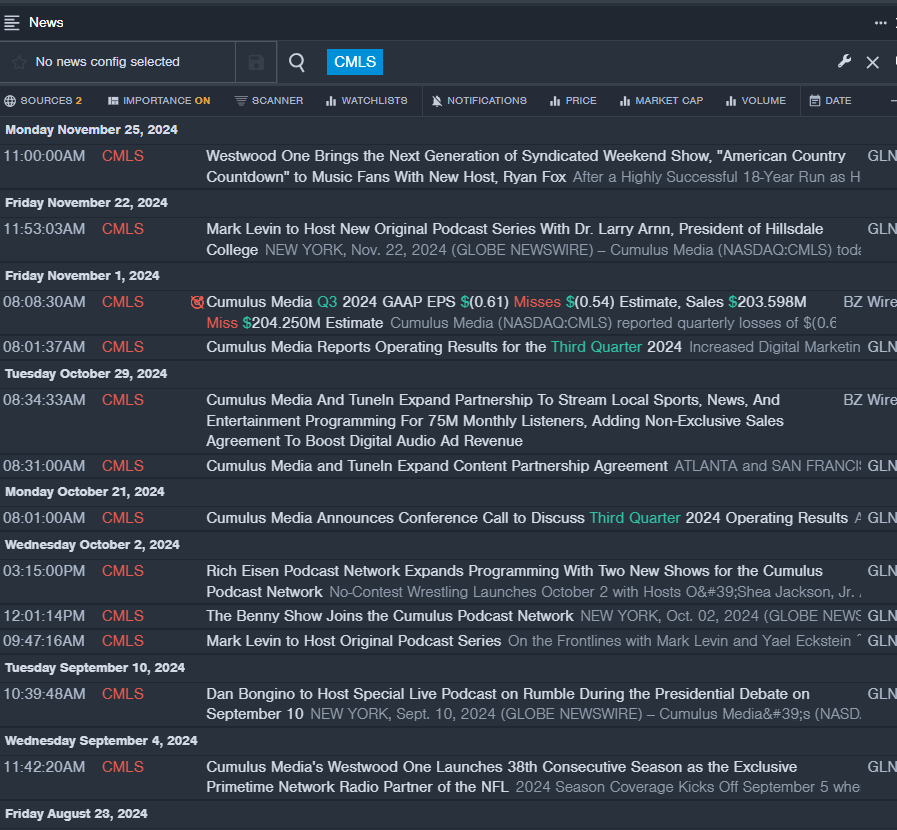

- On Nov. 1, Cumulus Media posted worse-than-expected third-quarter results. Mary G. Berner, President and Chief Executive Officer of Cumulus Media, said, "During the third quarter, we delivered revenue and EBITDA in-line with pacing commentary and analyst estimates. Given the market challenges, we maintained our focus on what we can control. Specifically, we continued investing to drive growth in our digital businesses, including in digital marketing services which increased revenue nearly 40% in the quarter; capitalizing on areas of improvement in national and political ad spending; maximizing operating cash flow; and improving operating leverage through ongoing expense reductions." The company's stock fell around 42% over the past month and has a 52-week low of $0.70.

- RSI Value: 25.88

- CMLS Price Action: Shares of Cumulus Media fell 3.3% to close at $0.70 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest CMLS news.

- 11月1日,Cumulus Media公佈的第三季度業績低於預期。Cumulus Media總裁兼首席執行官瑪麗·伯納表示:「在第三季度,我們的收入和息稅折舊攤銷前利潤與節奏評論和分析師的估計一致。鑑於市場挑戰,我們將重點放在我們可以控制的範圍上。具體而言,我們繼續投資以推動數字業務的增長,包括數字營銷服務,該服務的收入在本季度增加了近40%;利用國家和政治廣告支出的改善領域;最大限度地提高運營現金流;通過持續削減支出來提高運營槓桿率。」該公司的股票在過去一個月中下跌了約42%,跌至52周低點0.70美元。

- RSI 值:25.88

- CMLS價格走勢:週一,Cumulus Media的股價下跌3.3%,收於0.70美元。

- Benzinga Pro的實時新聞提醒了CMLS的最新消息。

Beasley Broadcast Group Inc (NASDAQ:BBGI)

比斯利廣播集團公司(納斯達克股票代碼:BBGI)

- On Nov. 5, Beasley Broadcast Group reported a quarterly loss of $2.33 per share. Caroline Beasley, Chief Executive Officer, said, "Beasley delivered third quarter net revenue of $58.2 million and same-station revenue growth of 0.5%, driven by strong political advertising revenue and a 11.7% increase in same-station digital revenue. The ongoing success of our digital transformation strategy continues to serve as an important offset to continued challenges in the audio advertising spot market." The company's stock fell around 31% over the past month and has a 52-week low of $7.66.

- RSI Value: 23.76

- BBGI Price Action: Shares of Beasley Broadcast jumped 11.7% to close at $9.25 on Monday.

- Benzinga Pro's charting tool helped identify the trend in BBGI stock.

- 11月5日,比斯利廣播集團公佈每股2.33美元的季度虧損。首席執行官卡羅琳·比斯利表示:「受強勁的政治廣告收入和同站數字收入增長11.7%的推動,比斯利第三季度淨收入爲5,820萬美元,同站收入增長0.5%。我們數字化轉型戰略的持續成功仍然是抵消音頻廣告現貨市場持續挑戰的重要手段。」該公司的股票在過去一個月中下跌了約31%,跌至52周低點7.66美元。

- RSI 值:23.76

- BBGI價格走勢:週一,比斯利廣播的股價上漲了11.7%,收於9.25美元。

- Benzinga Pro的圖表工具幫助確定了BBGI股票的走勢。

Asset Entities Inc (NASDAQ:ASST)

資產實體公司(納斯達克股票代碼:ASST)

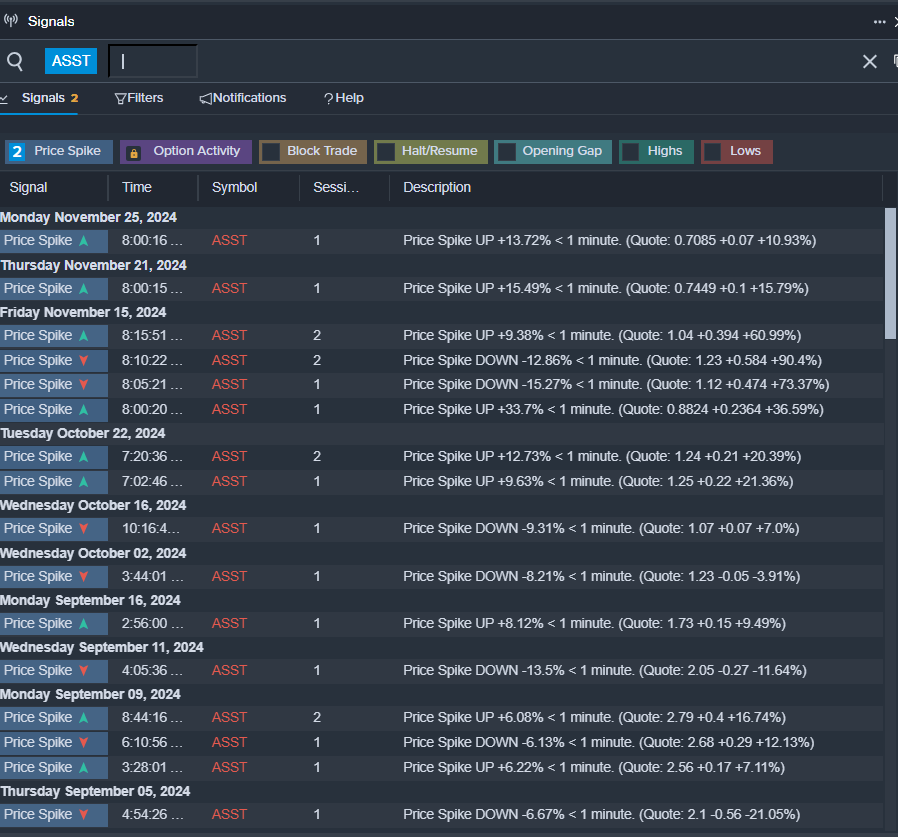

- On Nov. 15, Asset Entities reported third-quarter revenues of $202,921, representing a year-over-year increase from $60,135. "We are thrilled to see the strong year-over-year growth in revenue, with our recent strategic acquisitions and partnerships," stated CEO Arshia Sarkhani. "We are optimistic for what's ahead, as we continue executing strategic acquisitions, growth initiatives, and further collaborations and partnerships." The company's stock fell around 37% over the past month and has a 52-week low of $0.51.

- RSI Value: 24.21

- ASST Price Action: Shares of Asset Entities fell 9.9% to close at $0.58 on Monday.

- Benzinga Pro's signals feature notified of a potential breakout in ASST shares.

- 11月15日,資產實體公佈的第三季度收入爲202,921美元,較60,135美元同比增長。首席執行官阿希亞·薩哈尼表示:「通過我們最近的戰略收購和合作夥伴關係,我們很高興看到收入同比強勁增長。」「隨着我們繼續執行戰略收購、增長計劃以及進一步的合作和合作夥伴關係,我們對未來持樂觀態度。」該公司的股票在過去一個月中下跌了約37%,跌至52周低點0.51美元。

- RSI 值:24.21

- 資產價格走勢:週一,資產實體股價下跌9.9%,收於0.58美元。

- Benzinga Pro的信號功能被告知澳大利亞證券交易所股票可能出現突破。

Read This Next:

接下來閱讀這篇文章:

- Jim Cramer Says This Stock Is A Bitcoin Play And He Prefers To Own Bitcoin

- 吉姆·克萊默說這隻股票是比特幣遊戲,他更喜歡擁有比特幣