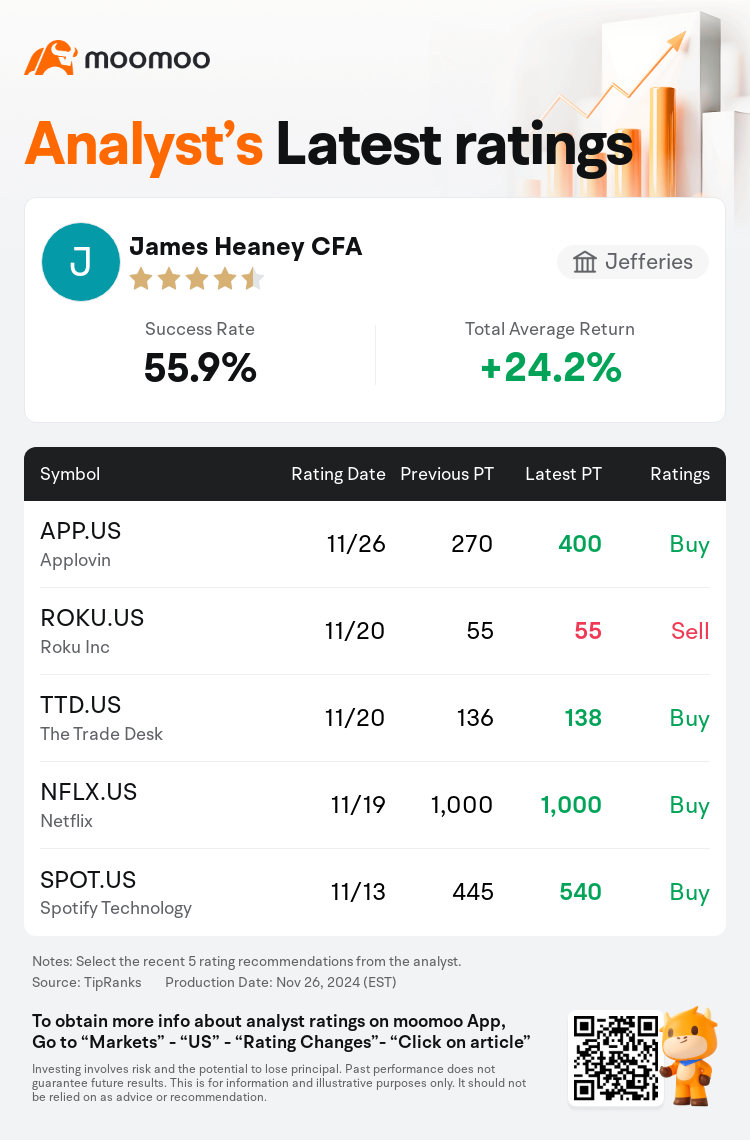

Jefferies analyst James Heaney CFA maintains $Applovin (APP.US)$ with a buy rating, and adjusts the target price from $270 to $400.

According to TipRanks data, the analyst has a success rate of 55.9% and a total average return of 24.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Applovin (APP.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Applovin (APP.US)$'s main analysts recently are as follows:

The upward adjustment in forecasts for AppLovin stems from several positive developments. These include a more diversified investor base following the company's third-quarter earnings report, the stock's inclusion in the Nasdaq 100 index, a shift towards an entirely unsecured debt capital structure, and an upgrade to investment grade status.

Positive findings on AppLovin's e-commerce product tests, particularly a notable one with a major agency, has bolstered confidence, leading to an increase in ad revenue projections from FY24 to FY28. Despite being in its initial stages, the product has demonstrated a significant return on ad spend comparable to major industry players. The performance has impressed key agencies, with expectations that budget allocations may highly favor AppLovin going forward.

Following discussions with experts involved in the company's e-commerce pilot, favorable initial feedback and metrics were reported from both agency and direct-to-consumer brand perspectives, noting returns on ad spend comparable to those of Meta. Recent stock performance and escalating momentum within the e-commerce sector are anticipated to generate multiple advantageous cycles for the stock and its business trajectory through 2025. The company is considered a leading choice within its coverage.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

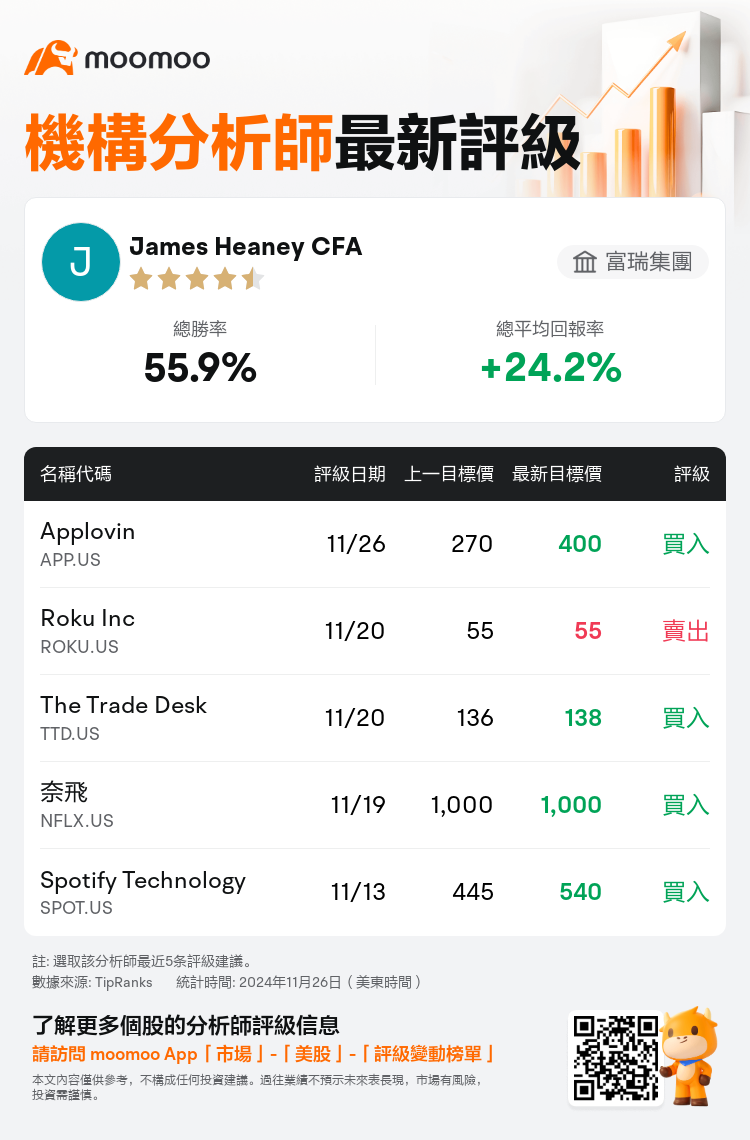

富瑞集團分析師James Heaney CFA維持$Applovin (APP.US)$買入評級,並將目標價從270美元上調至400美元。

根據TipRanks數據顯示,該分析師近一年總勝率為55.9%,總平均回報率為24.2%。

此外,綜合報道,$Applovin (APP.US)$近期主要分析師觀點如下:

此外,綜合報道,$Applovin (APP.US)$近期主要分析師觀點如下:

AppLovin預測的上調源於幾項積極的進展。其中包括繼公司發佈第三季度業績後更加多元化的投資者基礎,該股被納入納斯達克100指數,向完全無抵押債務資本結構的轉變,以及投資級別的升級。

AppLovin電子商務產品測試的積極發現,尤其是大型機構的一項值得注意的調查結果,增強了信心,導致24財年至28財年的廣告收入預測有所增加。儘管處於起步階段,但該產品的廣告支出回報率與主要行業參與者相當。業績給主要機構留下了深刻的印象,他們預計未來預算分配可能會對AppLovin產生很大幫助。

在與參與公司電子商務試點的專家進行討論後,從代理商和直接面向消費者的品牌角度來看,都報告了良好的初步反饋和指標,指出廣告支出回報與 Meta 相當。預計到2025年,最近的股票表現和電子商務行業不斷增強的勢頭將爲該股及其業務軌跡帶來多個優勢週期。該公司被認爲是其保險範圍內的主要選擇。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Applovin (APP.US)$近期主要分析師觀點如下:

此外,綜合報道,$Applovin (APP.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of