Unpacking the Latest Options Trading Trends in Workday

Unpacking the Latest Options Trading Trends in Workday

Financial giants have made a conspicuous bullish move on Workday. Our analysis of options history for Workday (NASDAQ:WDAY) revealed 27 unusual trades.

金融巨頭在Workday上進行了明顯的看好操作。我們對Workday (納斯達克:WDAY) 的期權歷史進行分析發現了27筆異常交易。

Delving into the details, we found 55% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $211,870, and 22 were calls, valued at $1,666,111.

深入細節後,我們發現55%的交易者看漲,而37%顯示看淡傾向。我們發現所有交易中,有5筆爲看跌期權,價值爲$211,870,而有22筆爲看漲期權,價值爲$1,666,111。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $210.0 to $310.0 for Workday during the past quarter.

分析這些合約的成交量和未平倉量,似乎大玩家一直在關注Workday在過去一個季度內的一個價格區間,即$210.0至$310.0。

Volume & Open Interest Trends

成交量和未平倉量趨勢

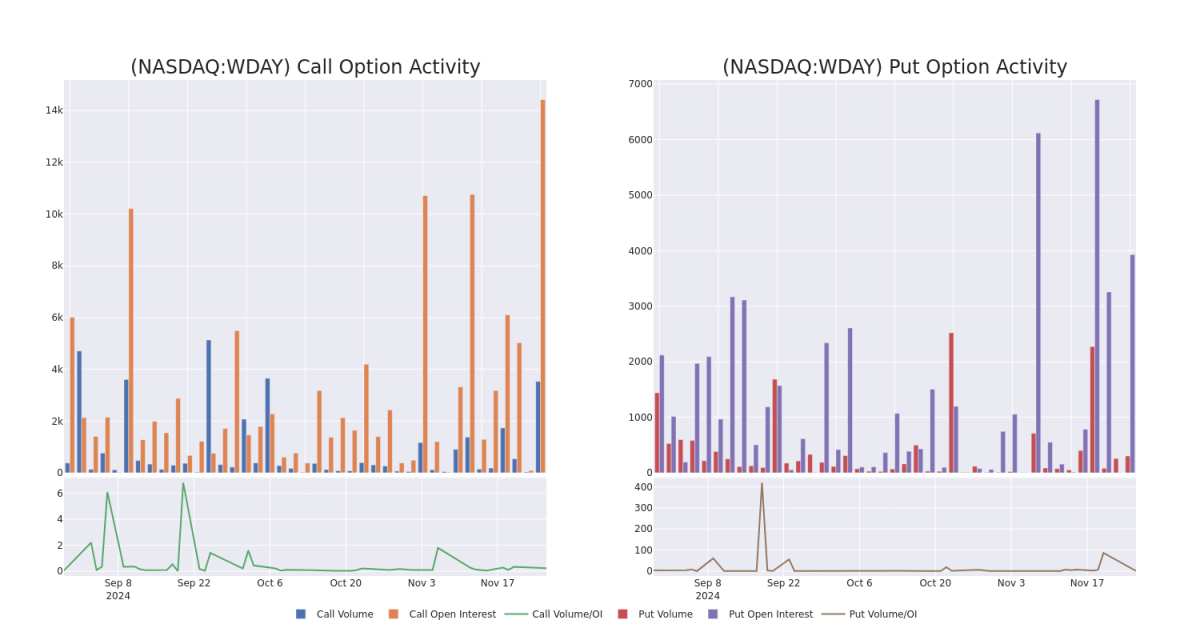

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Workday's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Workday's whale trades within a strike price range from $210.0 to $310.0 in the last 30 days.

在交易期權時,關注成交量和未平倉量是非常有效的舉措。這些數據可以幫助您追蹤Workday特定行權價格的期權的流動性和關注度。接下來,我們可以觀察過去30天內所有Workday鯨魚交易的看漲和看跌期權的成交量和未平倉量的演變,這些交易的行權價格範圍爲$210.0至$310.0。

Workday Option Activity Analysis: Last 30 Days

Workday期權活動分析:過去30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | CALL | TRADE | BULLISH | 03/21/25 | $30.3 | $29.6 | $30.19 | $260.00 | $301.9K | 1.1K | 102 |

| WDAY | CALL | TRADE | BEARISH | 12/20/24 | $12.3 | $11.9 | $12.0 | $277.50 | $240.0K | 15 | 201 |

| WDAY | CALL | TRADE | BULLISH | 01/17/25 | $17.7 | $17.4 | $17.8 | $270.00 | $178.0K | 769 | 141 |

| WDAY | CALL | SWEEP | BEARISH | 11/29/24 | $19.0 | $18.2 | $18.39 | $257.50 | $146.7K | 94 | 80 |

| WDAY | CALL | SWEEP | NEUTRAL | 11/29/24 | $5.3 | $5.2 | $5.2 | $290.00 | $88.5K | 1.2K | 215 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | 看漲 | 交易 | BULLISH | 03/21/25 | $30.3 | $29.6 | $30.19 | $260.00 | 301.9千美元 | 1.1K | 102 |

| WDAY | 看漲 | 交易 | 看淡 | 12/20/24 | $12.3 | $11.9 | $12.0 | $277.50 | $240.0K | 15 | 201 |

| WDAY | 看漲 | 交易 | BULLISH | 01/17/25 | $17.7 | $17.4 | $17.8 | $270.00 | $178.0K | 769 | 141 |

| WDAY | 看漲 | SWEEP | 看淡 | 11/29/24 | $19.0 | $18.2 | $18.39 | $257.50 | $146.7K | 94 | 80 |

| WDAY | 看漲 | SWEEP | 中立 | 11/29/24 | $5.3 | $5.2 | $5.2 | $290.00 | $88.5K | 1.2K | 215 |

About Workday

關於Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Workday是一家提供人力資本管理、財務管理和業務規劃解決方案的軟件公司。Workday以雲計算軟件提供商而聞名,總部位於加利福尼亞州普萊森頓。該公司成立於2005年,現有員工超過18,000人。

Having examined the options trading patterns of Workday, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過對Workday期權交易模式的研究,我們現在將直接關注該公司。這個轉變使我們能夠深入了解該公司目前的市場地位和表現。

Current Position of Workday

Workday的當前位置

- Trading volume stands at 1,278,315, with WDAY's price up by 1.17%, positioned at $270.83.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 0 days.

- 交易量爲1,278,315,WDAY的價格上漲1.17%,位於270.83美元。

- RSI指示股票可能已超買。

- 預計在0天內公佈收益報告。

What The Experts Say On Workday

關於Workday,專家怎麼說

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $303.3333333333333.

在過去的一個月裏,有3位行業分析師分享了對這支股票的見解,提出了平均目標價爲303.3333333333333美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Needham downgraded its action to Buy with a price target of $300. * In a cautious move, an analyst from Scotiabank downgraded its rating to Sector Outperform, setting a price target of $340. * An analyst from Loop Capital persists with their Hold rating on Workday, maintaining a target price of $270.

Benzinga Edge的期權異動板塊可以提前發現潛在的市場變動。了解大資金正在對您喜愛的股票採取何種立場。單擊此處獲取詳細信息。* Needham的分析師將其操作降級爲買入,並設定價格目標爲300美元。* Scotiabank的分析師爲謹慎起見,將其評級下調爲板塊表現優異,設定價格目標爲340美元。* Loop Capital的分析師堅持對Workday的持有評級,維持目標價爲270美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Workday with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易者通過持續教育、戰略交易調整、利用各種指標並緊跟市場動態來化解這些風險。通過Benzinga Pro實時警報,及時了解Workday的最新期權交易。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Workday's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Workday's whale trades within a strike price range from $210.0 to $310.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Workday's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Workday's whale trades within a strike price range from $210.0 to $310.0 in the last 30 days.