Unpacking the Latest Options Trading Trends in Intuitive Surgical

Unpacking the Latest Options Trading Trends in Intuitive Surgical

Whales with a lot of money to spend have taken a noticeably bullish stance on Intuitive Surgical.

擁有大量資金的鯨魚們對直覺外科公司採取了明顯的看好態度。

Looking at options history for Intuitive Surgical (NASDAQ:ISRG) we detected 11 trades.

查看直覺外科公司(納斯達克:ISRG)的期權歷史,我們發現了11筆交易。

If we consider the specifics of each trade, it is accurate to state that 54% of the investors opened trades with bullish expectations and 9% with bearish.

如果考慮每筆交易的具體情況,可以準確地說,54%的投資者以看好的預期開倉,9%的投資者則是看淡。

From the overall spotted trades, 2 are puts, for a total amount of $77,900 and 9, calls, for a total amount of $448,950.

在所有觀察到的交易中,有2筆看跌期權,總金額爲77,900美元,和9筆看漲期權,總金額爲448,950美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $240.0 and $560.0 for Intuitive Surgical, spanning the last three months.

在評估交易量和未平倉合約後,可以明顯看出主要市場參與者正在關注直覺外科公司價格區間在240.0美元到560.0美元之間,持續了過去三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

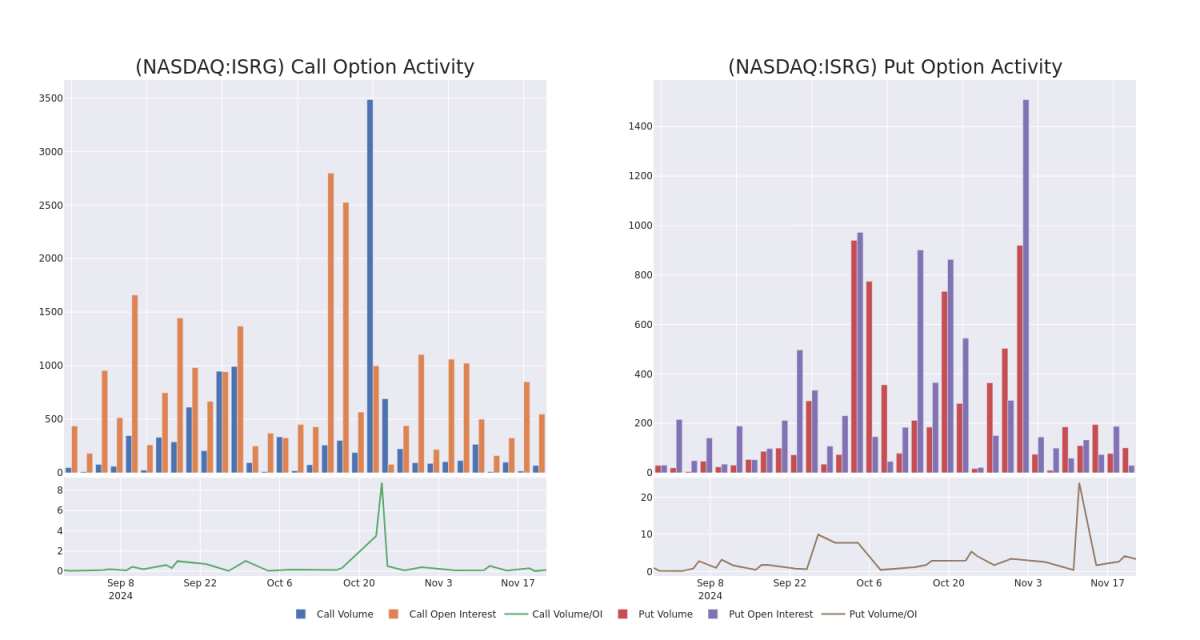

In terms of liquidity and interest, the mean open interest for Intuitive Surgical options trades today is 157.75 with a total volume of 182.00.

在流動性和關注度方面,今天直覺外科公司的期權交易的平均未平倉合約爲157.75,總成交量爲182.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Intuitive Surgical's big money trades within a strike price range of $240.0 to $560.0 over the last 30 days.

在以下圖表中,我們可以跟蹤在過去30天內,直覺外科公司的大手交易在$240.0到$560.0的行使價格區間內,買權和賣權的成交量及未平倉合約的變化情況。

Intuitive Surgical Option Activity Analysis: Last 30 Days

Intuitive Surgical期權活動分析:過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | CALL | SWEEP | NEUTRAL | 01/17/25 | $21.3 | $19.6 | $19.7 | $550.00 | $78.8K | 575 | 54 |

| ISRG | CALL | SWEEP | BULLISH | 06/20/25 | $65.0 | $60.7 | $65.0 | $520.00 | $65.0K | 173 | 10 |

| ISRG | CALL | TRADE | NEUTRAL | 06/20/25 | $64.9 | $61.4 | $63.0 | $520.00 | $63.0K | 173 | 20 |

| ISRG | CALL | TRADE | NEUTRAL | 01/17/25 | $305.0 | $300.7 | $302.7 | $240.00 | $60.5K | 52 | 2 |

| ISRG | CALL | TRADE | BULLISH | 03/21/25 | $28.8 | $27.6 | $28.8 | $560.00 | $57.6K | 140 | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | 看漲 | SWEEP | 中立 | 01/17/25 | $21.3 | $19.6 | $19.7 | $550.00 | $78.8K | 575 | 54 |

| ISRG | 看漲 | SWEEP | BULLISH | 06/20/25 | $65.0 | $60.7 | $65.0 | $520.00 | $65.0K | 173 | 10 |

| ISRG | 看漲 | 交易 | 中立 | 06/20/25 | $64.9 | $61.4 | $63.0 | $520.00 | $63.0K | 173 | 20 |

| ISRG | 看漲 | 交易 | 中立 | 01/17/25 | $305.0 | $300.7 | $302.7 | $240.00 | 60.5K美元 | 52 | 2 |

| ISRG | 看漲 | 交易 | BULLISH | 03/21/25 | $28.8 | $27.6 | $28.8 | $560.00 | $57.6K | 140 | 20 |

About Intuitive Surgical

關於Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Intuitive Surgical開發,生產和營銷用於輔助微創外科手術的機器人系統。它還提供系統的儀器,一次性配件和保修服務。該公司在全球各地的醫院放置了超過8600個da Vinci系統,其中美國安裝超過5000個,在新興市場數量正在增長。

Following our analysis of the options activities associated with Intuitive Surgical, we pivot to a closer look at the company's own performance.

在分析與Intuitive Surgical相關的期權活動之後,我們轉向更近距離地關注該公司的業績。

Present Market Standing of Intuitive Surgical

Intuitive Surgical目前的市場地位

- With a trading volume of 478,667, the price of ISRG is up by 0.66%, reaching $540.1.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 56 days from now.

- ISRG的成交量爲478,667,股價上漲0.66%,達到540.1美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一份盈利報告將在56天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

From the overall spotted trades, 2 are puts, for a total amount of $77,900 and 9, calls, for a total amount of $448,950.

From the overall spotted trades, 2 are puts, for a total amount of $77,900 and 9, calls, for a total amount of $448,950.