Shenzhen Colibri Technologies (SZSE:002957) Sheds CN¥560m, Company Earnings and Investor Returns Have Been Trending Downwards for Past Five Years

Shenzhen Colibri Technologies (SZSE:002957) Sheds CN¥560m, Company Earnings and Investor Returns Have Been Trending Downwards for Past Five Years

Shenzhen Colibri Technologies Co., Ltd. (SZSE:002957) shareholders should be happy to see the share price up 24% in the last quarter. But over the last half decade, the stock has not performed well. After all, the share price is down 51% in that time, significantly under-performing the market.

科瑞技術有限公司(深圳證券交易所代碼:002957)的股東應該很高興看到股價在上一季度上漲了24%。然而,在過去的五年中,這隻股票表現不佳。畢竟,該股價在此期間下跌了51%,明顯低於市場表現。

After losing 8.0% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

在過去一週損失了8.0%後,值得調查公司的基本面,以看看我們可以從過去的表現中推斷出什麼。

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

用本傑明·格雷厄姆的話說:在短期內,市場是一個投票機,但在長期內,它是一個稱重機。檢查市場情緒如何隨時間變化的一種方法是觀察公司股價與每股收益(EPS)之間的相互關係。

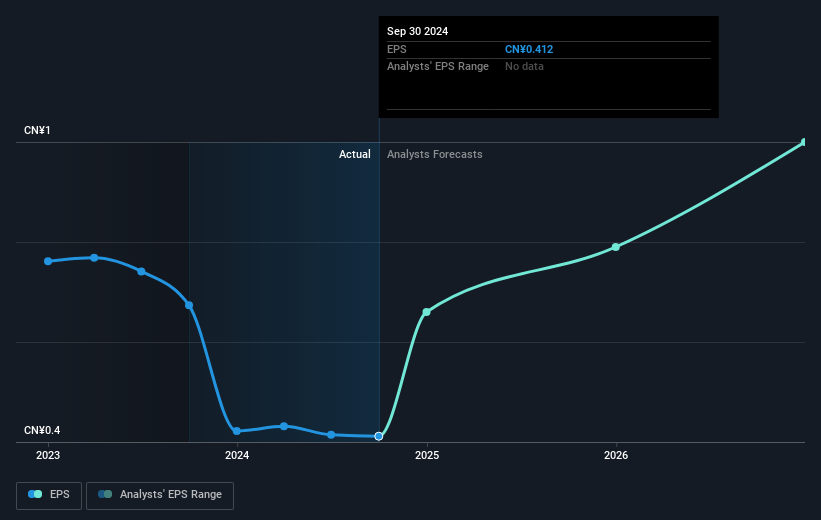

Looking back five years, both Shenzhen Colibri Technologies' share price and EPS declined; the latter at a rate of 10% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 13% per year, over the period. So it seems the market was too confident about the business, in the past.

回顧過去五年,科瑞技術的股價和每股收益均有所下降;後者的年降幅爲10%。讀者應注意,股價在此期間以每年13%的速度下跌,速度快於每股收益。因此,看起來市場過於自信於這項業務,這在過去顯而易見。

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

公司的每股收益(隨時間)如下圖所示(點擊查看確切數字)。

It might be well worthwhile taking a look at our free report on Shenzhen Colibri Technologies' earnings, revenue and cash flow.

免費查看關於科瑞技術盈利、營業收入和現金流的報告可能會非常值得一看。

What About Dividends?

關於分紅派息的問題

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Shenzhen Colibri Technologies, it has a TSR of -48% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

除了衡量股價回報,投資者還應考慮總股東回報(TSR)。股價回報僅反映股價的變化,而TSR還包括分紅的價值(假設已被再投資)以及任何折扣資本籌集或分拆的收益。可以說,TSR爲支付分紅的股票提供了更完整的圖景。在科瑞技術的案例中,其在過去5年的TSR爲-48%。這超過了我們之前提到的股價回報。而且,毫無懸念的是,分紅支付在很大程度上解釋了這種差異!

A Different Perspective

不同的視角

Shenzhen Colibri Technologies shareholders are down 14% for the year (even including dividends), but the market itself is up 5.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Shenzhen Colibri Technologies that you should be aware of before investing here.

科瑞技術的股東今年下降了14%(即使包括分紅),但市場自身上漲了5.3%。然而,請記住,即使是最好的股票有時在12個月內也會表現不佳。令人遺憾的是,去年的表現結束了一段糟糕的時期,股東在五年內面臨每年8%的總損失。一般來說,長期的股價疲軟可能是一個壞兆頭,儘管逆向投資者可能想要研究該股票,希望其能出現轉機。雖然考慮市場條件對股價的不同影響是非常值得的,但還有其他因素更爲重要。例如,我們發現了科瑞技術的2個警告信號,在您投資之前需要注意。

Of course Shenzhen Colibri Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

當然,科瑞技術可能不是最好的買入股票。因此,您可能想查看這份免費的成長股票集合。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文中引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?對內容有疑慮?請直接與我們聯繫。或者,發送電子郵件至 editorial-team (at) simplywallst.com。

這篇來自Simply Wall St的文章是一般性的。我們根據歷史數據和分析師預測提供評論,採用無偏見的方法,我們的文章並不旨在提供財務建議。它不構成對任何股票的買入或賣出建議,也未考慮到您的目標或財務狀況。我們旨在爲您提供以基本數據驅動的長期分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均沒有持倉。

Looking back five years, both Shenzhen Colibri Technologies' share price and EPS declined; the latter at a rate of 10% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 13% per year, over the period. So it seems the market was too confident about the business, in the past.

Looking back five years, both Shenzhen Colibri Technologies' share price and EPS declined; the latter at a rate of 10% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 13% per year, over the period. So it seems the market was too confident about the business, in the past.