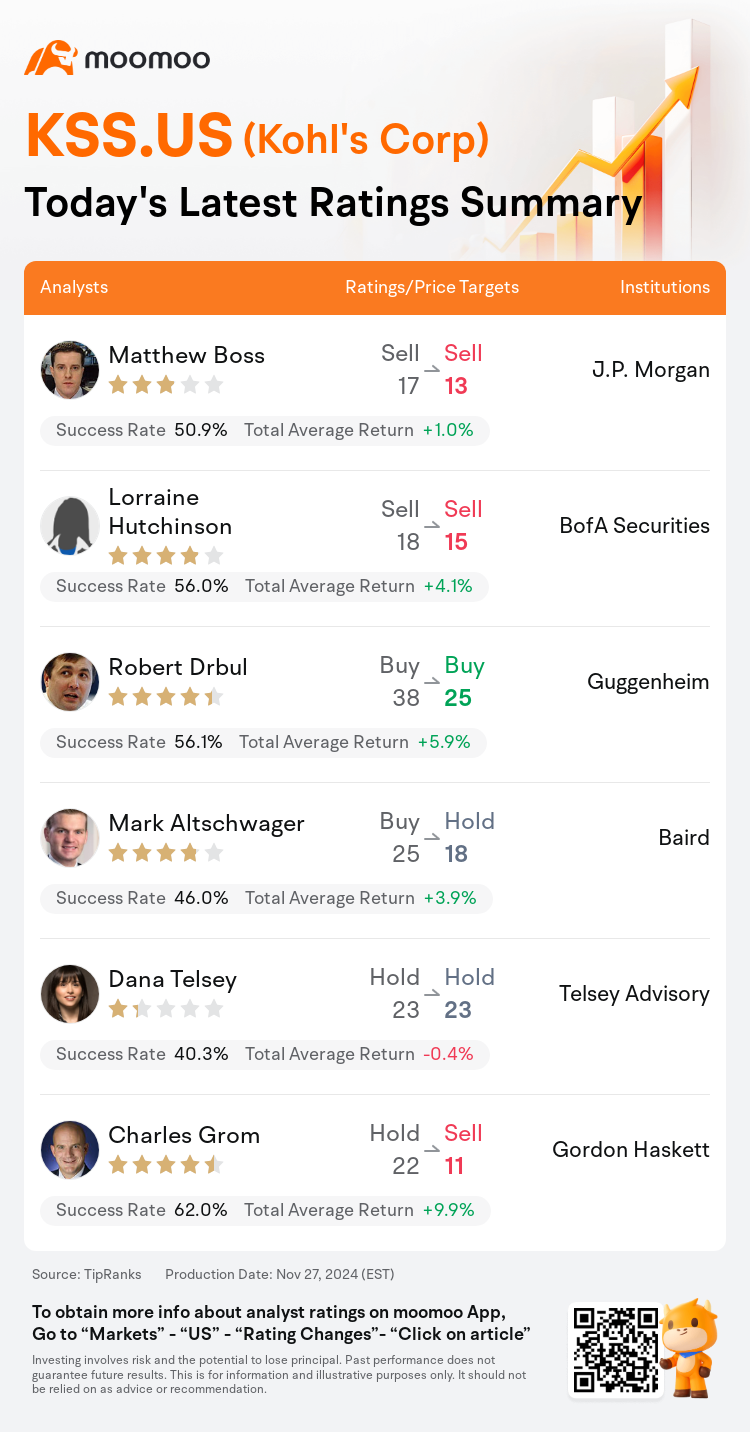

On Nov 27, major Wall Street analysts update their ratings for $Kohl's Corp (KSS.US)$, with price targets ranging from $11 to $25.

J.P. Morgan analyst Matthew Boss maintains with a sell rating, and adjusts the target price from $17 to $13.

BofA Securities analyst Lorraine Hutchinson maintains with a sell rating, and adjusts the target price from $18 to $15.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $38 to $25.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $38 to $25.

Baird analyst Mark Altschwager downgrades to a hold rating, and adjusts the target price from $25 to $18.

Telsey Advisory analyst Dana Telsey maintains with a hold rating, and maintains the target price at $23.

Furthermore, according to the comprehensive report, the opinions of $Kohl's Corp (KSS.US)$'s main analysts recently are as follows:

Kohl's has revised downward its fiscal year 2024 forecasts for sales, comparable store sales, operating margin, and earnings per share, acknowledging ongoing difficulties within its principal operations and anticipating a fiercely competitive holiday season. Additionally, the appointment of a new CEO has been noted, and while the incoming leader's expertise in customer interactions from Michaels is deemed valuable, the prevailing fundamental challenges of Kohl's are expected to persist.

Sales have been an ongoing issue at Kohl's for several years, with a noticeable deterioration in Q3; the company's initiatives are not meeting expectations, contributing to a worsening business situation. The competitive position for Kohl's remains challenging.

Kohl's experienced a notable decline in same-store-sales, with a 9.3% drop, further decelerating on a two-year stacked basis to 14.8%. This marks the 11th consecutive quarter of negative performance in the same category. The downtrend in sales during September and October can be partially attributed to unfavorably warm weather and hurricanes, alongside challenges ahead of the U.S. election.

The firm noted that management at Kohl's is implementing forceful measures to stabilize sales, with optimism that the new CEO will be a good match. However, they remain cautious regarding execution concerning private brands' inventory speed and management, as well as the reintroduction of fine jewelry. Challenges such as a discerning consumer base and a shorter holiday shopping period were also highlighted as potential headwinds.

Following Q3 results and the revised, more cautious outlook on discretionary spending at Kohl's, earnings estimates for FY24 and FY25 have been adjusted to $1.20 and $1.55, down from $2.00 and $2.25, respectively. Despite these disappointing outcomes, optimism remains regarding the company's strategic initiatives.

Here are the latest investment ratings and price targets for $Kohl's Corp (KSS.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

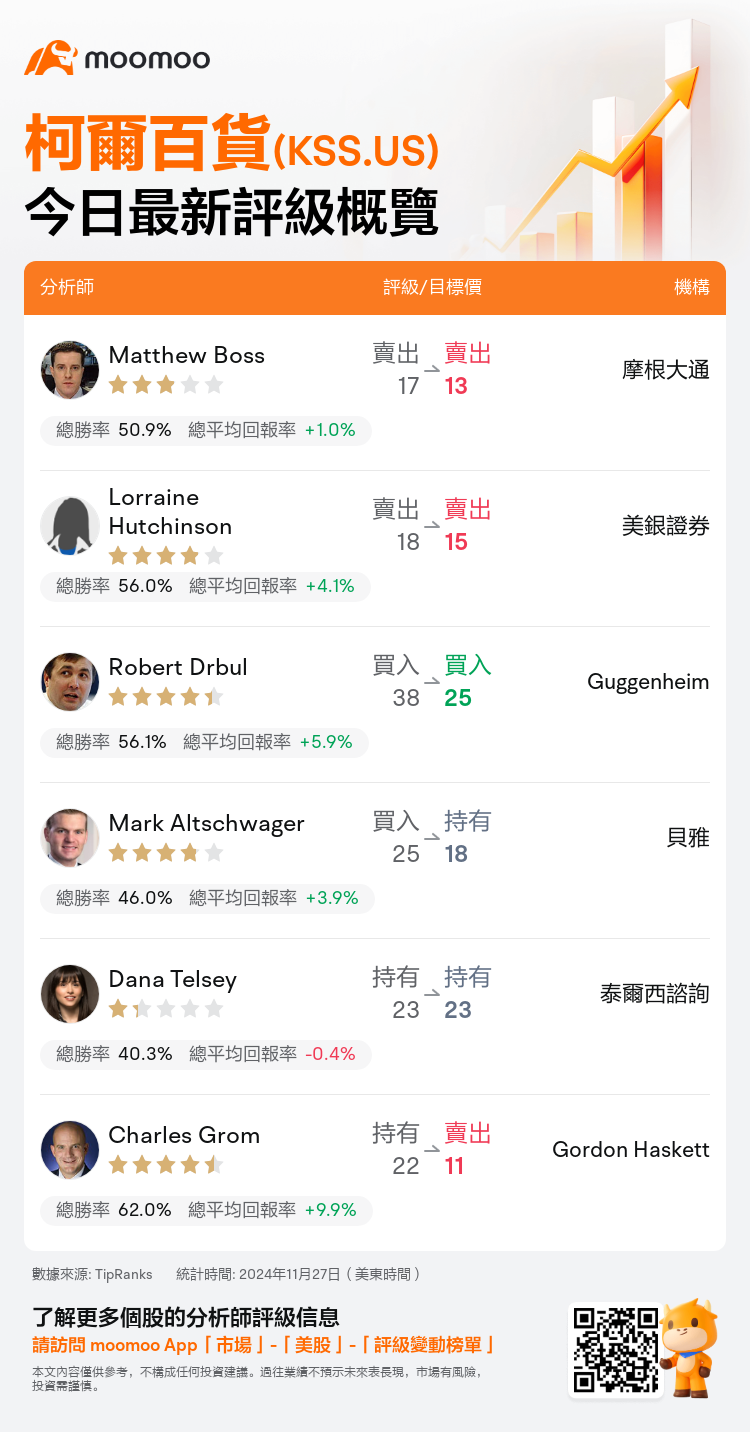

美東時間11月27日,多家華爾街大行更新了$柯爾百貨 (KSS.US)$的評級,目標價介於11美元至25美元。

摩根大通分析師Matthew Boss維持賣出評級,並將目標價從17美元下調至13美元。

美銀證券分析師Lorraine Hutchinson維持賣出評級,並將目標價從18美元下調至15美元。

Guggenheim分析師Robert Drbul維持買入評級,並將目標價從38美元下調至25美元。

Guggenheim分析師Robert Drbul維持買入評級,並將目標價從38美元下調至25美元。

貝雅分析師Mark Altschwager下調至持有評級,並將目標價從25美元下調至18美元。

泰爾西諮詢分析師Dana Telsey維持持有評級,維持目標價23美元。

此外,綜合報道,$柯爾百貨 (KSS.US)$近期主要分析師觀點如下:

科爾士下調了其2024財年的銷售、可比店銷售、營業利潤率和每股收益的預測,承認其主要業務面臨持續的困難,並預期即將到來的假日銷售季將非常激烈。此外,新任首席執行官的任命也被提及,儘管新領導者在Michaels的客戶互動經驗被認爲很有價值,但科爾士所面臨的基本挑戰預計仍將持續。

科爾士的銷售問題已經持續了好幾年,第三季度情況明顯惡化;公司的舉措未能達到預期,導致業務狀況惡化。科爾士的競爭地位仍然相當嚴峻。

科爾士的同店銷售出現顯著下滑,下降了9.3%,在兩年疊加基準下進一步減速至14.8%。這是該領域連續第11個季度的負增長。9月和10月銷售下滑的部分原因可以歸結爲氣溫反常和颶風,以及美國選舉前的挑戰。

該公司指出,科爾士的管理層正在採取強有力的措施來穩定銷售,並樂觀認爲新任首席執行官將很合適。然而,他們對私有品牌的庫存速度和管理執行持謹慎態度,以及重新推出精美珠寶的計劃。類似於挑剔的消費者群體和假日購物期縮短等挑戰也被強調爲潛在的逆風因素。

在第三季度業績和對科爾士可支配支出更謹慎展望之後,財政年度24和25的收益預估已調整爲1.20美元和1.55美元,分別較之前的2.00美元和2.25美元有所下降。儘管這些令人失望的結果,關於公司戰略舉措的樂觀情緒依然存在。

以下爲今日6位分析師對$柯爾百貨 (KSS.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Guggenheim分析師Robert Drbul維持買入評級,並將目標價從38美元下調至25美元。

Guggenheim分析師Robert Drbul維持買入評級,並將目標價從38美元下調至25美元。

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $38 to $25.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $38 to $25.