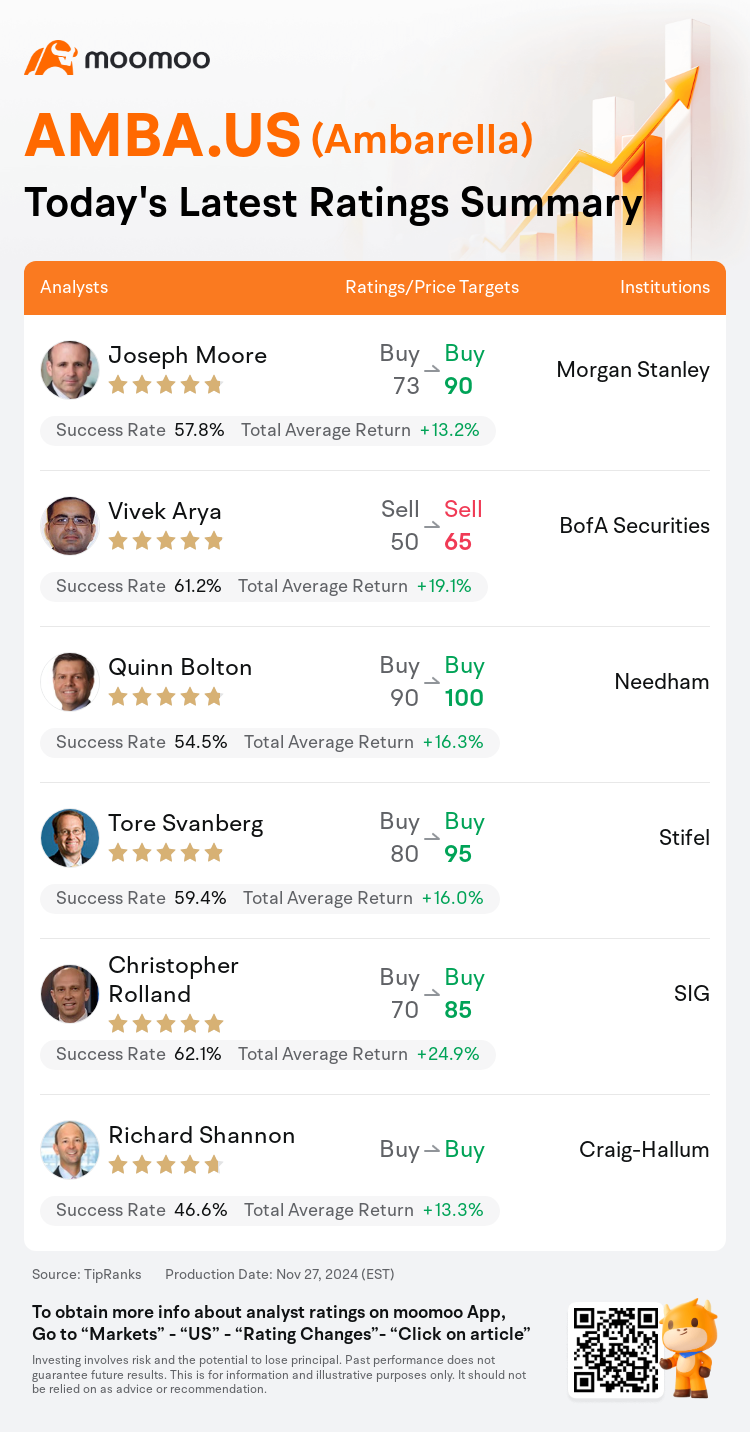

On Nov 27, major Wall Street analysts update their ratings for $Ambarella (AMBA.US)$, with price targets ranging from $65 to $100.

Morgan Stanley analyst Joseph Moore maintains with a buy rating, and adjusts the target price from $73 to $90.

BofA Securities analyst Vivek Arya maintains with a sell rating, and adjusts the target price from $50 to $65.

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $90 to $100.

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $90 to $100.

Stifel analyst Tore Svanberg maintains with a buy rating, and adjusts the target price from $80 to $95.

SIG analyst Christopher Rolland maintains with a buy rating, and adjusts the target price from $70 to $85.

Furthermore, according to the comprehensive report, the opinions of $Ambarella (AMBA.US)$'s main analysts recently are as follows:

Ambarella reported solid results for the October-end quarter, which positively influenced the stock's performance. Despite this, questions remain about whether the valuation is justifiable for a business considered to be relatively small scale, especially given that much of the valuation depends on growth projections beyond 2025 that are now perceived as less certain. The firm has slightly raised its sales estimates for calendar years 2025 and 2026, but has concurrently adjusted its pro-forma EPS forecasts downwards for these years.

Ambarella's recent performance was reinforced by 'another strong quarter and outlook,' driven by new product cycles. The analyst observed that their product strength in both IoT and automotive sectors contributed positively. Additionally, the superior capabilities of their technology coupled with the rising demand for Edge AI have effectively countered prevailing market challenges. There's anticipation of a significant automotive inflection by 2026.

Ambarella's recent 'beat-and-raise' performance in Q3 was favorably viewed, particularly noting its third consecutive guidance raise. The company is recognized for its effective execution on its CV product family pipeline, solidifying its status as a key player within the expanding AI at the Edge ecosystem.

Here are the latest investment ratings and price targets for $Ambarella (AMBA.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月27日,多家華爾街大行更新了$安霸 (AMBA.US)$的評級,目標價介於65美元至100美元。

摩根士丹利分析師Joseph Moore維持買入評級,並將目標價從73美元上調至90美元。

美銀證券分析師Vivek Arya維持賣出評級,並將目標價從50美元上調至65美元。

Needham分析師Quinn Bolton維持買入評級,並將目標價從90美元上調至100美元。

Needham分析師Quinn Bolton維持買入評級,並將目標價從90美元上調至100美元。

斯迪富分析師Tore Svanberg維持買入評級,並將目標價從80美元上調至95美元。

海納國際分析師Christopher Rolland維持買入評級,並將目標價從70美元上調至85美元。

此外,綜合報道,$安霸 (AMBA.US)$近期主要分析師觀點如下:

安霸公佈了截至十月的季度穩健業績,這對股價表現產生了積極影響。儘管如此,對於被認爲相對小規模的業務,其估值是否合理仍然存在疑問,尤其是考慮到很多估值依賴於2025年之後的增長預期,而這些預期現在被認爲不太確定。該公司略微上調了2025年和2026年的銷售預期,但同時下調了這兩年的臨時每股收益預測。

安霸最近的業績受到「另一個強勁季度和展望」的推動,得益於新產品週期。分析師觀察到,他們在物聯網和汽車領域的產品實力帶來了積極貢獻。此外,其科技的卓越能力與對邊緣人工智能日益增長的需求有效抵消了當前市場面臨的挑戰。預計到2026年,汽車領域將出現顯著的轉折點。

安霸在第三季度的'超預期並上調指引'的表現受到積極評價,尤其是注意到其連續第三次提高指引。該公司因在其計算機視覺產品系列管道上的有效執行而受到認可,鞏固了其在不斷擴展的邊緣人工智能生態系統中的關鍵角色。

以下爲今日6位分析師對$安霸 (AMBA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Needham分析師Quinn Bolton維持買入評級,並將目標價從90美元上調至100美元。

Needham分析師Quinn Bolton維持買入評級,並將目標價從90美元上調至100美元。

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $90 to $100.

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $90 to $100.