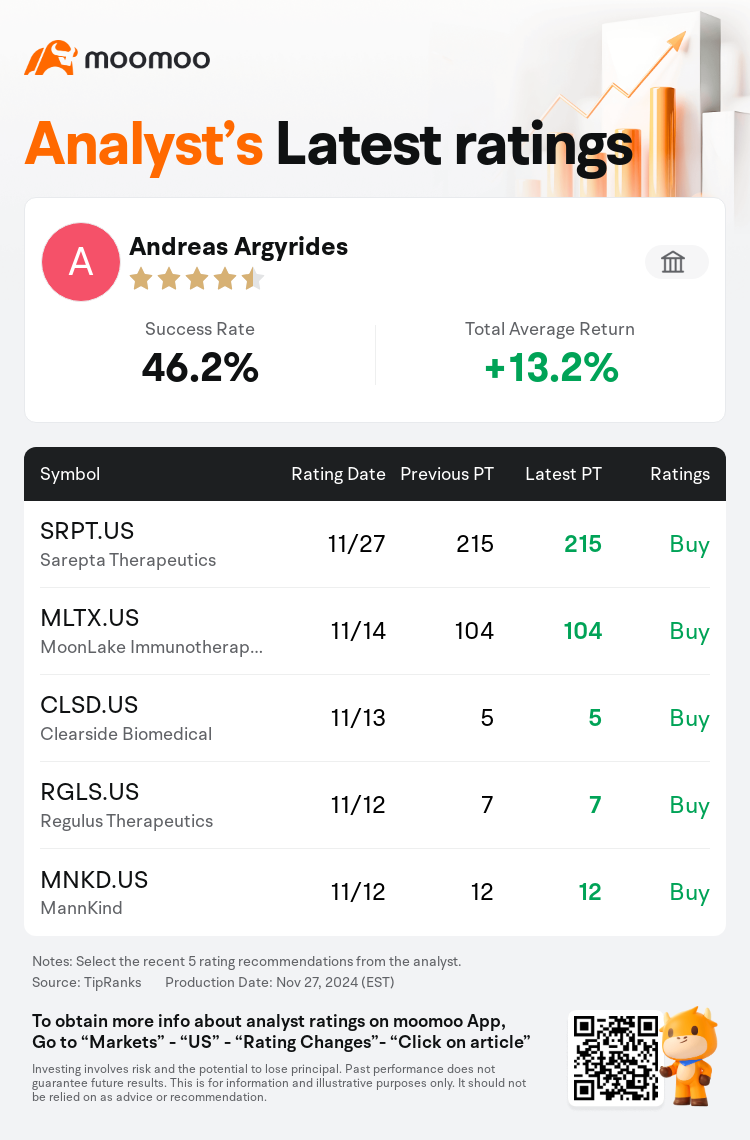

Oppenheimer analyst Andreas Argyrides maintains $Sarepta Therapeutics (SRPT.US)$ with a buy rating, and maintains the target price at $215.

According to TipRanks data, the analyst has a success rate of 46.2% and a total average return of 13.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Sarepta Therapeutics (SRPT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Sarepta Therapeutics (SRPT.US)$'s main analysts recently are as follows:

Following the company's announcement of a licensing agreement with another entity involving multiple programs, an analyst remains optimistic about the company's major product launch. The transaction is believed to enhance the company's pipeline, potentially adding new revenue streams beyond its primary franchise. This development is also seen as a strategic move to diversify the company's offerings and address investor concerns about overreliance on single-treatment gene therapies.

The collaboration between Sarepta and Arrowhead introduces a robust platform diversification and underscores a substantial long-term investment in chronic strategies targeting rare diseases. Additionally, this partnership broadens therapeutic coverage, with clinical programs extending across muscle, central nervous system, and pulmonary areas. The strategic alignment leverages Sarepta's proficiency in rare genetic medicine, and the accompanying share buyback initiative signals a positive outlook on near-term revenue projections.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

奧本海默控股分析師Andreas Argyrides維持$Sarepta Therapeutics (SRPT.US)$買入評級,維持目標價215美元。

根據TipRanks數據顯示,該分析師近一年總勝率為46.2%,總平均回報率為13.2%。

此外,綜合報道,$Sarepta Therapeutics (SRPT.US)$近期主要分析師觀點如下:

此外,綜合報道,$Sarepta Therapeutics (SRPT.US)$近期主要分析師觀點如下:

在公司宣佈與另一實體簽訂許可協議涉及多個項目後,分析師對公司的重大產品發佈保持樂觀態度。該交易被認爲將增強公司的產品線,並可能在其主要特許經營權之外增加新的營業收入來源。這一發展也被視爲公司多樣化業務並解決投資者對單一治療基因療法過度依賴的擔憂的戰略舉措。

Sarepta與Arrowhead之間的合作引入了強大的平台多元化,強調了對罕見病慢性策略的大規模長期投資。此外,這一合作擴大了治療覆蓋範圍,臨床項目涵蓋肌肉、中樞神經系統和肺部領域。戰略協調充分利用了Sarepta在罕見遺傳醫學方面的純熟,伴隨而來的股票回購計劃標誌着對近期營業收入預測的樂觀態度。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Sarepta Therapeutics (SRPT.US)$近期主要分析師觀點如下:

此外,綜合報道,$Sarepta Therapeutics (SRPT.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of