Is Crocs (NASDAQ:CROX) A Risky Investment?

Is Crocs (NASDAQ:CROX) A Risky Investment?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Crocs, Inc. (NASDAQ:CROX) does carry debt. But should shareholders be worried about its use of debt?

霍華德・馬克斯在他說到這一點時表達得很好,他說,與其擔心股價波動,'我擔心的是永久損失的可能性...每個我認識的實際投資者都在擔心這個問題。所以很明顯,當你考慮任何給定股票的風險時,你需要考慮債務,因爲過多的債務可能會拖垮一家公司。值得注意的是,Crocs卡駱馳公司(納斯達克代碼:CROX)確實存在債務。但股東們應該擔心它使用債務嗎?

When Is Debt A Problem?

什麼時候負債才是一個問題?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

當一個企業無法通過自由現金流或者以有吸引力的價格融資來輕鬆履行其債務時,債務和其他負債對企業變得有風險。如果情況變得真的很糟糕,債權人可能會控制這家企業。雖然這不是很常見,但我們經常看到負債累累的企業因爲債權人強迫其以賤價融資而永久稀釋股東利益。當然,對於資本密集型企業而言,負債可能是一種重要的工具。考慮企業使用多少債務時,首先要做的就是審查其現金和債務。

What Is Crocs's Debt?

卡駱馳的債務是多少?

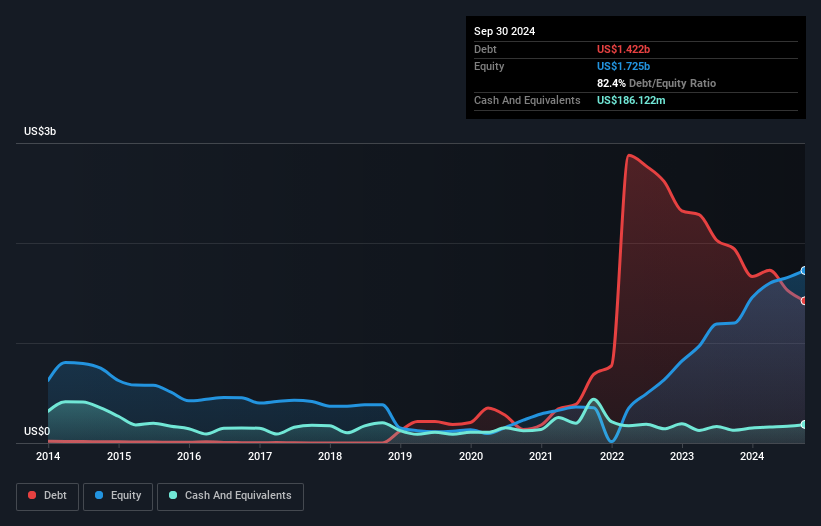

You can click the graphic below for the historical numbers, but it shows that Crocs had US$1.42b of debt in September 2024, down from US$1.94b, one year before. On the flip side, it has US$186.1m in cash leading to net debt of about US$1.24b.

您可以點擊下面的圖表查看歷史數據,但顯示Crocs在2024年9月有14.2億美元的債務,低於一年前的19.4億美元。另一方面,它有18610萬美元的現金,導致淨債務約爲12.4億美元。

How Healthy Is Crocs' Balance Sheet?

Crocs的資產負債表狀況如何?

We can see from the most recent balance sheet that Crocs had liabilities of US$692.5m falling due within a year, and liabilities of US$2.30b due beyond that. Offsetting this, it had US$186.1m in cash and US$386.2m in receivables that were due within 12 months. So it has liabilities totalling US$2.42b more than its cash and near-term receivables, combined.

我們可以從最近的資產負債表看到,卡駱馳有US$69250萬的短期到期負債,以及US$23億的長期到期負債。與此相抵消的是,它有US$18610萬的現金和US$38620萬的應收賬款,在12個月內到期。因此,其負債總額比其現金和短期應收款項共計US$24.2億更多。

This deficit isn't so bad because Crocs is worth US$6.33b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

這個赤字並不太糟糕,因爲卡駱馳價值US$63.3億,因此如果有需要,可能可以籌集足夠的資本來支撐其資產負債表。但我們絕對希望留意其債務帶來過多風險的跡象。

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

我們使用兩個主要比率來了解債務相對於收入的水平。首先是淨債務除以利息、稅項、折舊和攤銷前利潤(EBITDA),而第二個是其稅前利潤(EBIT)可以覆蓋利息支出的倍數(或簡稱爲利息覆蓋率)。 這種方法的優勢在於我們既考慮了債務的絕對量(淨債務與EBITDA)又考慮了與該債務相關的實際利息支出(利息覆蓋比)。

Crocs has net debt of just 1.1 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 9.0 times, which is more than adequate. Fortunately, Crocs grew its EBIT by 6.6% in the last year, making that debt load look even more manageable. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Crocs's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

卡駱馳的淨負債僅爲EBITDA的1.1倍,表明它確實不是一個魯莽的借款人。而且它擁有9.0倍的利息保障倍數,這是足夠的。幸運的是,卡駱馳在過去一年裏將EBIT增長了6.6%,使得債務負擔看起來更加可控。在分析債務水平時,資產負債表是顯而易見的起點。但最終,更重要的是未來的收入,這將決定卡駱馳維持健康資產負債表的能力。因此,如果您想了解專業人士的看法,您可能會發現分析師利潤預測的這份免費報告很有趣。

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Crocs produced sturdy free cash flow equating to 72% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

但我們的最後考慮也很重要,因爲公司無法用紙面利潤償付債務;它需要現金。因此,我們明顯需要看一下這個EBIT是否導致相應的自由現金流。在過去三年中,卡駱馳產生了穩健的自由現金流,相當於其EBIT的72%,與我們的預期大致相同。這筆冷硬現金意味着它可以在需要時減少債務。

Our View

我們的觀點

The good news is that Crocs's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its interest cover also supports that impression! Looking at all the aforementioned factors together, it strikes us that Crocs can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Crocs (of which 1 is significant!) you should know about.

好消息是,卡駱馳將EBIt轉化爲自由現金流的能力,就像一隻毛茸茸的小狗讓我們如同一個蹣跚學步的孩童一樣開心。好消息並不僅止於此,因爲其利息覆蓋也支持着這種印象!綜合考慮所有前述因素,我們判斷卡駱馳可以相對輕鬆地處理其債務。當然,雖然這種槓桿可以提高資本回報,但也帶來更多風險,因此值得密切關注。在分析債務水平時,資產負債表是開始的明顯地方。然而,並非所有的投資風險都存在於資產負債表中 - 遠非如此。這些風險可能很難發現。每家公司都面臨這些風險,我們已經發現了卡駱馳的2個警示信號(其中1個相當重要!)你應該知道。

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

當一切塵埃落定時,有時更容易專注於那些甚至不需要債務的公司。讀者可以立即免費查看零淨債務的成長股列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

We can see from the most recent balance sheet that Crocs had liabilities of US$692.5m falling due within a year, and liabilities of US$2.30b due beyond that. Offsetting this, it had US$186.1m in cash and US$386.2m in receivables that were due within 12 months. So it has liabilities totalling US$2.42b more than its cash and near-term receivables, combined.

We can see from the most recent balance sheet that Crocs had liabilities of US$692.5m falling due within a year, and liabilities of US$2.30b due beyond that. Offsetting this, it had US$186.1m in cash and US$386.2m in receivables that were due within 12 months. So it has liabilities totalling US$2.42b more than its cash and near-term receivables, combined.