A Closer Look at GameStop's Options Market Dynamics

A Closer Look at GameStop's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bearish stance on GameStop.

有很多錢可以花的鯨魚對GameStop採取了明顯的看跌立場。

Looking at options history for GameStop (NYSE:GME) we detected 14 trades.

查看GameStop(紐約證券交易所代碼:GME)的期權歷史記錄,我們發現了14筆交易。

If we consider the specifics of each trade, it is accurate to state that 21% of the investors opened trades with bullish expectations and 35% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有21%的投資者以看漲的預期開盤,35%的投資者持看跌預期。

From the overall spotted trades, 2 are puts, for a total amount of $66,780 and 12, calls, for a total amount of $577,948.

在已發現的全部交易中,有2筆是看跌期權,總額爲66,780美元,12筆看漲期權,總額爲577,948美元。

Predicted Price Range

預測的價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $125.0 for GameStop, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場推動者正在關注GameStop在過去三個月中20.0美元至125.0美元之間的價格區間。

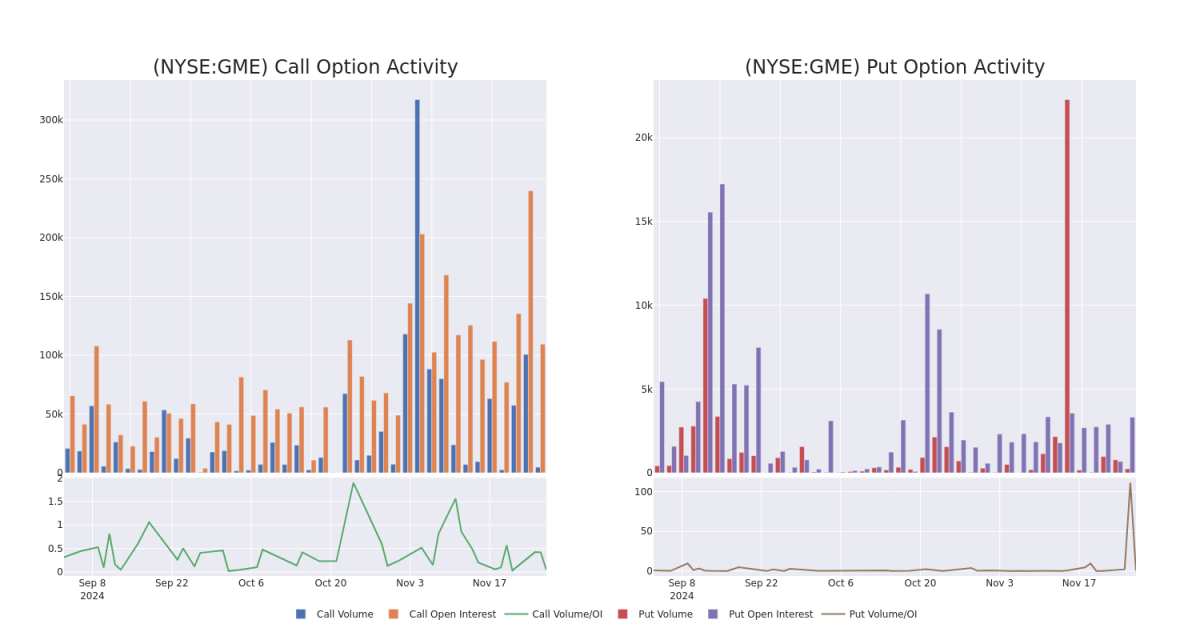

Volume & Open Interest Trends

交易量和未平倉合約趨勢

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GameStop's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale trades within a strike price range from $20.0 to $125.0 in the last 30 days.

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下GameStop期權的流動性和利息。下面,我們可以觀察過去30天內GameStop所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的變化,其行使價在20.0美元至125.0美元之間。

GameStop Option Activity Analysis: Last 30 Days

GameStop 期權活動分析:過去 30 天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $12.0 | $11.85 | $11.85 | $20.00 | $118.5K | 18.3K | 299 |

| GME | CALL | SWEEP | NEUTRAL | 06/20/25 | $12.0 | $11.65 | $12.0 | $25.00 | $72.0K | 2.0K | 61 |

| GME | CALL | TRADE | BULLISH | 01/17/25 | $7.6 | $7.6 | $7.6 | $26.00 | $56.2K | 2.5K | 1 |

| GME | CALL | TRADE | BULLISH | 01/17/25 | $5.25 | $5.2 | $5.25 | $35.00 | $52.5K | 7.5K | 288 |

| GME | CALL | SWEEP | BULLISH | 06/20/25 | $14.4 | $14.05 | $14.35 | $20.00 | $43.0K | 2.4K | 35 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 遊戲 | 打電話 | 掃 | 粗魯的 | 01/17/25 | 12.0 美元 | 11.85 美元 | 11.85 美元 | 20.00 美元 | 118.5 萬美元 | 18.3K | 299 |

| 遊戲 | 打電話 | 掃 | 中立 | 06/20/25 | 12.0 美元 | 11.65 美元 | 12.0 美元 | 25.00 美元 | 72.0 萬美元 | 2.0K | 61 |

| 遊戲 | 打電話 | 貿易 | 看漲 | 01/17/25 | 7.6 美元 | 7.6 美元 | 7.6 美元 | 26.00 美元 | 56.2 萬美元 | 2.5K | 1 |

| 遊戲 | 打電話 | 貿易 | 看漲 | 01/17/25 | 5.25 美元 | 5.2 美元 | 5.25 美元 | 35.00 美元 | 52.5 萬美元 | 7.5K | 288 |

| 遊戲 | 打電話 | 掃 | 看漲 | 06/20/25 | 14.4 美元 | 14.05 美元 | 14.35 美元 | 20.00 美元 | 43.0 萬美元 | 2.4K | 35 |

About GameStop

關於 GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp 是一家美國多渠道視頻遊戲、消費電子產品和服務零售商。該公司在歐洲、加拿大、澳大利亞和美國開展業務。GameStop主要通過GameStop、EB Games和Micromania商店以及國際電子商務網站銷售新的和二手的視頻遊戲硬件、實體和數字視頻遊戲軟件以及視頻遊戲配件。大部分銷售來自美國。

Present Market Standing of GameStop

GameStop目前的市場地位

- With a trading volume of 4,528,712, the price of GME is up by 3.63%, reaching $31.43.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 12 days from now.

- GME的交易量爲4528,712美元,價格上漲了3.63%,達到31.43美元。

- 當前的RSI值表明該股可能已被超買。

- 下一份收益報告定於即日起12天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到不尋常的期權活動:智能貨幣在移動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不尋常期權委員會在潛在的市場推動者發生之前就發現了它們。看看大筆資金對你最喜歡的股票持有哪些頭寸。點擊此處訪問。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GameStop with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro獲取實時提醒,了解GameStop的最新期權交易。

From the overall spotted trades, 2 are puts, for a total amount of $66,780 and 12, calls, for a total amount of $577,948.

From the overall spotted trades, 2 are puts, for a total amount of $66,780 and 12, calls, for a total amount of $577,948.