Decoding Coca-Cola's Options Activity: What's the Big Picture?

Decoding Coca-Cola's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bullish on Coca-Cola (NYSE:KO), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in KO often signals that someone has privileged information.

高風險投資者已對可口可樂(紐交所:KO)採取看好的立場,零售交易者需要關注這一點。\這一活動今天通過Benzinga對公開可用的期權數據的跟蹤引起了我們的注意。這些投資者的身份尚不明確,但KO的如此顯著舉動通常意味着有人掌握了內部信息。

Today, Benzinga's options scanner spotted 9 options trades for Coca-Cola. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了9筆可口可樂的期權交易。這並不是一個典型的模式。

The sentiment among these major traders is split, with 55% bullish and 44% bearish. Among all the options we identified, there was one put, amounting to $30,456, and 8 calls, totaling $678,335.

這些主要交易者的情緒呈現分化,其中55%看好,44%看淡。在我們識別出的所有期權中,有一筆看跌期權,金額爲30,456美元,和8筆看漲期權,總計爲678,335美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $75.0 for Coca-Cola during the past quarter.

分析這些合約的成交量和未平倉合約,可以看出,主要參與者在過去一個季度裏對可口可樂的價格區間爲55.0美元到75.0美元充滿關注。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

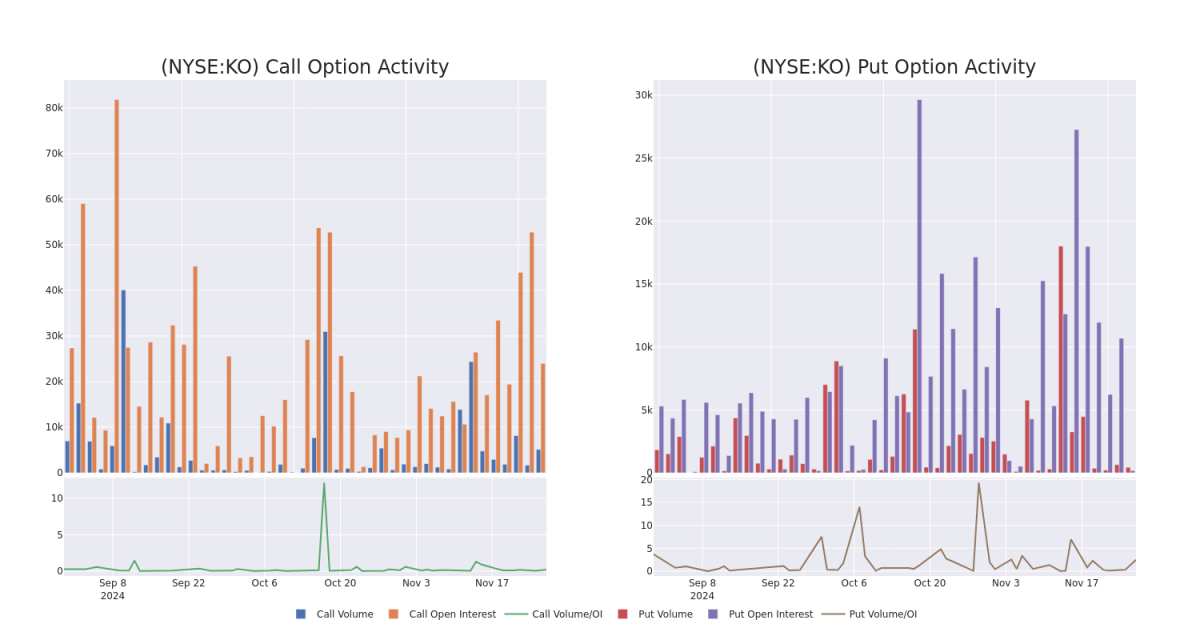

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Coca-Cola's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Coca-Cola's significant trades, within a strike price range of $55.0 to $75.0, over the past month.

檢查成交量和未平倉合約提供了股市研究的關鍵見解。這些信息在評估可口可樂在特定行權價的期權的流動性和興趣水平方面至關重要。以下是我們展示的可口可樂重要交易中,看漲和看跌期權在55.0美元到75.0美元的行權價格範圍內的成交量和未平倉合約趨勢的快照。

Coca-Cola 30-Day Option Volume & Interest Snapshot

可口可樂30天期權成交量和未平倉合約快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | CALL | SWEEP | BULLISH | 09/19/25 | $2.1 | $2.08 | $2.1 | $70.00 | $295.6K | 2.0K | 1.4K |

| KO | CALL | SWEEP | BULLISH | 09/19/25 | $4.3 | $4.25 | $4.28 | $65.00 | $104.8K | 1.2K | 263 |

| KO | CALL | SWEEP | BULLISH | 01/15/27 | $13.25 | $12.9 | $13.25 | $55.00 | $92.7K | 232 | 70 |

| KO | CALL | SWEEP | BEARISH | 02/21/25 | $1.08 | $1.04 | $1.04 | $67.50 | $43.8K | 5.1K | 2.3K |

| KO | CALL | SWEEP | BULLISH | 01/16/26 | $2.14 | $2.0 | $2.14 | $72.50 | $42.8K | 1.5K | 204 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | 看漲 | SWEEP | BULLISH | 09/19/25 | $2.1 | $2.08 | $2.1 | $70.00 | $295.6K | 2.0千 | 1.4K |

| KO | 看漲 | SWEEP | BULLISH | 09/19/25 | $4.3 | $4.25 | 4.28美元 | $65.00 | $104.8K | 1.2K | 263 |

| KO | 看漲 | SWEEP | BULLISH | 01/15/27 | $13.25 | $12.9 | $13.25 | $55.00 | $92.7K | 232 | 70 |

| KO | 看漲 | SWEEP | 看淡 | 02/21/25 | $1.08 | $1.04 | $1.04 | $67.50 | $43.8千美元 | 5.1千 | 2.3K |

| KO | 看漲 | SWEEP | BULLISH | 01/16/26 | $2.14 | $2.0 | $2.14 | $72.50 | $42.8千 | 1.5千 | 204 |

About Coca-Cola

關於可口可樂

Founded in 1886, Atlanta-headquartered Coca-Cola is the world's largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenue overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

成立於1886年,總部位於亞特蘭大的可口可樂是全球最大的非酒精飲料公司,擁有200多個品牌,覆蓋碳痠軟飲料、水、體育、能源、果汁和咖啡等關鍵類別。與其裝瓶商和分銷合作伙伴一起,公司通過零售商和餐飲場所在全球200多個國家和地區銷售帶有可口可樂和授權品牌的飲料製品。可口可樂在海外產生的營業收入約佔其總營業收入的三分之二,其中大部分來自拉丁美洲和亞太地區的新興經濟體。

After a thorough review of the options trading surrounding Coca-Cola, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對可口可樂周圍的期權交易進行徹底審查後,我們將更加詳細地研究該公司。這包括對其當前市場狀態和表現的評估。

Where Is Coca-Cola Standing Right Now?

可口可樂目前的狀況如何?

- Currently trading with a volume of 4,581,373, the KO's price is up by 0.57%, now at $64.92.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 76 days.

- 目前成交量爲4,581,373,KO的價格上漲了0.57%,現在爲64.92美元。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計在76天內發佈收益報告。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Coca-Cola options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易員通過不斷學習,調整他們的策略,監控多個因子並密切關注市場動向來管理這些風險。通過Benzinga Pro實時警報了解最新的可口可樂期權交易。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $75.0 for Coca-Cola during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $75.0 for Coca-Cola during the past quarter.